Research

Learn how Quasar ($QSR) utilizes the Cosmos SDK and Tendermint's Proof of Stake to offer scalable, secure DeFi solutions.

Quasar is an open-source Layer 1 blockchain for decentralized asset management. Built on the Cosmos SDK with Tendermint's Proof of Stake consensus, it uses smart contract vaults for yield generation, asset swaps, and airdrop participation. Its native token, QSR, powers the ecosystem.

This Quasar blockchain presentation explores the platform's architecture, its consensus mechanism, use cases, native token QSR, Quasar staking opportunities and more.

What is Quasar?

Quasar is a Layer 1 blockchain platform built to redefine decentralized asset management. It utilizes smart contract vaults to provide users with diverse financial services such as yield earning, asset swapping, and participation in airdrops.

Quasar's infrastructure leverages the Cosmos SDK and Tendermint's Proof of Stake (PoS) for scalability, security, and efficient high-volume transactions. It employs CosmWasm for secure, interoperable smart contracts in multiple languages.

Quasar's integration of Inter-Blockchain Communication (IBC) enables seamless management of diversified positions through interchain accounts and queries.

By automating these processes, Quasar simplifies complex investment strategies, providing an efficient, user-friendly DeFi experience.

Stake Quasar with Imperator.co!

Maximize your QSR staking rewards : earn more, start now.

Core technologies powering Quasar

Quasar is more than just a concept—it's built on a solid technological foundation

Tendermint: As Quasar's core engine, Tendermint delivers secure, efficient transactions, ensuring the platform's exceptional scalability and reliability.

Cosmos SDK: This framework forms the backbone of Quasar, providing modularity and flexibility to create a blockchain system that's adaptable and future-proof.

CosmWasm: By harnessing WebAssembly smart contracts through CosmWasm, Quasar enhances its versatility, offering broad and dynamic functionality.

