Research

Built for the future, Sui unites cutting-edge tech with an open framework, driving global adoption and limitless blockchain potential.

Sui (SUI) Blockchain, launched by Mysten Labs in May 2023, is a Layer-1 delegated proof-of-stake (DPoS) blockchain designed for scalability, safety, and mainstream adoption. Unlike other Layer-1 blockchains like Solana, Sui features a unique object-centric data model for parallel transactions and a horizontally scalable architecture.

The Sui Move language, an evolution of Meta's original Move, enhances developer experience with built-in safety features. Sui aims for a Web2-like user experience with features like zkLogin for wallet creation using familiar credentials and sponsored transactions to abstract gas fees.

Despite significant funding, Sui's long-term success depends on building a strong user base and supporting unique applications leveraging its technology.

Sui’s Background

Sui emerged from the remnants of Meta's ambitious but ultimately shuttered Diem and Novi projects. When Meta announced plans in 2019 to create a permissioned blockchain (Diem) and a global digital wallet (Novi), the initiatives faced overwhelming regulatory hurdles, leading to their closure in early 2022.

Recognizing the untapped potential of the underlying technologies, former project leaders branched out to establish Mysten Labs in 2021 to develop Sui, albeit diverging from the original Diem framework to build something novel.

Mysten Labs was founded by notable figures like Evan Cheng, Adeniyi Abiodun, and Sam Blackshear (who originally co-developed the Move programming language at Novi). With funding from prominent investors like a16z, Coinbase Ventures, and Binance Labs, the company raised $336 million across two private investment rounds in 2022 and launching in May 2023. Complementing Mysten’s efforts, the independent Sui Foundation was established to foster ecosystem growth and support projects building on Sui.

Sui’s Technical Overview

Object-Centric Data Model

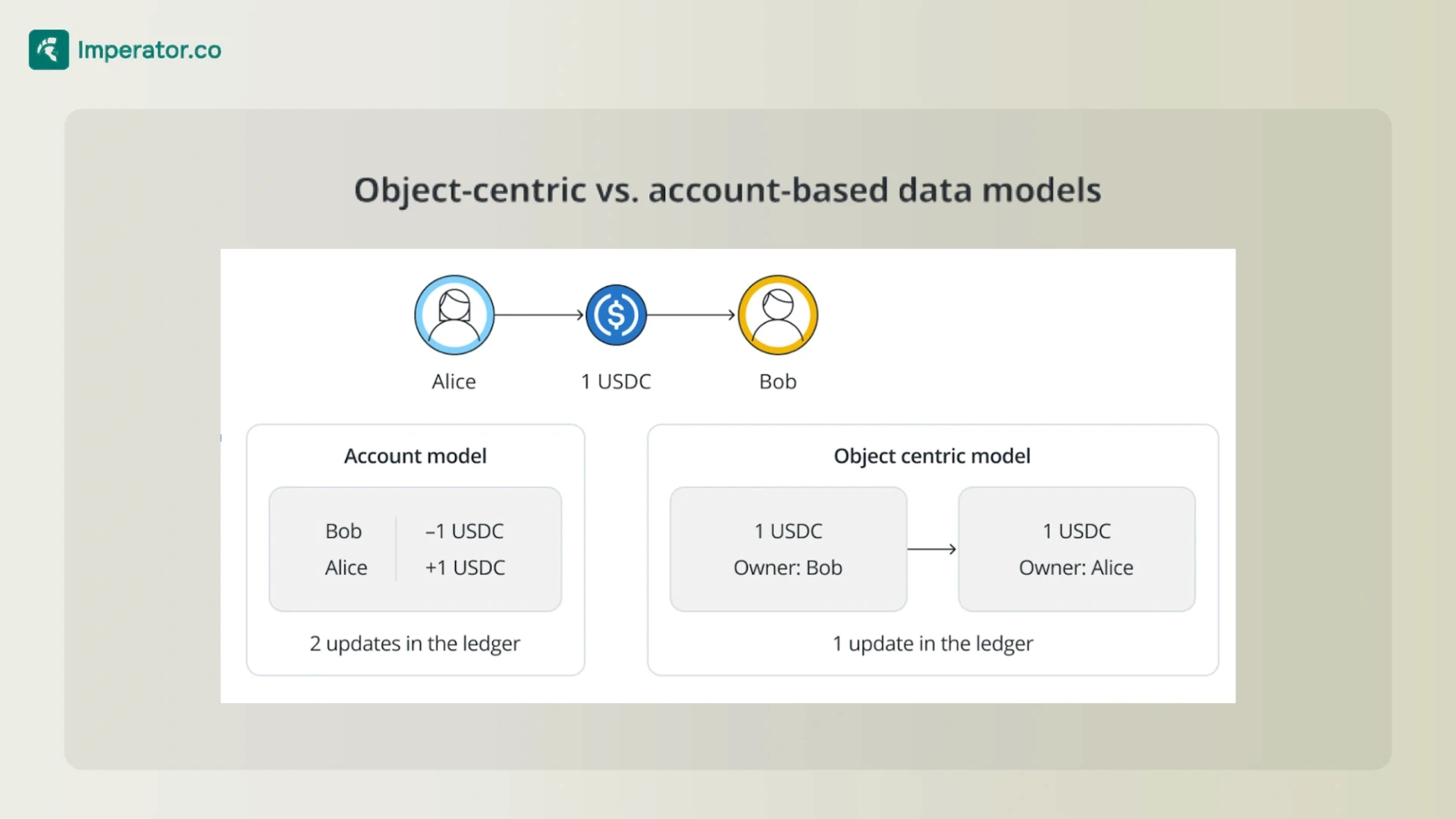

At the heart of Sui’s architecture lies its novel object-centric data model, which redefines how blockchain state is managed and transactions are executed. Traditional blockchain systems like Ethereum and Solana rely on account-based models, where the state is represented as balances and contract states are tied to accounts.

Others, like Bitcoin, use the UTXO (Unspent Transaction Output) model to track assets. Sui departs from these approaches by adopting a hybrid model, where the state is represented by objects with globally unique IDs.

