Research

dYdX is a decentralized perpetual futures exchange built on its own Cosmos-based blockchain, offering high-speed crypto derivatives trading with full decentralization

dYdX is a decentralized perpetual futures exchange. In this dYdX presentation, we will explore how dYdX has evolved since its inception and how it continues to provide one of the best solutions for a decentralized perpetual futures exchange across the broader crypto industry.

Key aspects like DYDX staking help secure the dYdX Chain that underpins the decentralized exchange while offering staking rewards to validators and stakers. This model enables the economic security and functionality of the exchange, all while supported by a robust and decentralized infrastructure.

What is dYdX ?

dYdX is a decentralized perpetual futures exchange that allows traders to speculate on the movement of crypto asset prices via a derivatives product known as perpetual futures contracts.

dYdX Chain is an open-source, standalone blockchain, where the protocol code is written by dYdX Trading, Inc. and all the infrastructure and services are run in a fully decentralized manner.

Technical Breakdown of dYdX Chain

To understand exactly why dYdX has been able to become and remain such a significant player in the decentralized perpetuals exchange space, one must understand the technical nuances of dYdX Chain and how it separates itself from its competitors.

Stake dYdX with Imperator.co!

Maximize your DYDX staking rewards : earn more, start now.

Cosmos-Based Blockchain Architecture

dYdX exchange runs on top of its own completely decentralized and sovereign Cosmos-based blockchain called dYdX Chain. dYdX Chain is the underlying blockchain that is able to facilitate the fully decentralized exchange architecture for the DEX.

dYdX Chain was built using the Cosmos SDK and uses CometBFT, formerly known as Tendermint, as its consensus mechanism. As a result, it inherits a similar infrastructure to other Cosmos-based chains like Osmosis, Injective blockchain, and Sei while also gaining interoperability capabilities through Cosmos’ Inter-Blockchain Communication Protocol (IBC).

dYdX Chain is also a Proof-of-Stake (PoS) chain that relies on its native token, DYDX, for economic security.

Most of dYdX’s key technical features come from the fact that the exchange now lives completely on a standalone layer-1 Cosmos-based blockchain.

Scaling capabilities of dYdX Chain

The dYdX Chain built using the Cosmos SDK has significantly upgraded the architecture of dYdX in general. Not only does building a Cosmos-based chain allow dYdX to exponentially increase the number of transactions per second it can execute on-chain, it relinquishes dYdX’s reliance on external blockchains and systems while offering full customizability over how the blockchain itself works.

Compared to the previous version of dYdX, also known as dYdX v3 on StarkEx, which is only able to process about ten trades per second and one thousand order places / cancellations per second, dYdX Chain is able to process up to two thousand transactions per second. This provides dYdX Chain with a much more scalable base on which to build upon that also allows for a part on-chain and part off-chain exchange system.

On-Chain and Off-Chain Features of dYdX Chain

A key component of allowing for a scalable part on-chain and part off-chain exchange system is the ability for teams building Cosmos-based blockchains to specify what sort of jobs their validators and nodes perform.

In the case of dYdX Chain, validators conduct traditional tasks that occur in other proof-of-stake blockchains like verifying transactions and producing new blocks, but they also contribute to the processing and execution of transaction orders.

Each of these features including the on-chain and off-chain order book and matching engine and the custom validator tasks are key features of a Cosmos-based chain and fundamental reasons for why dYdX Chain is able to scale its transactions per second capacity so significantly compared to the previous version built on Ethereum L2.

dYdX Chain features both on-chain and off-chain components of its exchange to be able to offer a decentralized product that is also scaled to be able to comfortably execute the trading volumes.

Off-Chain: Decentralized Order Book

dYdX maintains an off-chain order book that is managed by its validators nodes, all of which each maintain an off-chain in-memory order book to store proposed transaction orders. When a trader initiates an order, the order is routed to a randomly selected validator node before the validator ‘gossips’ the order to other validators and full nodes.

This is done so that other validators and nodes can update their own in-memory order books with the new order. This off-chain process of managing and storing initial orders off-chain prevents excess data from taking up memory and precious execution space on the blockchain.