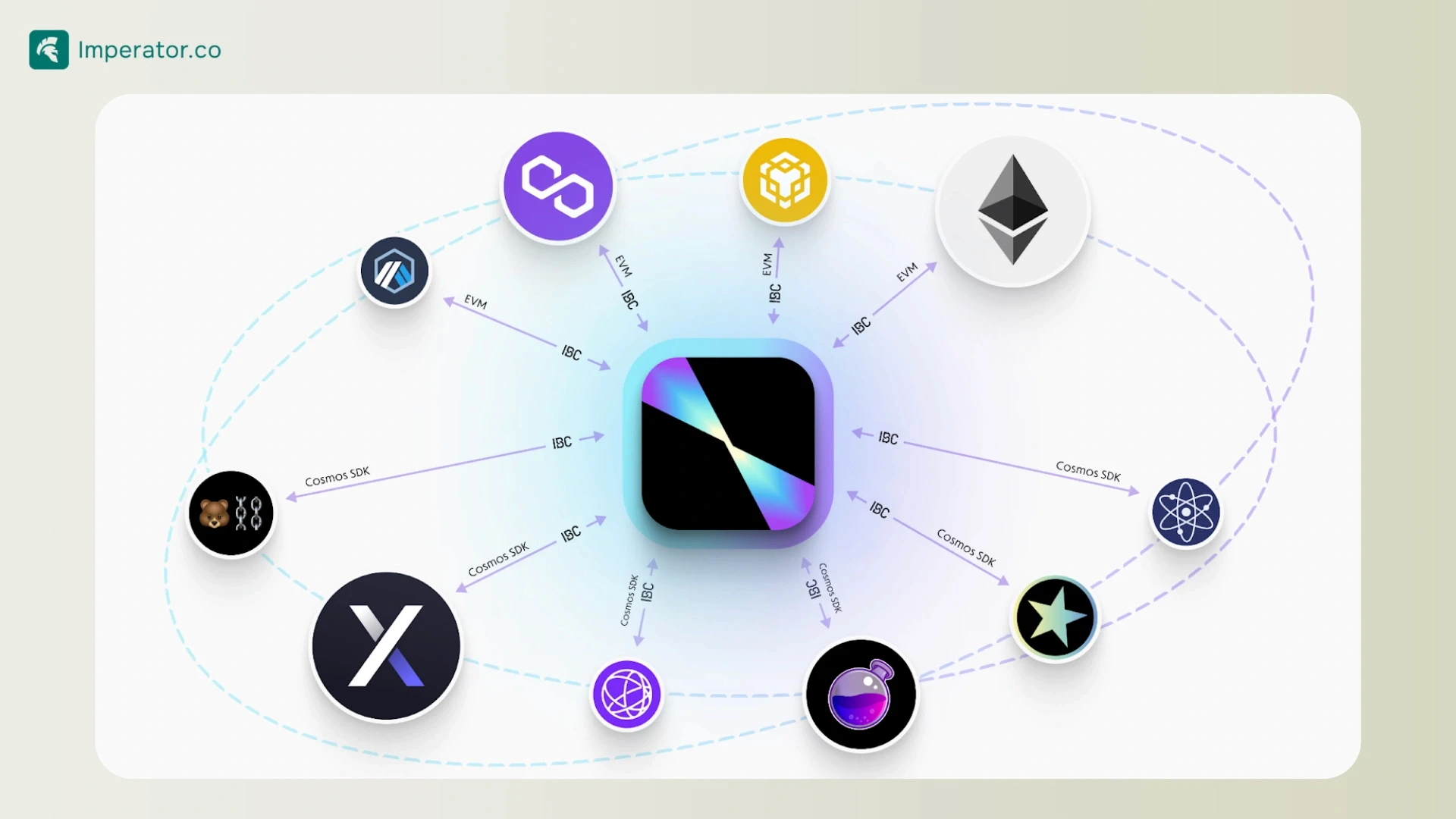

Inter-Blockchain Communication Protocol (IBC): Quasar leverages IBC, the backbone of cross-chain interoperability, connecting with networks like Osmosis, Injective, Axelar, and Sei to enable seamless asset transfers and efficient decentralized asset management.

Quasar's Strategic Initiatives in DeFi

Quasar is actively reshaping decentralized finance (DeFi) by focusing on key industry trends:

Airdrop Strategies: The platform recognizes a shift in airdrop focus from stakers to active DeFi participants. Quasar depositors are well-positioned to benefit from this change, making them prime candidates for upcoming reward and incentive programs.

Optimizing Interchain Liquidity: As decentralized exchanges (DEXes) unify trading volumes across modular platforms, accessing liquidity becomes more streamlined. Quasar aims to be the critical link for channeling liquidity through the Cosmos ecosystem and interconnected networks.

By emphasizing Inter-Blockchain Communication (IBC) expansion, unified yield strategies, and overcoming fragmented capital, Quasar is shaping the future of DeFi. The platform focuses on advanced infrastructure and seamless user experiences to drive the next wave of growth.