Stake SUI with Imperator.co!

Maximize your SUI staking rewards : earn more, start now.

In Sui, objects encapsulate the history and state of an asset. This design allows for four distinct types of object ownership:

Address Ownership: Objects directly owned by an address, such as NFTs or fungible tokens.

Object Ownership: Objects owned by other objects, enabling complex hierarchies (e.g., an avatar NFT owning a weapon NFT in a game).

Shared Ownership: Objects accessible by multiple entities, such as liquidity pools or auction contracts.

Immutable Objects: Read-only objects that cannot be modified once created, suitable for permanent data storage.

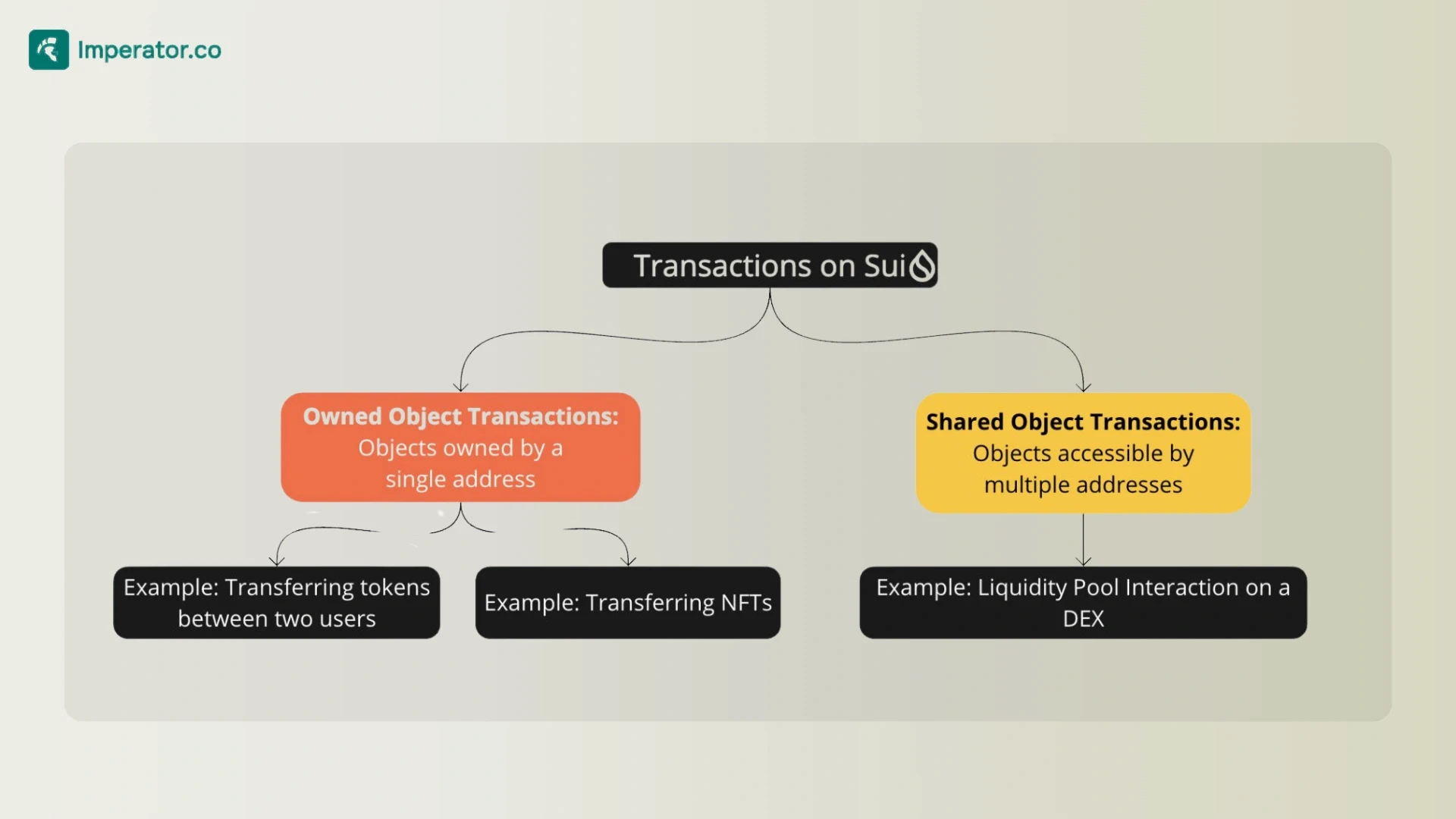

This object-centric model enables parallel transaction processing, bolstering scalability. Transactions are grouped based on the objects they interact with, allowing unrelated transactions to execute simultaneously.

For instance, transactions involving different NFTs can be processed independently, while those interacting with the same liquidity pool are sequenced to ensure integrity. This causal ordering mechanism eliminates the need for a global total ordering of transactions.