It also allows users of dYdX to submit and cancel orders without having to pay any sort of fees until the order itself is actually filled because the submission of transactions are done off-chain.

On-Chain: Decentralized Matching Engine

The on-chain process occurs after a user has placed an order and the order has reached the off-chain order book managed by the validator nodes. While the order is in the order book, the validator nodes communicate with each other on a real-time basis to find matching buy and sell orders to execute both sides of a transaction.

When a match is found between two orders, the selected validator adds the matched trade to the next proposed block on dYdX Chain. The proposed block then goes through the consensus process, requiring two-thirds of all validator nodes to confirm the block before the block containing the original transaction order is committed on-chain.

Decentralized Governance in dYdX Chain

Since dYdX V4 moved to its own chain and completely decentralized all of its processes, it has allowed dYdX community members to propose and move forward with new features via the new decentralized governance process.

DYDX token holders are now able to add and remove new markets, modify the parameters of existing live markets, change the roster of third-party price sources, adjust the fee schedule, change trading reward mechanisms, change the funding rate formula, and even maintain ownership over the insurance fund.

New Functionalities in dYdX Chain

Much of this new optionality has led dYdX Chain to introduce and integrate new features.

Permissionless Market Listing with MegaVault

Users will be able to instantly list virtually any market on dYdX Chain without requiring governance approval.

They will be able to do this by depositing a certain amount of USDC, determined by governance, into a MegaVault. The MegaVault will then automatically begin quoting orders on that market to ensure instant liquidity is available for all new markets.

MegaVault is a user-facing feature which will enable dYdX Chain users to deposit USDC, provide liquidity to various markets, and earn yield in return. The deposited USDC is used to run automated market-making strategies across dYdX Chain markets.

Permissioned keys on dYdX

dYdX Chain is building the option for users to have permissioned keys to enhance security and control over their wallets. Permissioned keys grant specific, controlled access to a wallet and ensure only authorized participants can or cannot perform certain actions, such as depositing or withdrawing funds.

By introducing permissioned keys, dYdX Chain is aiming to provide a more secure and customizable environment for institutional and high-value traders.

Skip Connect Oracle integration

dYdX Chain integrated with Skip Connect (formerly known as Slinky) as a price oracle for dYdX Chain markets to allow the chain to expand to over eight hundred new potential markets, including Solana assets.

This integration also includes the possibility of integrating Market Map, a feature that allows for an operator to actively maintain and update market parameters to increase the number of potential new markets and ensure the safety of current markets.

Isolated Markets on dYdX

dYdX Chain has integrated isolated markets or markets that have segregated collateral pools and insurance funds. Until recently, dYdX Chain only permitted markets that were cross-margined at a protocol level, which means they shared the same collateral pool and insurance fund

All markets that are cross-margined contribute to the overall risk properties across the entire protocol. As a result, the universe of available markets on any live deployment of dYdX Chain had been constricted by the need to protect the solvency and functionality of the protocol as a whole

Isolated markets are markets that have segregated pools of collateral and their own insurance fund. Each isolated market, then, has its own individual risk properties. This enables a protocol to more safely support a much greater range of market types.

Solana Markets on dYdX

dYdX Chain has integrated with Raydium to unlock oracle prices on all Raydium assets (Solana) and thus unlock a large number of new markets.

Cosmos Ecosystem Integration

Although there have been some community members who have criticized the use of a Cosmos-based chain along with the additional hurdle of needing to bridge to dYdX Chain in order to use DEX, it also opens up dYdX to a world of possibilities natively within the Cosmos ecosystem.

Interoperability through Cosmos IBC

By joining the Cosmos ecosystem, dYdX gains access to the Cosmos ecosystem via Cosmos’ Inter-Blockchain Communication (IBC) protocol, which enables seamless communication and asset transfers between diverse blockchains in the Cosmos ecosystem

This will allow Cosmos users to easily interact with dYdX Chain and vice versa, allowing dYdX Chain to leverage the liquidity and user bases of other Cosmos chains and expand its reach and potential market. A huge part of this will be dYdX Chain’s access via IBC to Noble chain.