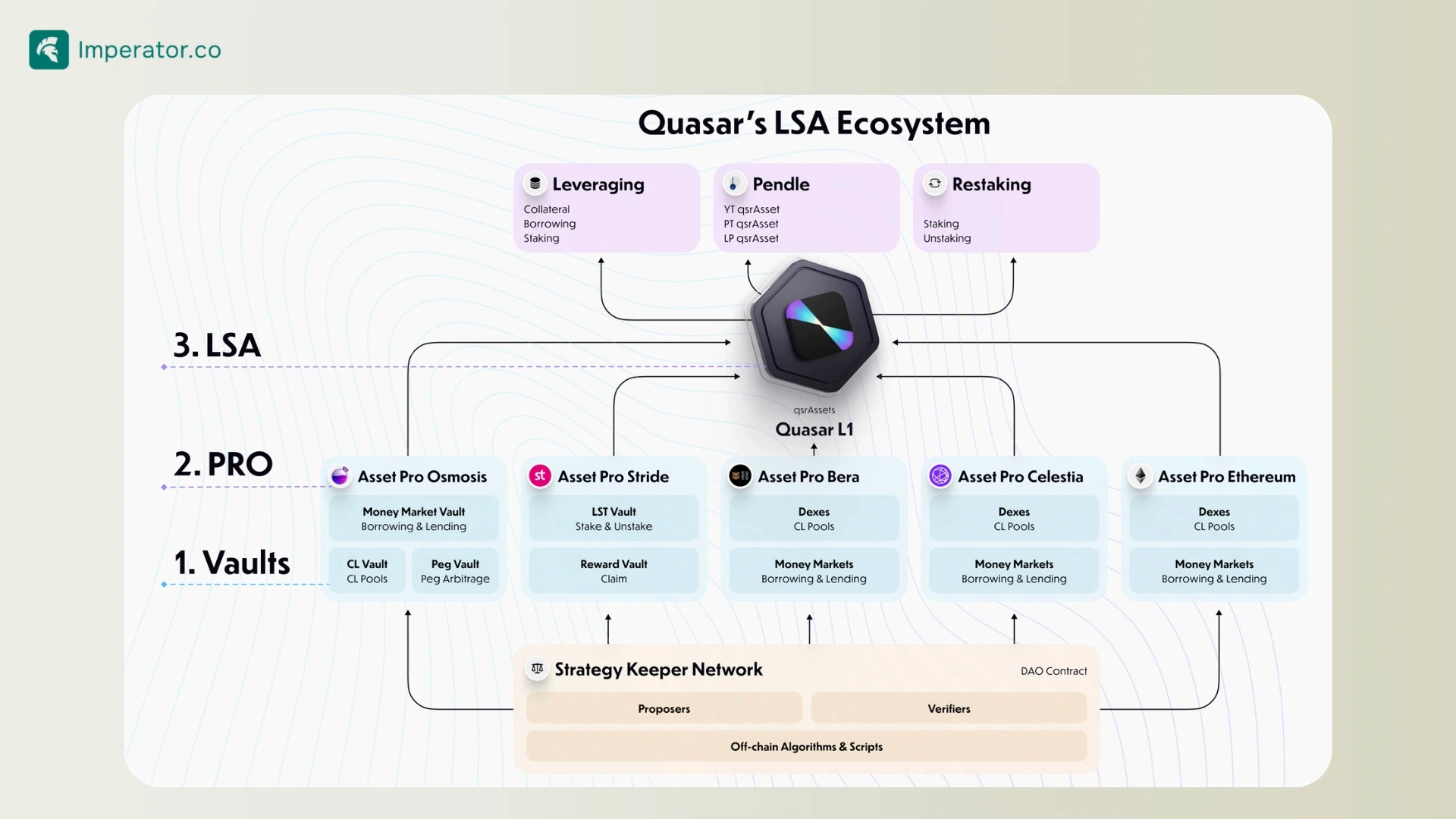

Quasar Simplifies DeFi with Layered Staking Assets

Quasar Network introduces Layered Staking Assets (LSAs), combining staking and DeFi yields into a versatile asset to revolutionize decentralized finance.

LSAs actively rebalance capital between liquid staking tokens (LSTs) and high-yield destinations, ensuring users earn at least the base staking yield while unlocking opportunities for even greater returns.

This innovation eliminates constant management, offering effortless access to competitive yields.

By simplifying infrastructure and automating yield strategies, LSAs enhance the user experience.

Quasar Network empowers users with rewards like LP swaps, airdrops, incentives, staking, restaking, and cross-chain DeFi yields—all seamlessly integrated to maximize benefits with minimal effort.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

The QSR Token

What is the QSR Token?

$QSR is the cornerstone of the Quasar Protocol, embodying ownership, growth, governance, and strategic alignment at its core.

L1 Security: $QSR secures Quasar's Layer 1 infrastructure by ensuring all strategies, executions, rebalances, transfers, and vault deposits are accurately tracked, verified, and accessible for transparent auditing.

Strategist Keeper Network (S.K.N.): $QSR powers the S.K.N., a decentralized, multi-step system that guarantees compliant, swift, and secure execution of off-chain computations on-chain, while incentivizing S.K.N. participants.

Governance and Association: As both the governance token and key asset of the Quasar Association—a Swiss non-profit committed to ecosystem growth—$QSR empowers holders to propose and vote on critical decisions related to deployments, protocol upgrades, and variable adjustments.

Community Fund and ProtoRev Usage: $QSR holders play a pivotal role in steering the on-chain community fund and ProtoRev allocation, directly influencing the protocol’s future development and ensuring resources are effectively deployed.