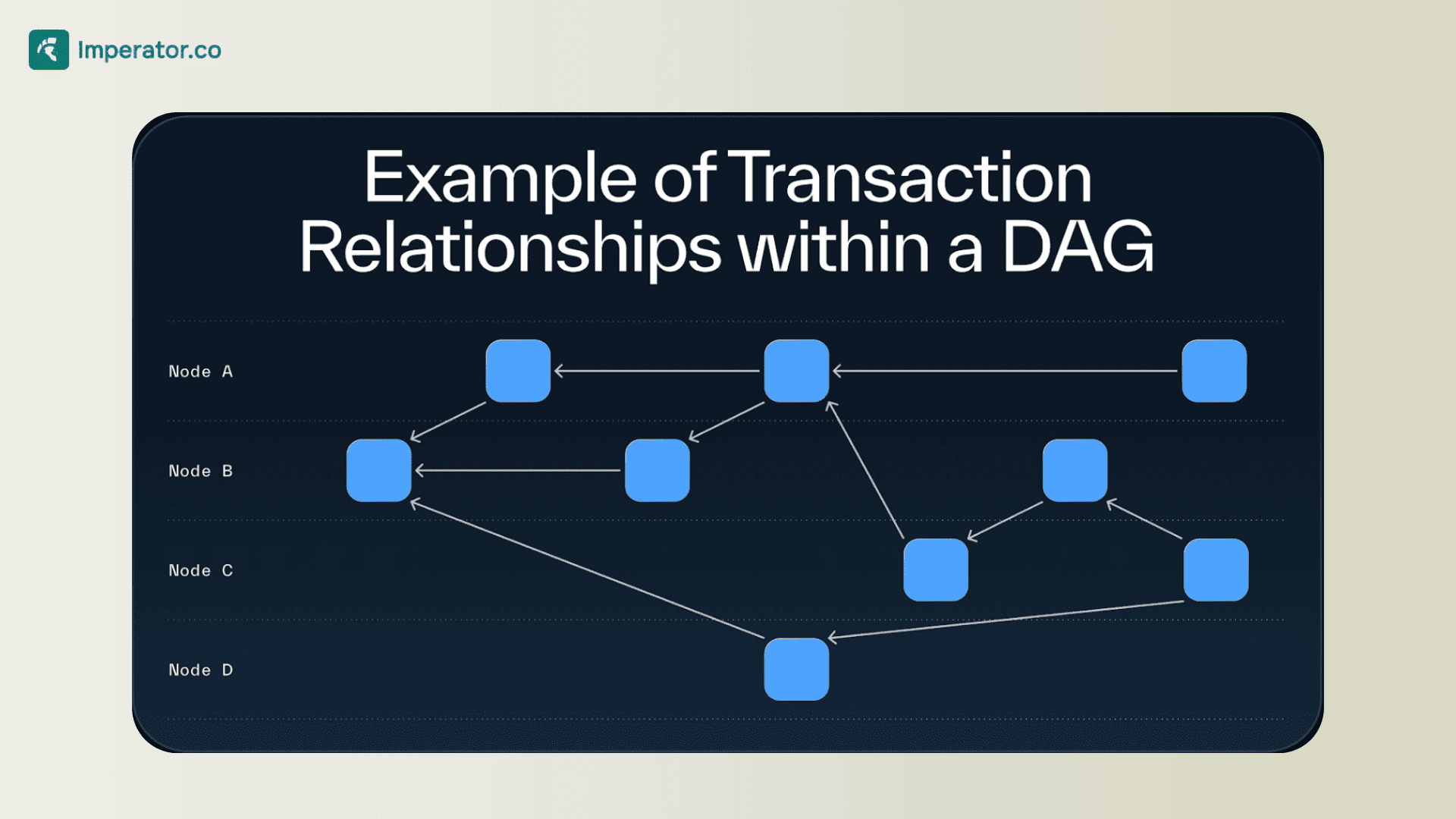

Structurally, the global state in Sui takes the form of a Directed Acyclic Graph (DAG), where objects are vertices and transactions are edges. Live objects—those without outgoing edges—represent the current state, making the global ledger a collection of all live objects.

This structure facilitates efficient querying and transaction validation while minimizing redundant processing.

By decoupling state from accounts, Sui achieves scalability and flexibility, making it particularly well-suited for use cases like gaming, where assets frequently interact in complex ways.

Moreover, the model simplifies the user experience by presenting transactions in a clear, object-oriented manner, akin to Android-style permissions, where users can see exactly which objects will be modified and how.

Sui Move Programming Language

Sui’s object-centric architecture is complemented by its programming language, Sui Move, a derivative of the Move language originally developed by Mysten Labs co-founder Sam Blackshear.

Move was designed with safety as its cornerstone, and Sui Move extends this vision by integrating with Sui’s data model.

Resource-Oriented Programming: At the heart of Sui Move is the concept of resources, digital assets that cannot be duplicated, accidentally destroyed, or modified by unauthorized code. This guarantees asset safety and prevents common vulnerabilities like double-spending.

Bytecode Verification: Before deployment, Sui Move contracts undergo rigorous checks using the Move bytecode verifier. This static analysis ensures adherence to type safety, memory safety, and resource rules, providing a layer of security unmatched by traditional languages like Solidity.

Modular Design: Sui Move supports reusable modules, enabling developers to build complex applications with fewer lines of code. This modularity simplifies development and reduces the likelihood of errors.

Sui Move is designed to be accessible to both seasoned blockchain developers and those new to the space. Tools such as the Move Prover aid in formal verification, ensuring that smart contracts behave as intended across all possible inputs and states.

The move-analyzer plugin for Visual Studio Code provides real-time feedback and debugging support. Additionally, planned enhancements include auto-formatting, a debugger, and a Read-Eval-Print Loop (REPL) environment for rapid prototyping.

Compared to Solidity, Sui Move offers built-in safeguards against several critical vulnerabilities. For example, it mitigates reentrancy attacks by design—a flaw responsible for significant exploits, such as the Ethereum DAO hack. Additionally, five of the OWASP Top 10 vulnerabilities are impossible in Sui Move, with three more partially mitigated.

Additionally, Sui Move is tailored to leverage the object-centric data model. Smart contracts in Sui Move interact directly with objects rather than accounts, simplifying logic and enabling more intuitive programming.

Developers can also create programmable transaction blocks (PTBs) that batch up to 1,024 operations. PTBs can be used for mass NFT minting, complex DeFi operations, or even multi-step workflows, executed atomically.