USDC Liquidity via Noble on dYdX

Noble is a Cosmos-based chain that focuses on issuing native stablecoins, which crucially includes Circle’s USDC stablecoin. Circle has partnered with Noble to issue the official, canonical version of the USDC stablecoin natively on Noble, enabling Cosmos developers and users to benefit from a fully reserved, redeemable, dollar-backed stablecoin with native liquidity.

As a result of Noble’s IBC integration, dYdX V4 is able to access native USDC liquidity via Circle’s Cross-Chain Transfer Protocol (CCTP) integration with IBC.

One last point towards dYdX’s integration with the Cosmos ecosystem is that dYdX Chain is able to gain access to a plethora of existing infrastructure like wallets, explorers, IBC relayers, and other supporting services. This includes explorers like Mintscan and wallet providers like Phantom, Keplr, Leap, and Cosmostation.

Decentralization fuels dYdX resilience

dYdX's Path to Full Decentralization

dYdX’s evolution from dYdX v3 to dYdX Chain has increased its regulatory resilience as the protocol is now fully decentralized and exists on its own chain. dYdX v3 still saw some parts of the protocol controlled and maintained by dYdX Trading Inc.

Quite crucially, this included the fee allocation since dYdX Trading Inc. collected all the fees generated from dYdX v3. This completely changes in dYdX Chain as the protocol becomes fully community-controlled through the DYDX token. Every part of the protocol is now adjustable via the decentralized governance protocol and fees now accrue to validators and DYDX token stakers instead of dYdX Trading Inc.

dYdX Market Share and Volume insights

dYdX V3 vs dYdX Chain: Volume Comparison

As of writing, dYdX no longer leads decentralized derivatives exchanges in average daily trading volume or market share but continues to remain near the top.

dYdX v3 has hosted over $1.2 trillion in derivatives trading volume since inception while dYdX Chain has hosted over $230 billion in derivatives trading volume since its launch less than a year ago on November 28, 2023.

dYdX Chain has also hosted over 16.6 thousand traders and 143 individual markets on its platform since genesis and currently maintains $175 million in TVL per its subaccounts. Additional data regarding dYdX Chain’s metrics can be viewed here

Although dYdX V3 has been dYdX’s most successful product to date, it continues to see a consistent decrease in trading volume and open interest as traders and liquidity begin migrating to dYdX Chain.

In 2023, dYdX v3 saw the sum of daily open interest hover mostly between $200 million and $300 million but since the launch of dYdX Chain, it has steadily dropped to a point where daily open interest has now reached below $100 million.

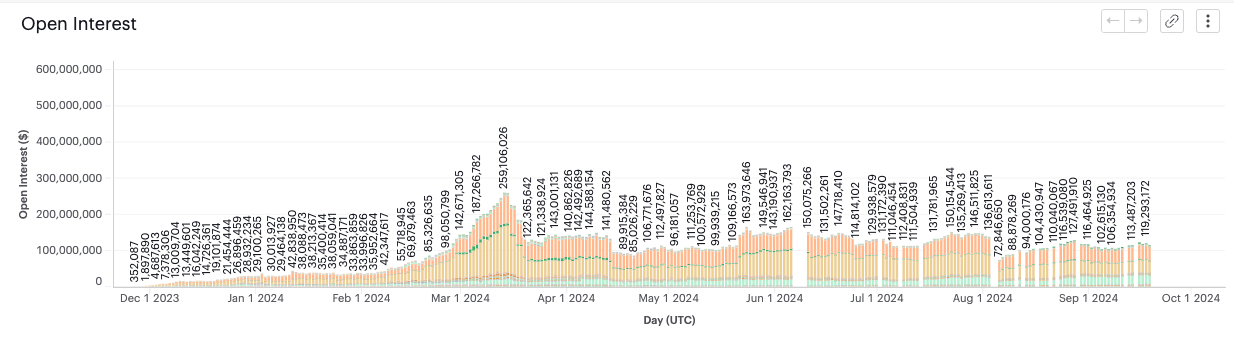

dYdX Chain Open Interest: A year of growth

On the flip side, dYdX Chain has slowly ramped up trading volume since its launch date, beginning at a modest couple million of open interest in late 2023. However, the level of daily open interest has consistently grown since launch and even spiked to a high of $259 million on March 15, 2024

