Research

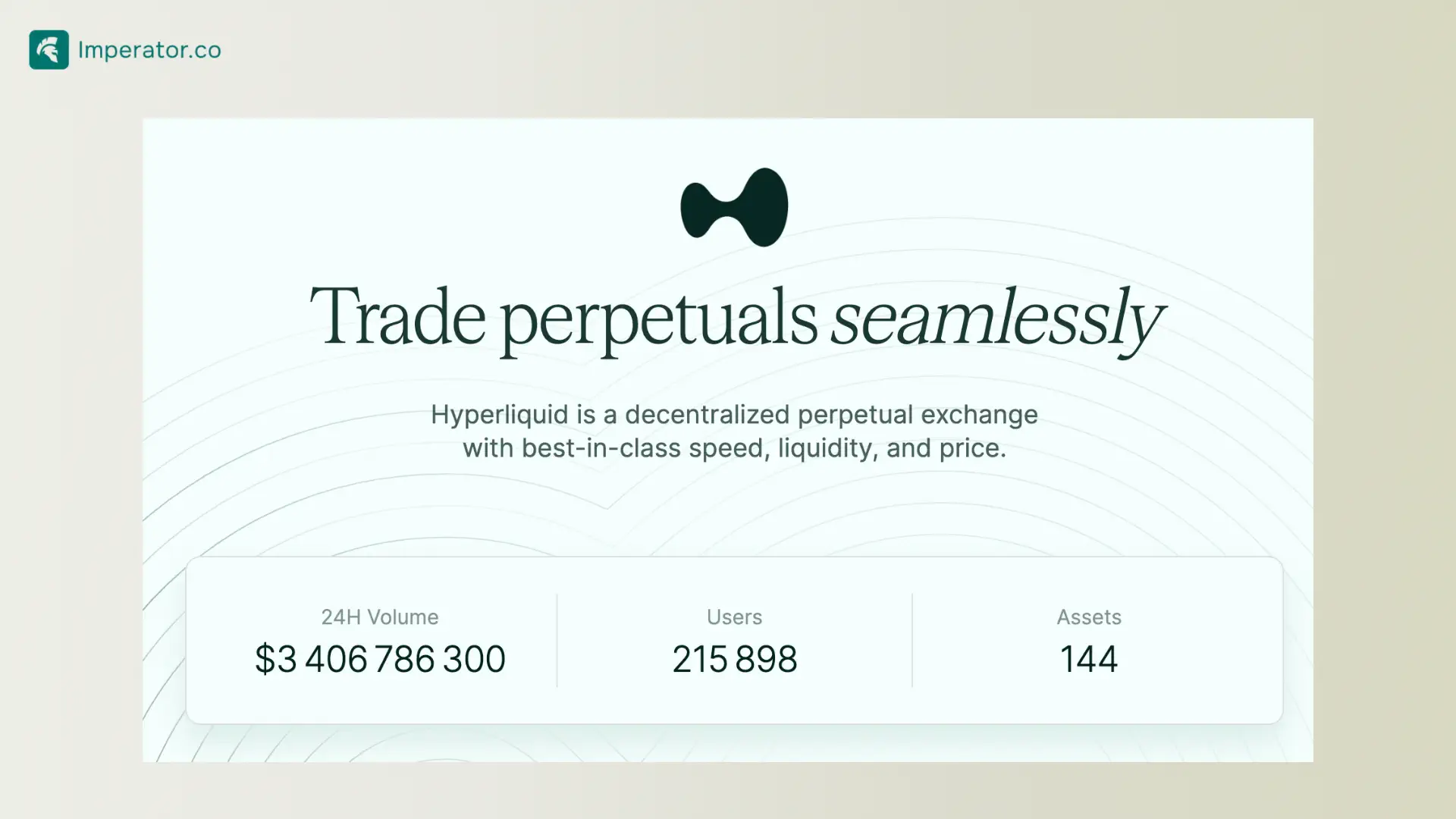

Discover Hyperliquid: a high-performance DEX for perpetual futures, built on its Layer 1 blockchain, offering deep liquidity, low fees, and efficient trading.

What is Hyperliquid ? Hyperliquid is a perpetual futures DEX built on its high-throughput Layer 1 blockchain, Hyperliquid L1. It combines exchange efficiency with blockchain transparency, offering deep liquidity, low costs, and a seamless user experience.

This Hyperliquid blockchain presentation explores the platform's core concepts, consensus mechanisms, the role of its native token, HYPE, including opportunities for Hyperliquid staking and governance.