Mysticeti Consensus Protocol

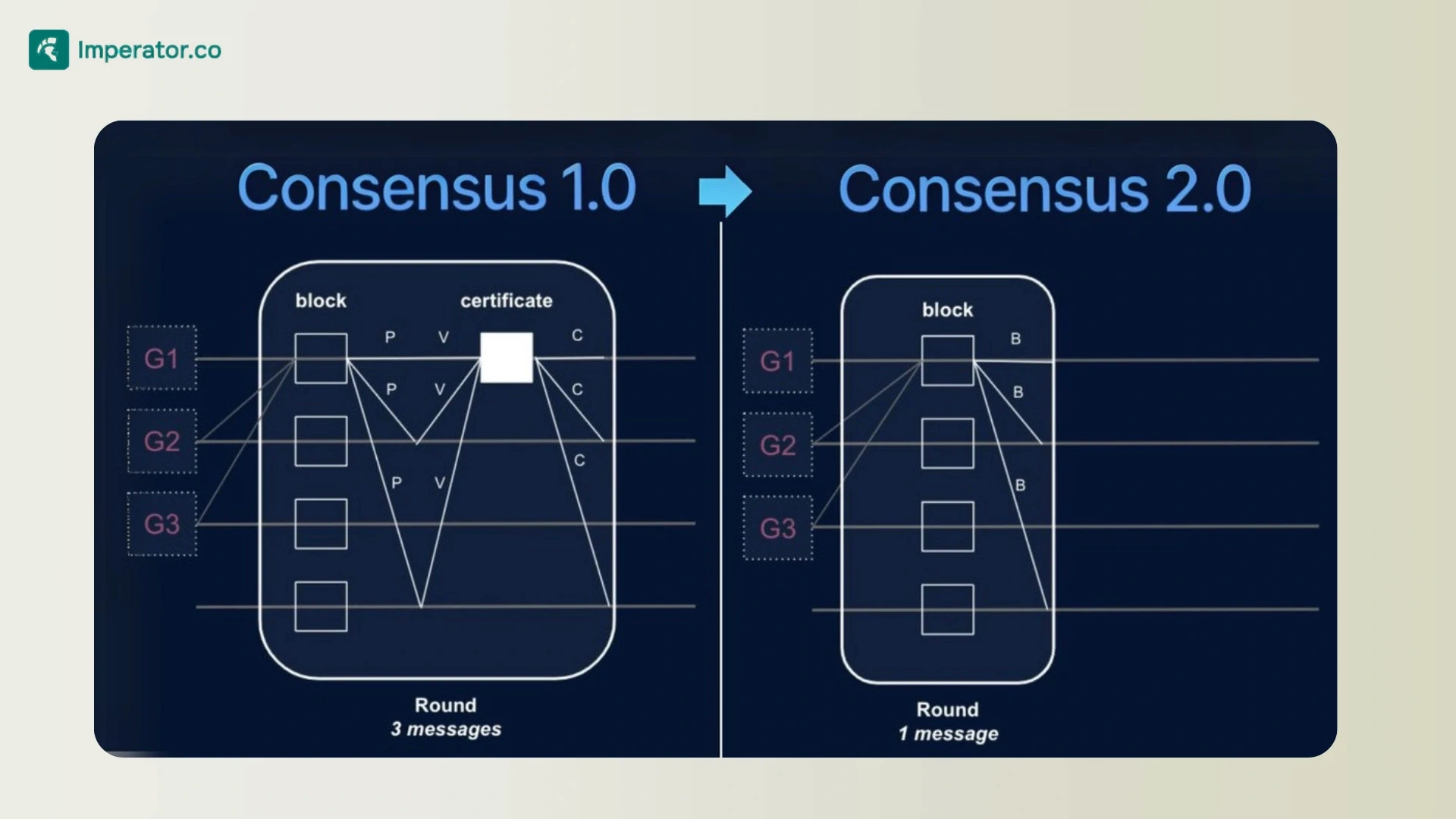

Previously, Sui blockchain employed the Narwhal-Bullshark consensus protocol, a DAG-based mechanism that decoupled transaction dissemination from commit logic. While effective in maintaining high throughput, it required multiple communication rounds for certification, leading to higher latency.

Mysticeti builds on Narwhal-Bullshark’s foundation but introduces several optimizations that reduce latency and improve throughput:

Uncertified DAG: Shifting from a certified DAG to an uncertified DAG eliminates the need for explicit block certification. Nodes propagate blocks optimistically, reducing message delays per round from three to one, cutting consensus latency by 80% (as little as 390 milliseconds).

Multi-Leader Proposals: Mysticeti supports multiple concurrent leaders per round, increasing fault tolerance and accelerating the commit process.

Universal Commit Rule: Blocks can be committed as soon as determinable conditions are met, reducing undecided blocks and streamlining transaction sequencing.

Pipelining: Processing multiple waves of transactions simultaneously ensures a steady flow of commitments and further reduces delays.

These optimizations enable Mysticeti to maintain high throughput—well over 100,000 transactions per second (TPS)—with a maximum theoretical TPS of 297,000.

Technically, Mysticeti employs direct and indirect commit rules based on the DAG structure to determine whether to commit or skip leader blocks efficiently. For transactions involving owned objects, Sui network utilizes optimistic finality, allowing immediate execution without waiting for consensus, further reducing latency.

Mysticeti also introduces native randomness using threshold cryptography and Distributed Key Generation (DKG), enhancing security by providing unpredictable and unbiased random values.

Scalability: Other Mechanisms

Sui's architecture incorporates several other mechanisms that collectively enhance scalability and performance. As mentioned, owned object can be processed without consensus, this is done using Byzantine Consistent Broadcast. However, shared object transactions, that involve objects accessible by multiple addresses, require consensus for proper sequencing.

By grouping transactions based on the objects they interact with, Sui enables parallel execution of unrelated transactions. Also, by allowing the batching of operations, PTBs increase transaction throughput and lower the average cost per transaction.

Finally, the scalability of Sui’s network is bolstered by its approach to validator operations. Validators process transactions individually rather than batching them into blocks, reducing network latency and allowing for more granular optimization.

Moreover, the network’s scalability is horizontal and thus theoretically uncapped, as validators can increase capacity by adding worker machines to their infrastructure.

Storage Fund and Gas Fee Model

Sui’s scalability extends beyond transaction throughput, incorporating a storage fund to manage long-term data availability. The storage fund accumulates fees from users who store data on the network, alongside a portion of staking rewards. Users can delete stored data to reclaim their fees.