Since that spike, open interest levels have consistently sat around $100 million to $150 million on a daily basis. Most of the open interest on dYdX V4 and especially during the run-up to March 15, 2024, consisted of trading around Bitcoin and Ethereum as Bitcoin had reached a new all-time high of $73,125 on March 13, 2024 after the approval of spot Bitcoin ETFs in the U.S. in January 2024.

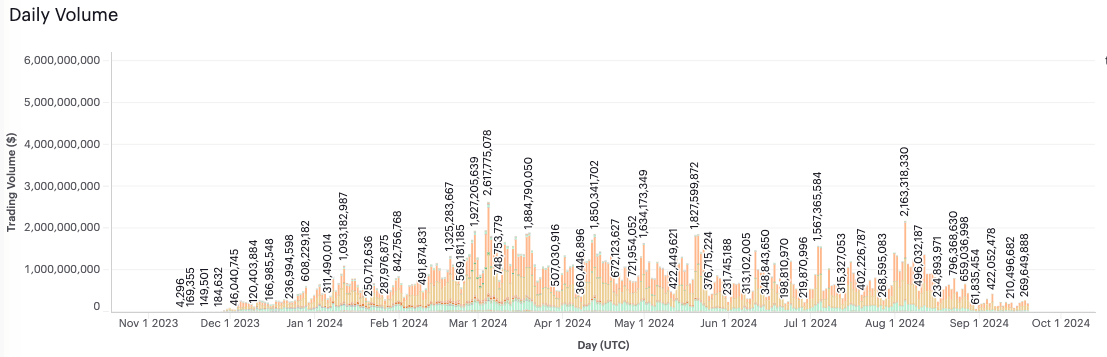

dYdX Chain Trading Volume & Users

dYdX Chain daily trading volume has mainly ranged between $200 million and $500 million with occasional periods where daily trading volume ranges around $1 billion. This period has even seen daily trading volume spike up to as high as $2.6 billion.

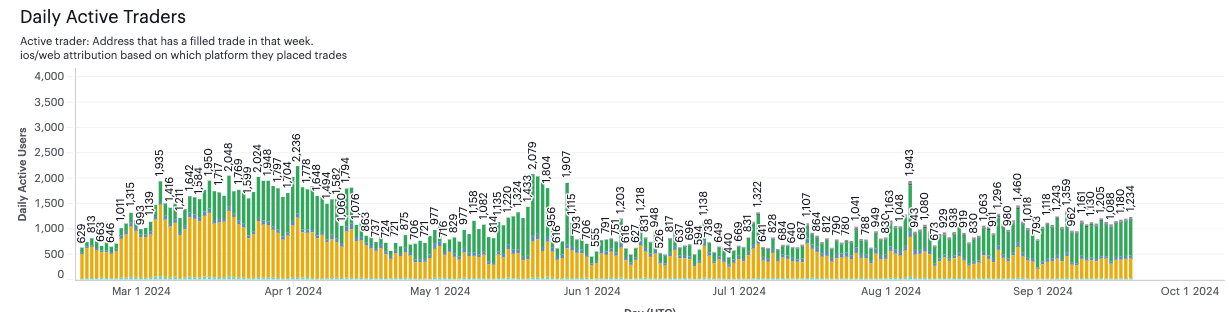

The number of daily active traders on dYdX Chain, defined as the number of addresses that have filled at least one trade in that week, has remained consistent around 1,000 daily active traders after seeing a hump in March 2024 and a spike leading into June 2024. The two primary types of traders, denoted by the colors yellow and green, refer to web-based and api-based traders, respectively.