What is Hyperliquid?

Hyperliquid is a perpetual futures decentralized exchange (DEX) on a proprietary performant Layer 1 blockchain, the Hyperliquid L1. It leverages an on-chain order book for transparent transactions.

Stake Hyperliquid with Imperator.co!

Maximize your HYPE staking rewards : earn more, start now.

The technology behind Hyperliquid L1

Hyperliquid L1 is an ambitious project built on Tendermint and relies on a custom consensus algorithm, HyperBFT, an EMV-compatible bridge, HyperEVM, and a Proof-of-Stake (PoS) consensus mechanism.

It is specifically designed to leverage these features to provide an efficient operating environment for decentralized finance (DeFi) applications.

Imperator offers advanced Hyperliquid RPC nodes designed to enhance blockchain interaction, providing high-performance, security, and scalability for decentralized finance (DeFi) applications.

Core Features of Hyperliquid

Hyperliquid aims to offer wholesome transparency, low trading and transaction costs, deeper liquidity, and unmatched throughput. It also hopes to introduce a stellar user experience to the DeFi space.

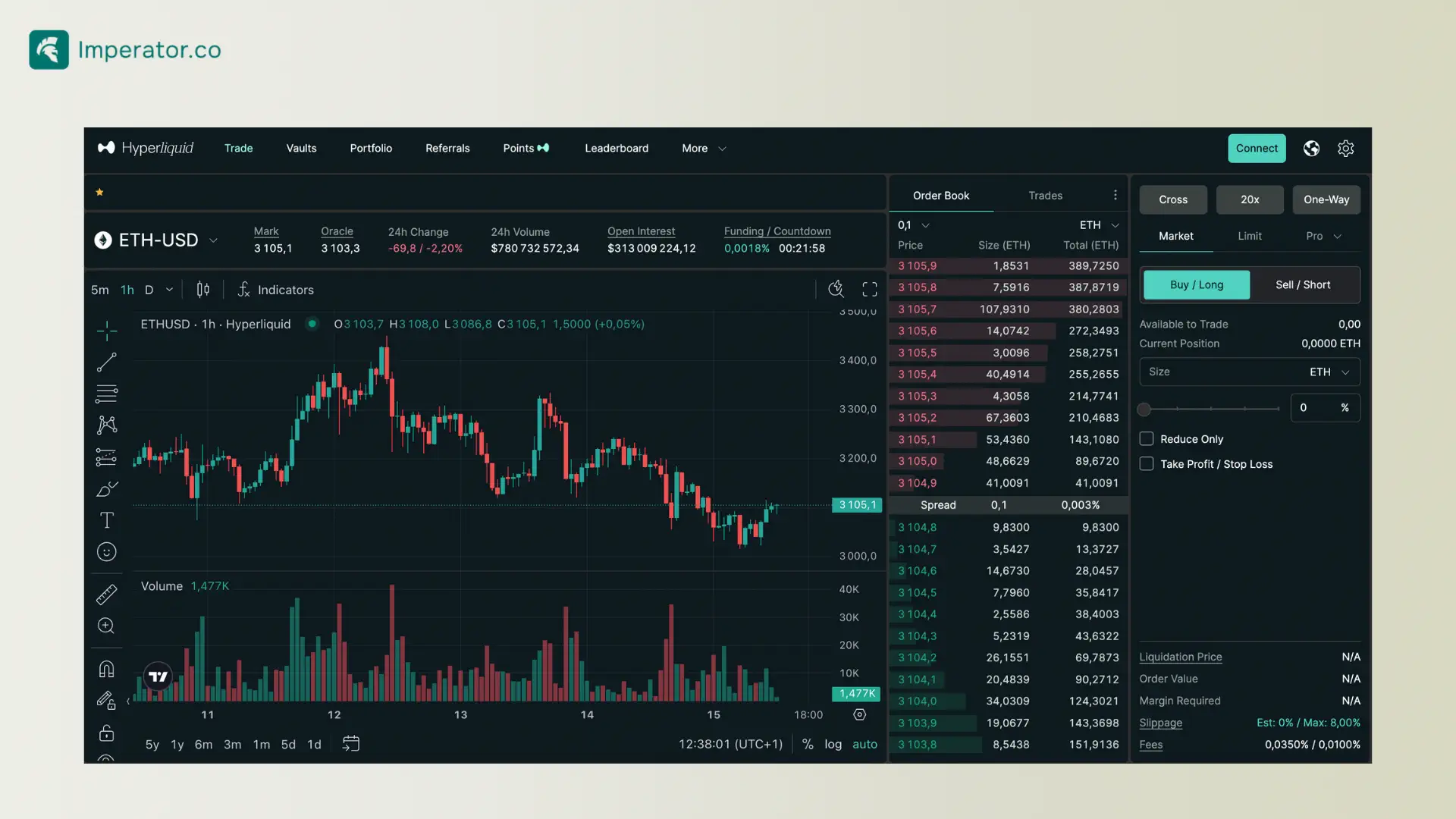

The DEX offers one-click trading, near-instant transactions, and API support for every trader, and stop-loss (SL) and partial take-profit (TP) for advanced traders.

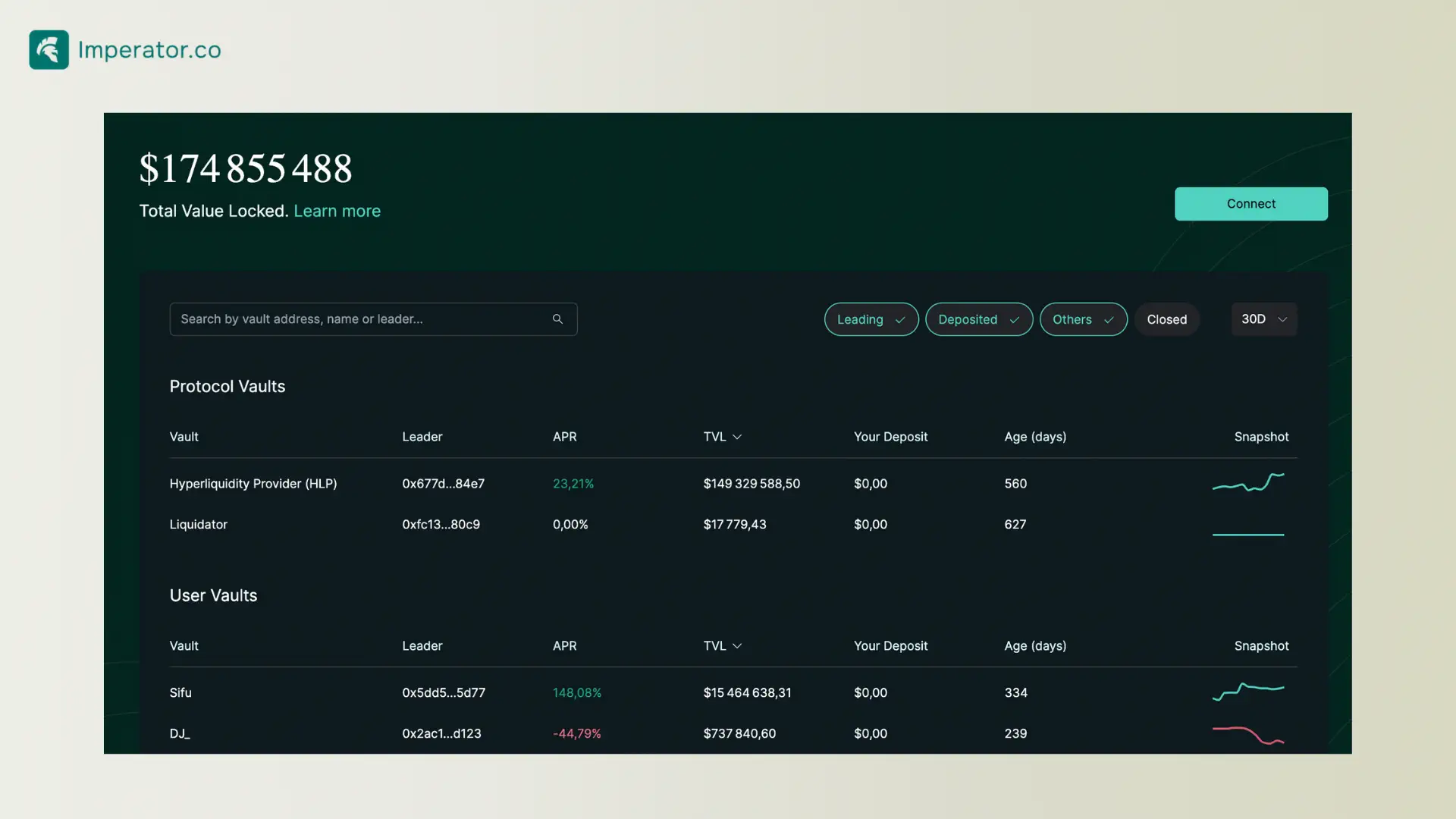

The platform aims to deepen liquidity by connecting interoperable sources in the DeFi realm. Hyperliquid has native vaults that open liquidation strategies and market-making to its community.