This storage-centric approach makes Sui uniquely suited for hosting complex digital assets directly on-chain. For example, developers can publish NFTs containing embedded multimedia like videos or high-resolution images, bypassing the need for external storage solutions such as IPFS, reducing friction.

Sui’s gas fee model complements this design. Gas fees are divided into computation and storage components, with validators determining a minimum gas price per transaction each epoch. A “reference gas price,” calculated as the 2/3’s percentile price by stake, provides a baseline, while users can tip above this rate for priority execution. All honest validators are rewarded uniformly, meant to mitigate centralization by preventing larger validators from disproportionately increasing their stake through earlier rewards.

User-Friendly Features of Sui Blockchain

Sui blockchain places a strong emphasis on enhancing user experience and broadening accessibility. One of its most innovative features is zkLogin, which allows users to create wallets using their existing Web2 credentials, such as Google or Apple accounts, eliminating the need for traditional seed phrases.

Another user-friendly feature is sponsored transactions, which enable applications to cover gas fees on behalf of users, simplifying interactions and making blockchain-based platforms more intuitive. Services like Shinami's Gas Station API facilitate sponsored transactions, with some periods seeing over 80% of transactions sponsored.

Sui also enhances transparency through Android-style permissions. Wallets and applications can present transaction signing requests in a manner similar to Android permissions, showing users exactly which objects will be modified, providing clear insights into the consequences of transactions.

Additional Innovations

The Sui Indexing Framework provides customizable access to on-chain data through a flexible data ingestion system, allowing developers to collect raw and derived datasets and facilitating tailored data feeds for specific applications.

The integration with Amazon Web Services (AWS) simplifies the deployment and management of Sui full nodes and leverages AWS's infrastructure for enhanced performance, availability, and reliability.

The Sui Name Service (SuiNS) has also transitioned from the .sui suffix to an @ prefix, bridging Web2 and Web3 identities more seamlessly. The introduction of subnames allows for hierarchical identities, enhancing organizational and individual branding.

Competitive Analysis of Sui

Sui operates in a highly competitive landscape, among its most direct competitors are Solana and Aptos—platforms that share certain design similarities (e.g., integrated/ high throughput) but differ in their approaches to data modeling, transaction processing, and scalability.

Sui vs Solana

Solana is currently the leading high-throughput blockchain in terms of adoption. It achieves high performance through a unique consensus mechanism called Proof of History (PoH) and executes transactions using a pessimistic approach where dependencies are declared upfront.

It employs an account-based system for recording the global ledger state, and developers must pre-declare all accounts a transaction will interact with, allowing the system to execute non-overlapping transactions in parallel.

However, Solana's approach can be more labor-intensive, as it requires declaring more accounts compared to Sui's object model. Implementing account checks correctly is also challenging, which has led to significant security breaches in the Solana ecosystem that Sui Move inherently avoids through its design.

Sui differentiates itself by enabling validators to execute transactions in parallel via a causal-ordering approach based on its object-centric data model. Transactions that do not interact with the same object can be processed in parallel without consensus.

This allows Sui to achieve high throughput—theoretically 297,000 TPS, far surpassing Solana’s theoretical 65,000 TPS. However, Solana’s upcoming Firedancer mainnet would erode this performance edge with a theoretical TPS of 1 million.

As of now, none of these factors matter quite as much as Solana’s strong network effects from its robust and growing ecosystem, user base and developer community. The difficulty in porting over developers in particular is compounded by Sui Move, which introduces a learning curve for those accustomed to Solidity or Rust.

To illustrate this advantage, for Q3 2024 Solana averaged 70.1 million daily transactions (down 12% QoQ) while Sui averaged 3.3 million daily transactions (down 54% QoQ), translating to $110 million and $750 thousand in total transaction fees, respectively, over the quarter. Similarly in terms of daily DEX volume, Solana averaged $1.7 billion while Sui averaged $48.7 million.

The one bright spot for Sui is its low cost with an average transaction fee of $0.0024 over Q3, roughly one-tenth that of Solana which hovered at $0.0234, albeit with 21 times the transaction count. However, to actually battletest network performance Sui must attract both developers and users, offering either compelling technology for developers or use cases for participants, which don’t seem to exist so far.

Perhaps the one area where Sui could really gap ahead is gaming, given strong greater focus, both from an ecosystem and system architecture perspective, however this remains an elusive and notoriously difficult category for the crypto industry.

Sui vs Aptos

Aptos is another nascent blockchain that shares roots with Sui, originating from former engineers of Facebook's Diem project. Both have raised hundreds of millions in funding—an extra $50 million, totalling $350 million for Aptos—and have rapidly garnered attention for their high scalability and security. However, despite these similarities, the differences in their technical approaches and ecosystems highlight where they each may either excel or falter.

At the core of both Sui and Aptos lies Move, the programming language developed for Diem. However, their interpretations of Move diverge significantly. Sui’s object-centric approach—where each asset is treated as a unique object with its own transaction history—creates a streamlined, potentially more scalable system. However, this novelty comes with the risk of further complexity for developers and potential scalability bottlenecks as it scales.

On the other hand, Aptos sticks with a more traditional account-based model but refines Diem’s original vision with optimizations like AptosBFT consensus and parallel execution. Aptos’ approach is more familiar to developers, which could give it an edge in attracting talent, but it faces the challenge of competing with the simpler, more battle-tested systems in Ethereum and Solana.

In practice, while Sui's transaction volume can theoretically exceed Aptos'—processing millions of transactions a day—the real-world application of this model is unproven at scale. Aptos, in contrast, has been able to process a large number of transactions (up to 326 million in a day thanks to viral clicker game Tapos Cat), but its reliance on more traditional methods means it will ultimately face the same scalability issues that plague older chains like Ethereum and Solana.

Sui’s ecosystem is consistently much more active in terms of user engagement. Its daily active transactions have been fluctuating around 3 to 4 million, while Aptos rarely budges over 1 million. However, much of Sui’s activity has been driven by DeFi applications like NAVI Protocol, which have been boosted by airdrop campaigns—leading to questions about the sustainability of this growth.