dYdX vs other Decentralized Perpetual Markets

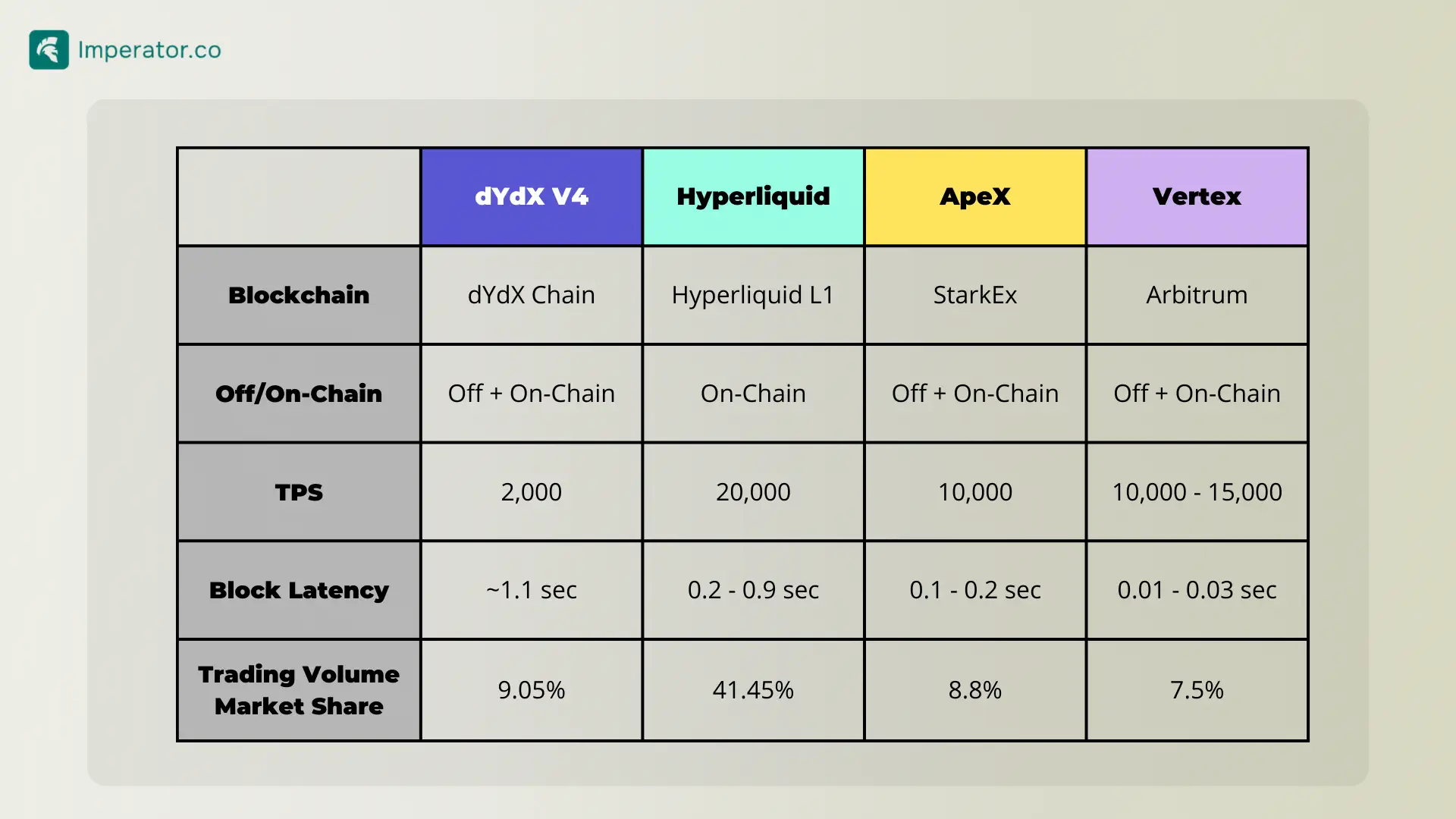

dYdX has always been a trailblazer in the decentralized perpetuals exchange space but since it launched, numerous competitors have risen in an attempt to take a piece of the pie. Some of these competing protocols include exchanges like Hyperliquid, ApeX, Vertex Protocol.