Aside from deepening liquidity, the vaults provide an avenue for revenue sharing with the community.

The Core Concepts of Hyperliquid

Blockchain technology presents bold value propositions. The use cases of the tech are revolutionizing various segments of the global economy. One of the most prominent and very successful applications is DeFi.

With every signal pointing to this solution as the most likely direction global finance will take, making it as efficient as possible is only sensible.

Decentralization, Self-Custody and Transparency

Hyperliquid has identified three critical features for DeFi: absolute decentralization, self-custody, and transparency.

The platform presents these features, giving users centralized exchange-level UX minus the risks associated with delegated custody of funds.

While building decent solutions on existing chains is easier, more is needed to scale an order book to meet global trading parameters.

Order books' critical role in trading demands that the infrastructure supporting them has stellar qualities. Hyperliquid L1 is robust enough to support the demands of a global exchange.

Hyperliquid's Efficient Costs

Hyperliquid L1 enables the DEX to run an optimized exchange state machine, not general smart contracts. Thus, it can run efficiently on negligible gas fees (<$0.001 per transaction).

The DEX plans to introduce trading fees later on its roadmap. However, it currently does not charge for trades.

Ultimately, the DEX plans to introduce trading fees rivaling centralized exchange rates and rebates for market makers.

How does Hyperliquid work?

Hyperliquid provides an efficient environment for trading perpetual contracts through trade transparency, scalable infrastructure, and democratized liquidity.

Hyperliquid relies on a high-performance L1 blockchain and HyperBFT consensus to ensure high throughput and low latency. HyperBFT enables real-time trade processing, while the optimized blockchain ensures transparency.

The L1, HyperBFT, and PoS consensus together make Hyperliquid a secure and seamless platform for perpetual contract trading.

HyperEVM

HyperEVM allows users to transfer assets between the Hyperliquid L1 and Ethereum-based networks. This approach is similar to dYdX Chain's use of the Cosmos SDK

The same validator sets operating the Hyperliquid L1 secure the bridge, ensuring that transfers across the various ecosystems are safe. It is designed to facilitate high transaction volumes efficiently and securely.

Hyperliquid Perpetual Order Book

Hyperliquid DEX is the flagship app of the ecosystem, and it differs widely from common DEXs as it does not rely on automated market makers (AMMs).

Instead, it leverages a traditional order book where traders place bids and request assets. The DEX mimics the UX of centralized exchanges. It puts all trading processes on-chain to enhance transparency.

Oracle-Dependent Pricing Tool

The platform uses a decentralized oracles pricing system where validators publish spot prices from major exchanges.

The data determines funding rates and margin levels and triggers liquidation events.

Clearinghouse and Margin Protocol

Hyperliquid DEX incorporates a clearinghouse that can manage users’ margin positions and balances, supporting cross-margin, where traders share collateral across multiple positions, and isolated-margin trading methods, where specific collateral is dedicated to individual positions.

Hyperliquid Vaults

Vaults allow users to fund Hyperliquid trades. The DEX natively integrates vaults, enabling users to deposit into the strategies running therein.

Users who deposit into the vaults copy the vault’s trades by default and earn a share of the profit and loss (PNL).

What makes Hyperliquid useful?

Hyperliquid stands out in the DeFi ecosystem by tackling some of the most pressing challenges faced by decentralized finance today.

By bridging the performance gap between centralized and decentralized exchanges, minimizing transaction costs, and deepening liquidity, Hyperliquid aims to provide a seamless and efficient trading experience.

Here are the key ways in which Hyperliquid proves its value:

Bridges the performance gap: Hyperliquid offers CEX-level UX and performance, and benefits of DEX.

Minimize transaction costs: Its optimized exchange state machine, efficient order matching, and unique approach to transaction and trading charges have significantly reduced gas costs and trading fees for end users.

Deepens liquidity: Reducing spread across numerous interoperable smaller exchanges while concentrating liquidity allows the platform to offer deeper trading volumes.