Meanwhile, Aptos has benefited from a more diversified set of applications, including liquidity hubs like Aries Market and Amnis and viral clicker game Tapos Cat. The diversity in Aptos’ ecosystem could eventually prove more stable in the long term, especially as it focuses on developing key infrastructure in DeFi, staking, and stablecoins, riding secular tailwinds around regulation and institutional adoption.

Interestingly, both chains are exploring hardware initiatives to increase adoption. Aptos collaboration with JamboPhone, designed to bring affordable crypto access to emerging markets in Africa and Latin America, is a commendable idea but is far from a guaranteed success and doesn’t benefit from the same, deep blockchain integrations as Solana’s Saga phone.

On the other hand, Sui’s SuiPlay0X1, a blockchain-powered handheld gaming device, seems to target a more lucrative and promising market, especially with its partnerships with major Korean developers, provided it can smooth the onboarding process and overcome the massive competition from established gaming ecosystems.

Despite their technological innovations, both Sui and Aptos face a major hurdle: the steep learning curve of Move. While it offers enhanced security features, Move is a relatively niche language, and convincing developers to adopt it, especially when EVM-compatible solutions like Ethereum and Solana are so widely adopted, is a monumental challenge.

Aptos has the advantage of refining Diem’s original architecture, which may appeal to developers more familiar with traditional blockchain structures. In contrast, Sui’s unique approach could alienate potential developers, especially if the benefits of its object-centric design don’t materialize in practice.

All things considered, Sui is playing a higher risk-reward game than Aptos, given that its scalability promises are enticing, but its unproven object-centric model, developer challenges and bet on gaming pose real risks. Meanwhile Aptos, with its more traditional yet refined approach, might find more stability in the long run but will have to execute seamlessly and find creative ways to compete with entrenched ecosystems that have powerful network effects.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

The SUI Token

SUI is the native token of the Sui network and serves multiple purposes: network security (Sui staking), transaction and storage fees and governance. The total fixed supply of SUI is 10 billion tokens.

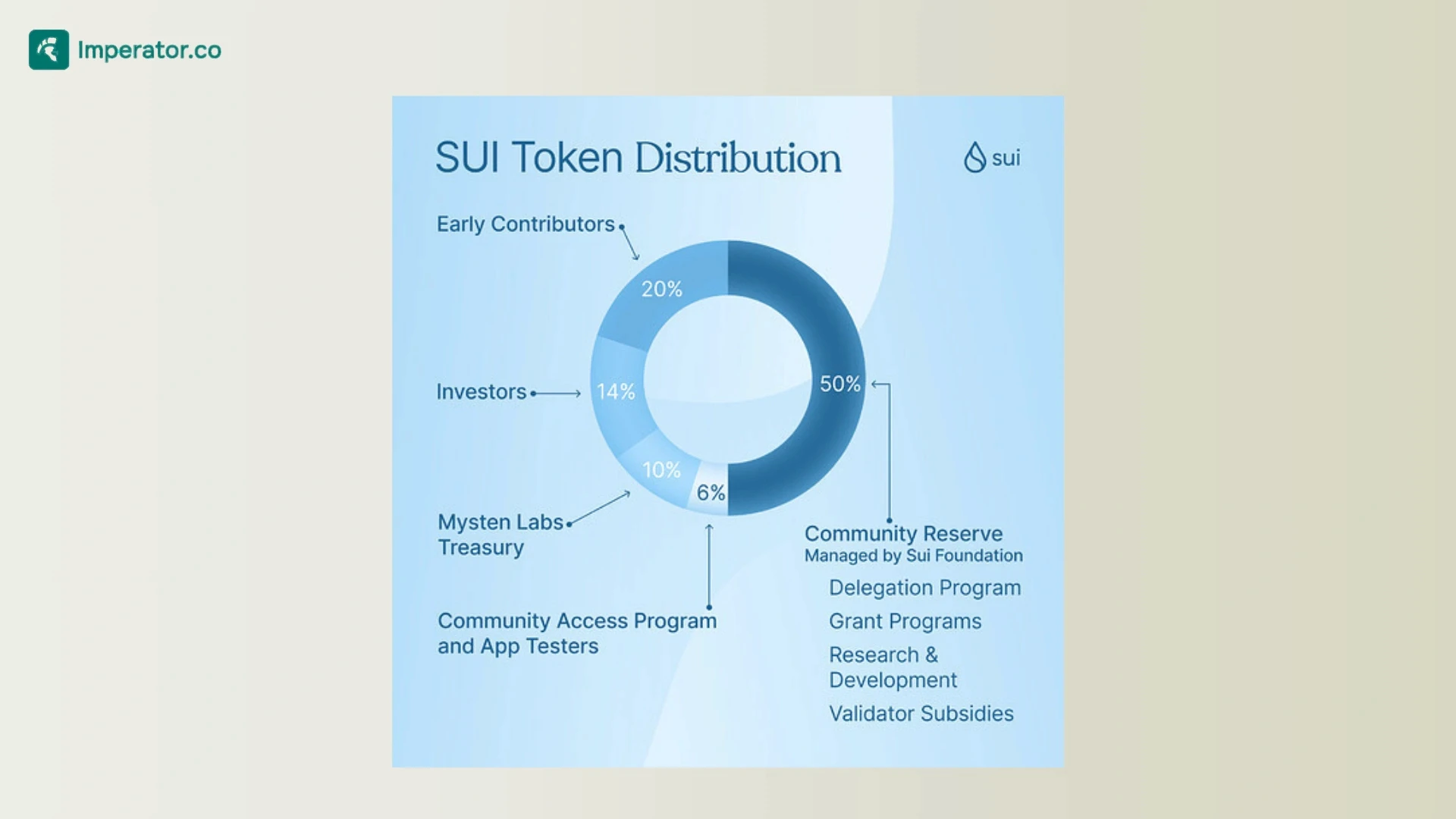

SUI Token Distribution

Community Reserve (50%): Controlled by the Sui Foundation, this reserve funds community programs such as validator bootstrapping, developer grants, and research initiatives.