When taking a look at trading volume alone over the past year, dYdX V3 used to dominate the perpetuals trading market with nearly 60% market share in September 2023 but since then, Hyperliquid has become the market leader holding over 40% in September 2024.

Why Hyperliquid Leads Perpetual Trading

Hyperliquid adopted dYdX’s idea of running an exchange on a proprietary chain, launching the Hyperliquid perpetual exchange on its own layer-1 chain called Hyperliquid L1. It initially launched with capabilities of 20,000 transactions per second and less than 0.5 second block latency.

However, since launch, it has improved to support 100,000 orders per second and now uses a custom consensus algorithm called HyperBFT to optimize for latency.

Block latency now has a median 0.2 seconds and 99th percentile 0.9 seconds. Additionally, in contrast to dYdX Chain, Hyperliquid claims to support its order book and clearing house functionalities completely on-chain

However, the trade-off being made to support such high levels of throughput on-chain lies within Hyperliquid’s set of four nodes operated solely by the internal team that are all collocated in Tokyo, Japan.

Although Hyperliquid is aiming to move towards a more decentralized architecture, read-only, non-validating nodes have only just been introduced on testnet, signaling that validating nodes on mainnet are still quite some time away. This is in stark contrast to dYdX Chain’s openly public list of 60 independent and distributed validators that can be viewed here.

Due to Hyperliquid’s UI/UX bridging directly from Arbitrum, its speed in launching new markets for hyped and relevant tokens at the time, and the fanfare generated around its points system and potential for an airdrop, it quickly gained a higher and higher level of market share since launch.

It has consistently grown its market share since last year and continues to dominate the market today. However, one will have to see how well it fares after the conclusion of its points system and the launch of its token, no longer further directly incentivizing traders to trade on its platform.

ApeX Pro & Omni: Non-Custodial Trading Options

ApeX is a permissionless and non-custodial exchange that hosts two primary products, ApeX Pro and ApeX Omni.

ApeX Pro: ApeX Pro is a non-custodial trading platform that delivers access to cross-margined perpetual contracts using an order book model integrated with StarkEx, the layer-2 chain offered by StarkWare. ApeX Pro has multi-chain support that allows for deposits and withdrawals from Ethereum and EVM-compatible chains.

ApeX Omni: ApeX Omni is an aggregated multichain liquidity trading platform built on a modular, intent-centric architecture. It provides a full-suite of trading products with perpetuals up to 100x leverage and 10,000 transactions per second.

Vertex Protocol: Arbitrum’s Integrated DEX

Vertex Protocol is a decentralized exchange (DEX) built on the Arbitrum network that offers spot trading, perpetual futures, and an integrated money market in one vertically integrated platform.

Like dYdX Chain, Vertex Protocol combines an off-chain order book (the "sequencer") with an on-chain automated market maker (AMM). This enables fast order matching (5 - 15 ms latency) while tapping AMM liquidity, reducing gas fees and slippage compared to pure on-chain models

It also uses universal cross-margin accounts so users can trade both spot and perpetual markets with a single cross-margin account.

What is DYDX Coin ?

Understanding the DYDX Token

dYdX Chain has its native token, DYDX, which is a utility staking and governance token used to bond with dYdX Chain validators to secure the network via the proof-of-stake network and influence future governance proposals.

DYDX staking

Those who stake DYDX with validators also gain the additional benefit of staking rewards in the form of USDC that consist of protocol fees less any insurance fund fees and validator commission fees.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

The protocol fees are generated from maker and taker fees and are allocated to validators and stakers. We’ve written a guide on the best dYdX validators to help you choose the right validator

