Research

Discover Osmosis, a Cosmos-SDK DEX that facilitates DeFi in an interchain environment and seeks to redefine and extend the possibilities of new finance.

Osmosis, a Cosmos SDK-based appchain, powers a native DEX and cross-chain DeFi hub. As the premier trading and liquidity center for the Cosmos ecosystem, Osmosis DEX utilizes Cosmos L1’s Inter-Blockchain Communication (IBC) protocol to connect and enable appchains within the network.

This Osmosis presentation investigates the platform, its value propositions, how it works, and Osmosis staking.

What is Osmosis?

Osmosis is a Cosmos SDK-based Proof-of-Stake (PoS) blockchain that powers a native cross-chain DEX and a decentralized finance (DeFi) hub for the Cosmos ecosystem.

The setup consists of an app chain with a native automated market maker (AMM) protocol, a decentralized exchange (DEX), and an environment for creating and deploying DEX apps.

Osmosis uses the Inter-Blockchain Communication protocol (IBC)—such as Injective, Akash, and Agoric—to **facilitate cross-chain transactions among blockchains in the **Cosmos ecosystem. It enables users to go beyond the forays of traditional token swaps and instead experience DeFi functionality in a cross-chain reality.

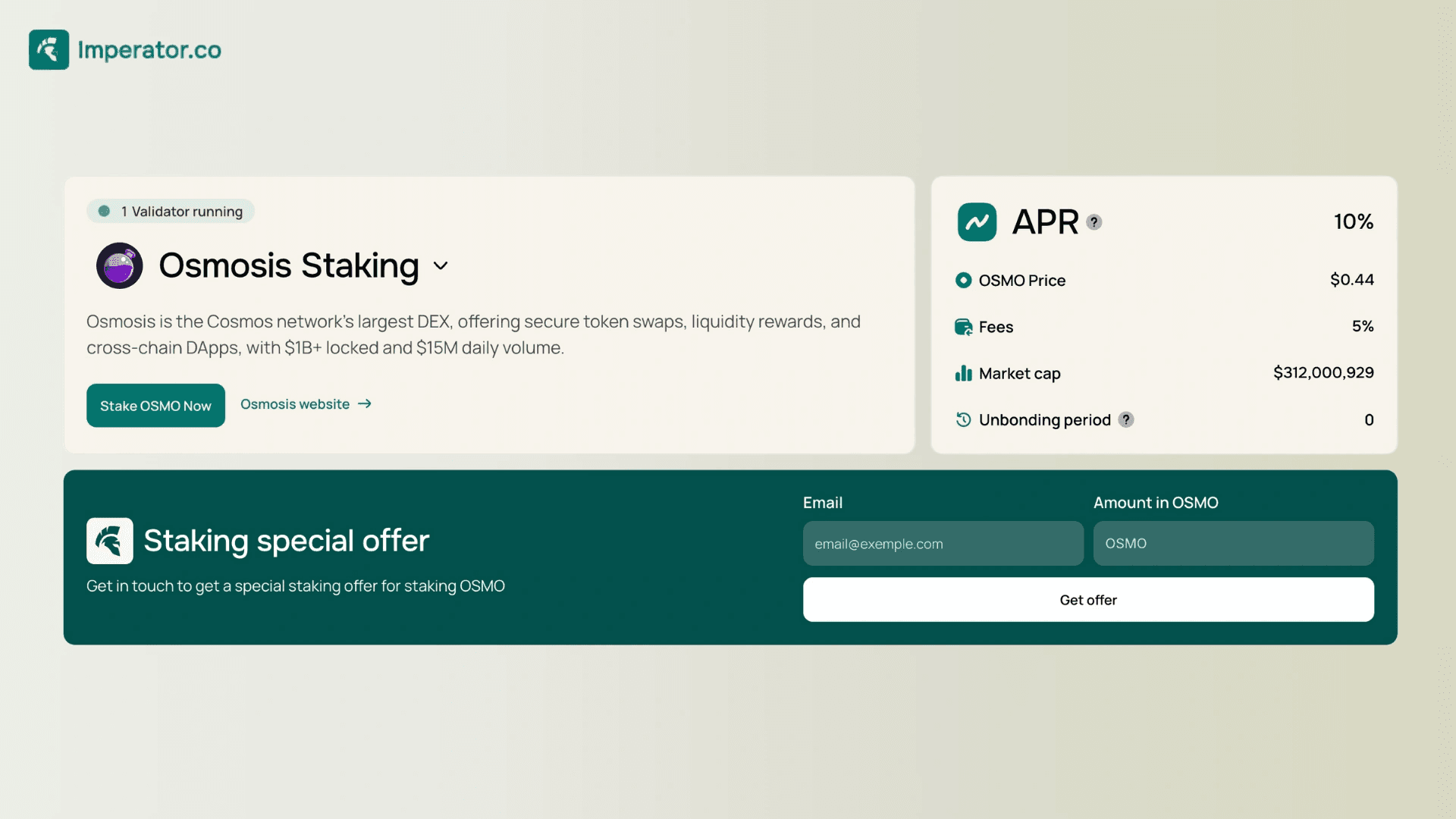

OSMO is the native token of the Osmosis network. It is staked to secure the platform, provide assets to its liquidity pools through Superfluid Staking, participate in Osmosis governance, and pay transaction fees.