QSR Tokenomics

The $QSR token is designed to drive Quasar's growth and sustainability. With a max supply of 1,000,000,000 tokens (61% minted at launch), its allocation reflects a balance between community involvement, ecosystem incentives, and long-term development :

Investors: 21%

Quasar Founders & Team: 14.5%

Public Liquidity Seeding (via LBP): 4.5%

Unallocated (future fundraising & team members): 9%

Incentives: 10%

Community Pool (airdrops & community spending): 25%

Inflation: 15% (0% at mainnet, increasing to 5% post-LBP)

Advisors: 1%

Quasar Staking

Participants support Quasar's Proof-of-Stake (PoS) consensus mechanism by staking QSR tokens, ensuring the chain remains secure, efficient, and decentralized.

Stakers contribute to block validation and governance, gaining the ability to influence protocol upgrades and key decisions.

Quasar’s staking process is designed to be seamless and user-friendly, allowing participants to confidently stake their assets while enjoying steady returns. Find the best Quasar validators in our dedicated guide.

Quasar staking also fosters alignment between the network’s growth and community, creating a powerful ecosystem built on shared goals and incentives.

Diving into Quasar Vaults

Quasar’s vault system connects user deposits with strategic liquidity deployment, enhancing participation across ecosystems.

Concentrated Liquidity Solutions: Quasar’s vaults optimize capital allocation using concentrated liquidity strategies, directing capital to specific price ranges for maximized efficiency and higher returns compared to traditional pools.

Automated Digital Asset Management (DAM): These smart contract-powered vaults automate complex DeFi strategies like yield farming and liquidity provision, pooling resources to capture opportunities individual investors might miss and simplifying DeFi participation.

Community-Driven and Protocol-Owned Liquidity (P.O.L.): Quasar supports both community-managed and protocol-owned vaults, promoting transparent governance and aligning liquidity deployment with broader ecosystem goals.

Cross-Chain Efficiency and Growth: Leveraging Inter-Blockchain Communication (IBC), Quasar vaults facilitate seamless liquidity flow across ecosystems like Osmosis, driving cross-chain DeFi growth and operational efficiency.

How Quasar Vaults Work

Pooling: User deposits are combined, creating a larger capital pool.

Strategy Execution: Smart contracts deploy capital into predefined DeFi strategies.

Profit Generation: Vaults engage in yield farming, liquidity provision, and other profit-generating activities.

Distribution: Returns are distributed back to contributors after deducting applicable fees.

Quasar’s innovative vaults are reshaping digital asset management with their adaptability, robust design, and community-centric approach, positioning them at the forefront of DeFi evolution.

What is Quasar ($QSR): Closing Thoughts

Quasar stands out by making decentralized asset management more efficient and accessible. With its smart contract vaults, IBC integration, and Layered Staking Assets, it streamlines complex DeFi strategies while maximizing yields.

Built on reliable tech like the Cosmos SDK and Tendermint, Quasar offers a solid foundation for anyone looking to optimize their assets in a growing, interconnected DeFi ecosystem.

FAQs about the Quasar (QSR) Network

What is Quasar Network?

Quasar is a Layer 1 blockchain designed for decentralized asset management. It utilizes smart contract-powered vaults to optimize yield strategies, asset swaps, and liquidity management across multiple chains via IBC.

What makes Quasar different from other blockchains?

Quasar focuses on automated DeFi strategies, using smart contract vaults and Inter-Blockchain Communication (IBC) to enable seamless cross-chain asset management.

What is the QSR token used for?

$QSR powers Quasar’s ecosystem, securing the network, enabling governance, and fueling strategic liquidity deployments via vaults.

How does Quasar leverage IBC?

Quasar uses IBC (Inter-Blockchain Communication) to integrate with other Cosmos-based blockchains like Osmosis, Injective, and Sei, ensuring seamless cross-chain transactions.

Can I stake QSR tokens?

Yes, QSR staking secures the network and allows participants to earn rewards while playing a role in governance decisions.

What are Layered Staking Assets (LSAs)?

LSAs combine staking and DeFi yield strategies, rebalancing assets between liquid staking tokens (LSTs) and high-yield opportunities for optimized returns.

How do Quasar vaults work?

Quasar’s vaults automate DeFi yield strategies, pooling liquidity for efficient staking, farming, and cross-chain swaps.

Maximize your QSR staking rewards : earn more, start now.