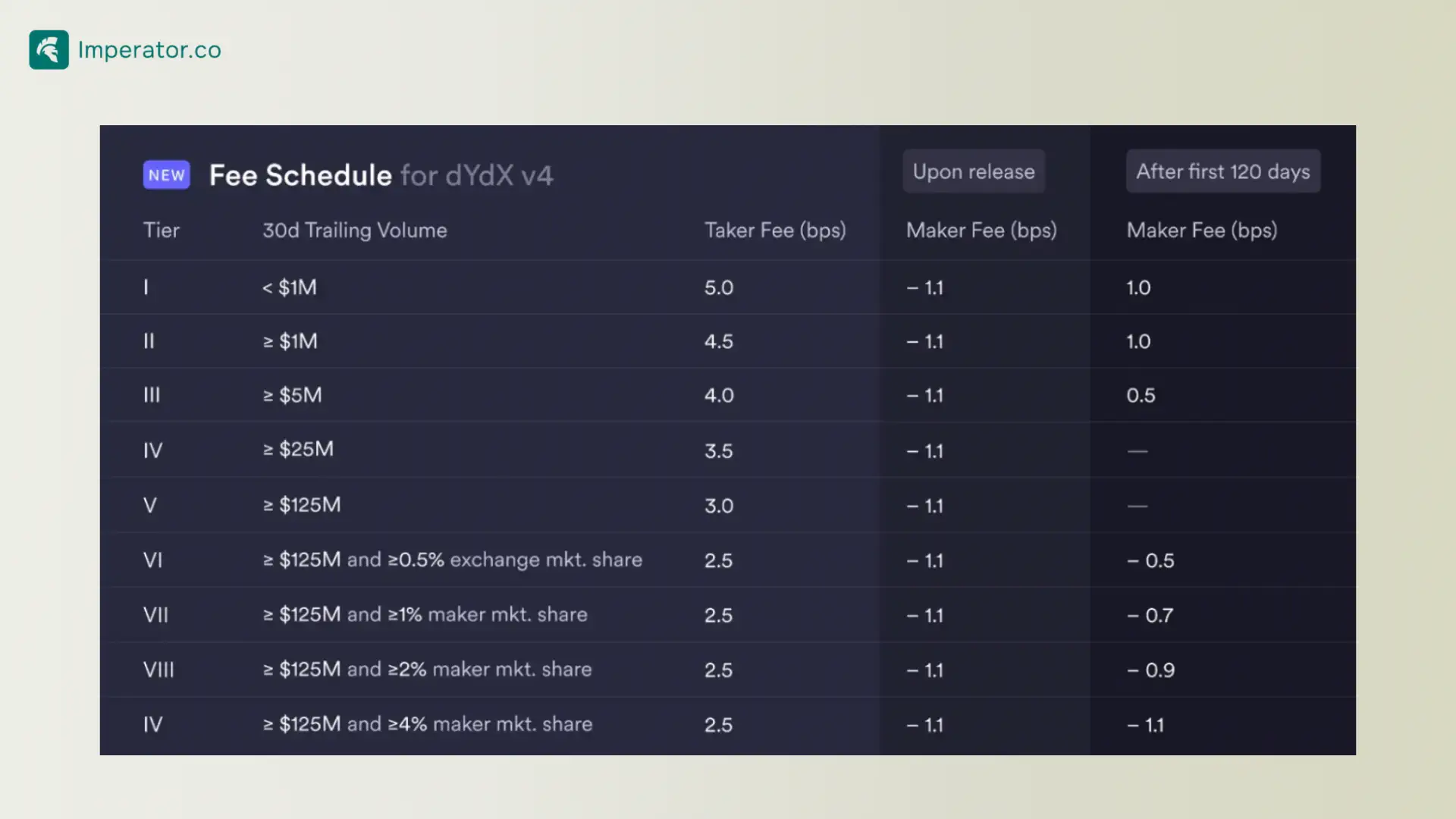

The fee schedule for dYdX Chain is as follows:

DYDX Tokenomics

The DYDX token maximum supply of one billion was minted during the DYDX token genesis event and the circulating supply is slowly increased via operations and rewards.