Early Contributors (20%): Distributed to Sui’s research and production teams, including Mysten Labs, the network's initial contributor.

Investors (14%): Allocated to investors, though the Sui Foundation has disclosed minimal information about sales.

Mysten Labs Treasury (10%): Mysten Labs retains a treasury allocation for unspecified purposes.

Community Access Program (6%): This includes token sales targeting early community members via the Recognition Sale and a broader General Sale, managed by external exchanges.

SUI Circulation Supply

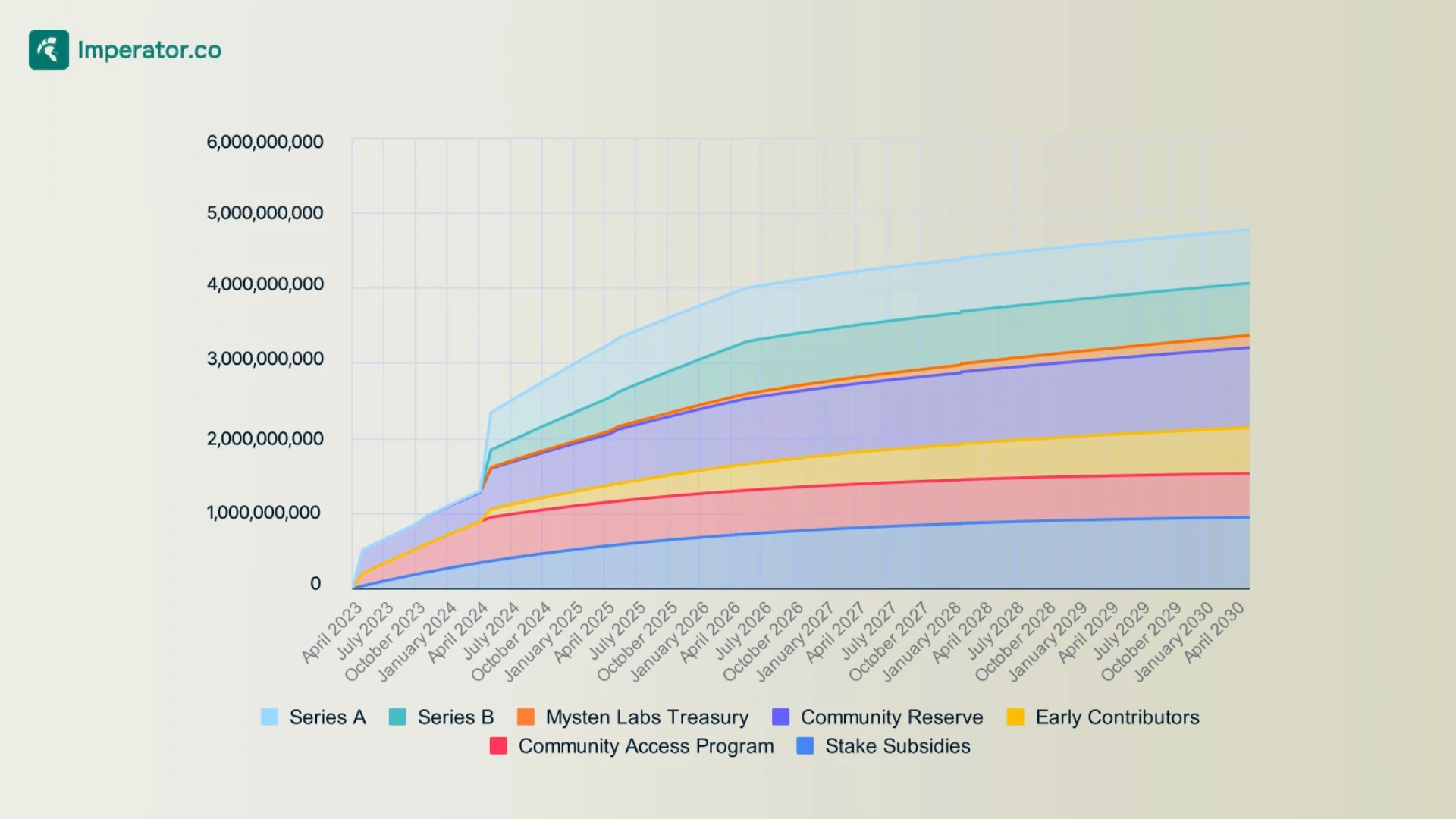

SUI employs a declining inflation model for staking rewards. By Q3 2024, the annualized inflation rate was 0.44%, set to decrease by 10% every quarter. Locked tokens remain eligible for staking, resulting in a staking rate of 78.8% of the total supply by Q3 2024.

However, this high stake rate has slightly depressed real yield, with an annualized return of -0.31%.

Sui Ecosystem

Sui DeFi Ecosystem and Growth

Key DeFi protocols include:

NAVI: Leading with $422 million TVL (30% market share), NAVI drives Sui's lending ecosystem. It introduced advanced DeFi strategies like liquid staking leverage and improved its user interface with NAVI Pro. NAVI's incentives, including a 10-million NAVX token ecosystem fund, have supported its dominance.

Suilend: Developed by the Solend team as their first project outside Solana. Suilend has nearly caught up to NAVI, doubling its TVL in November alone to $398 million, boosted by adding USDC support and a points campaign rewarding depositors.

Cetus: Sui’s top decentralized exchange (DEX), usually doing $200 - $300 million in daily volume, launched Cetus Vaults and Cetus Plus to improve automated liquidity management and transaction efficiency.

DeepBook: A native central limit order book (CLOB) layer integrated across the ecosystem, DeepBook has had over $500 billion in cumulative trading volume. The launch of DeepBook V3 will introduce dynamic trading fees, flash loans, and shared liquidity.

Zooming out, average daily DEX volume declined 33% from Q2 to Q3 while SUI-denominated TVL is down 23.3% over the same period. Sui's DeFi growth has been significantly driven by high-yield incentives. This approach attracts liquidity but may not foster sustainable engagement. Additionally, Sui's DeFi ecosystem is still relatively small compared to established platforms.