Broadens trading options: DeFi participants get access to an expansive range of trading strategies because Hyperliquid DEX brings together perpetual futures trading, advanced order types, and up to fifty times leverage.

HYPE Token

What is the HYPE Token?

HYPE is the native token of the Hyperliquid ecosystem. It is not in circulation as of press time. However, the Hyper Foundation held a successful launch event and plans a genesis distribution in Q4/2024.

Token holders will participate in the governance process of the Hyperliquid platform and contribute to liquidity and market making. Besides, HYPE will be used to incentivize the community to provide liquidity.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

How to get started with Hyperliquid

Follow these steps to get started on Hyperliquid:

Create a Hyperliquid-compatible Wallet

To use the Hyperliquid platform, you need a wallet to store and manage your assets.

Various self-custody platforms like MetaMask, MyEtherWallet (MEW), trust Wallet, Trezor, and Ledger support Hyperliquid-compatible assets.

Buy and bridge assets

Follow the steps below to buy assets:

Sign up or log into an exchange.

Search for ETH, USDC, PURR, GRASS, GOAT, NEIRO…

Buy using approved payment methods.

Transfer to a Hyperliquid-compatible wallet.

Use HyperEVM to bridge the assets to Hyperliquid L1.

Use the platform as is appropriate

Hyperliquid is a user-centric platform with an admirable interface. Users should first explore the DEX and study its markets and trading pairs to make the most of it.

After acclimatization, placing orders, managing positions, and providing liquidity should follow.

Staking HYPE Tokens

Token holders who stake HYPE earn rewards in exchange for facilitating transaction validation, contributing to platform stability, and securing the Hyperliquid blockchain.

This staking mechanism is similar to other Proof-of-Stake blockchains like Sei Network.

We have prepared a detailed guide to help you choose the best Hyperliquid validators.

Who created Hyperliquid?

Hyperliquid was created by Harvard grads Jeff Yan and Iliensinc. The two previously worked at Hudson River Trading and Citadel, renowned high-frequency trading companies.

The core development team has yet to attract external funding. However, Hyper Foundation, the initiative supporting the development of the Hyperliquid blockchain and ecosystem, has chalked a genesis token distribution for Q4 2024.

What is Hyperliquid: Closing Thoughts

Hyperliquid introduces newer heights of efficiency to the DeFi space by cherry-picking the best features of CEXs and DEXs.

These features position it to take advantage of the innovation and rapid growth in DeFi. It stands to shape on-chain trading in particular and the DeFi space in general.

FAQs about Hyperliquid

What is Hyperliquid (HYPE)?

Hyperliquid is a perpetual futures DEX on a custom performant Layer 1 blockchain, the Hyperliquid L1. It leverages an on-chain order book for transparent transactions and its PoS consensus and proprietary consensus algorithm, HyperBFT, to create an efficient operating environment for DeFi.

How does Hyperliquid ensure efficient trading?

Hyperliquid uses its custom HyperBFT consensus algorithm and Proof-of-Stake (PoS) mechanism to deliver high throughput, low latency, and real-time trade processing.

What is the core concept of the Hyperliquid ecosystem?

Hyperliquid offers CEX-level UX with the speed and efficiency of a DEX. It has a preferable infrastructure for perp trading, lowers the cost of gas and trading fees, and deepens liquidity by democratizing liquidity.

How does Hyperliquid compare to dYdX?

While both platforms focus on perpetual futures trading, Hyperliquid uses a proprietary Layer 1 blockchain (Hyperliquid L1) with an on-chain order book, whereas dYdX relies on Cosmos SDK and off-chain order matching for scaling.

What is an Hyperliquid RPC Node, and why is it important?

Hyperliquid RPC Nodes allow developers and users to interact with the blockchain seamlessly for tasks like reading data and submitting transactions. Imperator provides high-performance RPC node services to enhance the network's efficiency.

What is the HYPE token, and how can it be used?

HYPE is the native token of the Hyperliquid ecosystem. It is used for governance, liquidity incentives, staking, and rewards for contributing to the platform's security and stability.

What wallets are compatible with Hyperliquid?

Compatible wallets include MetaMask, MyEtherWallet (MEW), Trust Wallet, Trezor, and Ledger, allowing users to store and manage their assets safely.

Who created Hyperliquid?

Jeff Yan and Iliensinc created Hyperliquid. The two previously worked at Hudson River Trading and Citadel, renowned high-frequency trading companies.

Maximize your HYPE staking rewards : earn more, start now.