The current DYDX token allocation after multiple DYDX Improvement Proposals (DIP-14, DIP-16, DIP-17, DIP-20, DIP-24) is as follows:

27.7% to Investors (277 million tokens)

26.1% to Community Treasury (261.1 million tokens)

15.3% to Employees and Consultants (153 million tokens)

14.5% to User Trading Rewards (144.7 million tokens)

7.0% to Future Employees & Consultants (70 million tokens)

5.0% to Retroactive Mining Rewards (50.3 million tokens)

3.3% to Liquidity Provider Rewards (32.8 million tokens)

0.6% to Liquidity Staking Pool (5.8 million tokens)

0.5% to Safety Staking Pool (5.3 million tokens)

dYdX Market Position in 2024

From Leader to Challenger

dYdX is currently situated in a peculiar position after leading the decentralized perpetual futures market for so long as it now sits squarely behind a new player, Hyperliquid.

Although dYdX continues to innovate and works towards bringing a better and more comprehensive experience to its users.

Even the Founder and President of dYdX, Antonio Juliano, admitted that dYdX has become “complacent”.

This was in response to a tweet by @HsakaTrades stating how dYdX has become complacent, lost its leading position, and is now coping with the fact by frantically copying its competitors’ features.

However, Juliano stated this the best, “the one thing about dYdX that has remained consistent is bold dramatic innovation. That will continue with next generation AMMs, instant perp listings on anything, and beyond”.

dYdX’s Focus on dYdX Chain Growth

As dYdX moves forward, it will continue to try to gain a foothold in the market during this transitory period as dYdX v3 is slowly sun-setting so that all of their focus can be put towards growing dYdX Chain.

To jump start this process, the Founder and CEO of dYdX at the time, Antonio Juliano, announced on May 13, 2024, that he is stepping down from the CEO position and Ivo Crnkovic-Rubsamen, a longtime friend and partner of Juliano will be taking over.

However, in a short reversal of events, Juliano announced that he would return to dYdX as CEO on October 10, 2024, to lead dYdX against “tough competition”.

In addition to leadership changes and returns, dYdX announced on July 23, 2024, that they are exploring “strategic alternatives” for the dYdX V3 offshore matching engine so that they can focus all of their energy specifically on growing dYdX V4. dYdX announced on September 27, 2024, that they have ultimately decided to simply sunset dYdX V3.

This means that the exchange is planned to halt on October 28, 2024, at 12:05 PM UTC, the contracts will be frozen on October 30, 2024, and it will remain as frozen contracts that users can simply withdraw from.

What's New on dYdX Chain

Outside of operational changes, dYdX recently announced the launch of dYdX Chain v5.0 on June 12, 2024, which included the introduction of Isolated Markets & Isolated Margin, Protocol-enshrined LP Vault, Slinky Sidecar and Raydium Integrations, Batch Order Cancellation, Signature Verification Parallelization, Soft Open Interest Cap, and Full Node Streaming

Most recently, dYdX announced the launch of dYdX Chain v6.0.3 in September 2024, which included the integration of Market Mapper by Skip, Market Mapper Revenue Sharing, Timestamp Nonces, and Individual Vault Parameters.

However, this wasn’t all of it as dYdX has already announced what is upcoming in its next major launch coming in Fall 2024, dubbed “dYdX Unlimited”. The dYdX Unlimited upgrade is planned to include permissionless market listing, the MegaVault liquidity pool, and affiliates program, and permissioned keys.

Outside of this, Antonio Juliano has also stated on Twitter on September 17, 2024, that prediction markets, similar to something like Polymarket, would be coming to dYdX V4 soon.

This is actively being implemented as the first proposal for a prediction market comes to a close, successfully adding a TRUMPWIN-USD perpetual market by October 9, 2024. Each of these developments and features to come will undoubtedly grow dYdX V4’s capabilities, functionalities, and reach for new traders and new capital.

What is dYdX: Closing thoughts

Although dYdX has lost its top spot as the leading decentralized perpetual futures market, under new leadership and a renewed drive to innovate and take on Hyperliquid, dYdX looks poised to regain much of its lost market share.

But no matter how this pans out, dYdX as a protocol will always mark the beginning of crypto’s foray into a decentralized perpetual futures exchange. Now, we just have to wait to see how dYdX will rewrite the future.

Maximize your DYDX staking rewards : earn more, start now.