In particular, the lack of unique DeFi applications that differentiate it from competitors could hinder long-term growth. Two bright spots going forward, however, are DeepBook, which can provide a seamless trading experience potentially comparable to CEXs, and Circle’s deployment of USDC along with plans to integrate with Circle’s Cross-Chain Transfer Protocol (CCTP), leveraging Sui’s low fees and latency for payments.

Gaming Ecosystem of Sui

Rather, Sui has focused on gaming to differentiate itself, leveraging its high throughput, low latency, unique architectural and overall user experience.

One of the core strengths of Sui is its object-centric data model, which can treat game assets as first-class entities on the blockchain. This model allows for dynamic and composable NFTs, enabling developers to alter NFT metadata without the need to burn and reissue tokens.

For instance, a player's in-game character can own items like weapons or armor, with each item represented as an NFT nested within another. This hierarchical structuring mirrors the complex, interconnected nature of gaming assets, enhancing gameplay through asset evolution and customization.

Also, blockchain games often struggle with user acquisition due to wallet setup complexities and unfamiliarity with crypto concepts among mainstream gamers. To streamline user onboarding, Sui offers zkLogin and sponsored transactions, enabling players to engage with blockchain-based games without the hurdles associated with interacting with crypto directly.

Sui's commitment to gaming is also evident in its upcoming hardware release, the SuiPlay0X1 handheld gaming device (covered in more detail in the Roadmap section) and strategic partnerships with Korean gaming giants Netmarble, NHN, and NCSoft.

Notable projects in Sui's gaming ecosystem include:

SWAYE: Launched OG Battlefront in May 2024, aiming to create an accessible Web3 game using account abstraction and AI within Telegram.

DARKTIMES: A Nordic brawler royale developed by Blowfish Studios, backed by Animoca Brands.

XOCIETY: Developed by NDUS Interactive, this pop shooter with RPG elements utilizes Sui's dynamic NFTs and is built on Unreal Engine 5, with early access expected by the end of 2024.

ONE Fight Arena: In partnership with ONE Championship, Sui is integrating its technology into this Web3-enabled mobile game slated for release in Q1 2025.

NFT Ecosystem

The NFT market on Sui is also a notable bright spot, with total trading volume reaching 13.3 million SUI by Q3 2024, a 16.7% since Q1.

Top Marketplaces: Clutchy and TradePort lead the ecosystem, supported by features like fractionalized NFTs and Sui Kiosk for royalty enforcement.

Notable Collections: Fuddies and SuiFrens dominate trading activity, leveraging dynamic NFT functionality to enhance user engagement.

Sui also supports unique use cases, such as Artfi, which fractionalizes high-value art into NFTs, and Sui Generis, which specializes in soulbound NFTs and restricted trades.

Sui Blockchain Roadmap

Gaming

Mysten Labs announced the SuiPlay0X1, a $599 handheld gaming console available for pre-order and expected to ship in 2025. Resembling a Steam Deck but integrated with crypto gaming features, it supports both traditional PC games and Web3 games, offering digital ownership embedded directly into the operating system.

Pre-ordering includes an "Eternals" NFT that may grant future rewards, echoing the strategy of the Solana Saga phone, where early adopters received significant value through airdrops.

The SuiPlay0X1 serves as a reference design rather than aiming to dominate hardware sales. Mysten Labs adopts a strategy similar to Google's Pixel phones, setting standards for other manufacturers to adopt and enhance.

By showcasing the integration of powerful gaming hardware with a blockchain-based operating system, Mysten Labs and Playtron encourage other manufacturers to join the ecosystem. This collaborative approach turns potential competitors into partners; for example, Ayaneo recently announced a native Playtron handheld device.

As more manufacturers adopt Playtron OS, developers are incentivized to build for the platform, attracting more users and creating a network effect, already bearing fruit with over 50 games slated to join the platform.

Walrus: Decentralized Storage

In June 2024, Mysten Labs announced Walrus, a decentralized blob storage network powered by the Sui blockchain, aiming to provide cost-effective and resilient data storage for blockchain applications and autonomous agents.

Walrus uses innovations in erasure coding to distribute unstructured data into smaller slivers across storage nodes, achieving a minimal replication factor of 4x-5x while maintaining data availability even if up to two-thirds of the nodes fail.

As of now, Mysten Labs has launched a developer preview storing over 22 TB of data and Web3 media outlet Decrypt announced it would store its entire content library on Walrus

The roadmap includes expanding functionality, transitioning Walrus into an independent decentralized network with its own utility token WAL, operating the network through dynamic storage node management using a delegated proof-of-stake mechanism involving WAL, refining APIs based on developer feedback and establishing the Walrus Foundation

Scaling and Sui Network Optimization

Sui’s roadmap prioritizes scalable throughput by enabling parallel transaction processing and horizontal validator scaling. Features like congestion pricing aim to maintain network stability during demand spikes, while planned improvements to MEV mitigation and storage fund governance will enhance fairness and sustainability.

Sui’s future also includes deeper integrations with protocols like Circle’s Cross-Chain Transfer Protocol (CCTP) and continuous updates to its developer tools, such as an improved language server.

Sui undeniably offers a novel and high-performance smart contract platform with its unique technical innovations. However, superior technology and user experience alone are insufficient for success, as evidenced by the graveyard of alternative Layer-1 blockchain. Success often requires capturing a specific, compelling use case powerful enough to disrupt existing network effects and attract developers and users—much like DePIN and memecoins did for Solana or AI agents for Base.

While the learning curve associated with Sui Move is a notable challenge, the more pressing concern is Sui's ambitious gaming strategy and its execution. The current market faces intense competition for a limited pool of gaming-oriented web3 users, coupled with high user acquisition costs. The question is whether Sui can leverage its performant technology and user-friendly features to onboard a new set of users entirely.

Maximize your SUI staking rewards : earn more, start now.