The Value Propositions of the Osmosis Network

Stake Osmosis with Imperator.co!

Maximize your OSMO staking rewards : earn more, start now.

Expand Blockchain Beyond the Limitations of Native Tokens

DEXs expand users' opportunities in the DeFi space. However, platforms such as Curve, PancakeSwap, Uniswap, and others have some downsides.

A critical drawback common to almost all the DEXs above is their limited functionality, which stretches only as far as the tokens native to their blockchains allow.

Osmosis seeks to expand the possibilities, leveraging IBC to enable users to stake tokens from other chains.

Introducing Customizable, Flexible, Deep Liquidity Pools

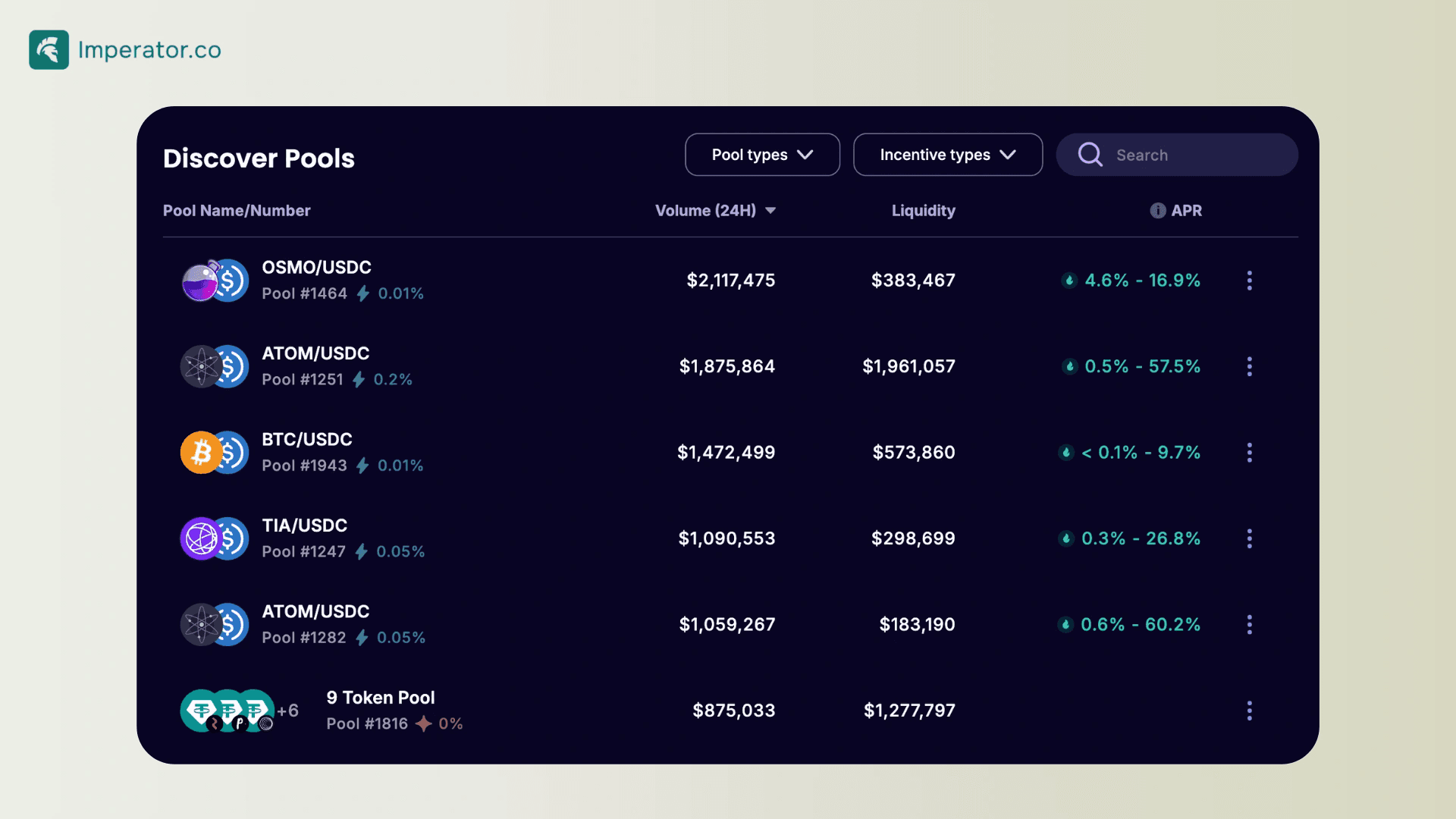

The DEX enhances the convenience and user experience of DeFi by introducing customized liquidity pools.

This approach allows liquidity providers (LPs) to offer liquidity in diverse manners instead of the rigid, two-token pool with a 50:50 token ratio that characterizes platforms such as Balancer and Uniswap.

Ultimately, the strategy deepens liquidity and eliminates numerous frictions associated with conventional DEX swaps.

Creating a Smoother DEX Apps Environment

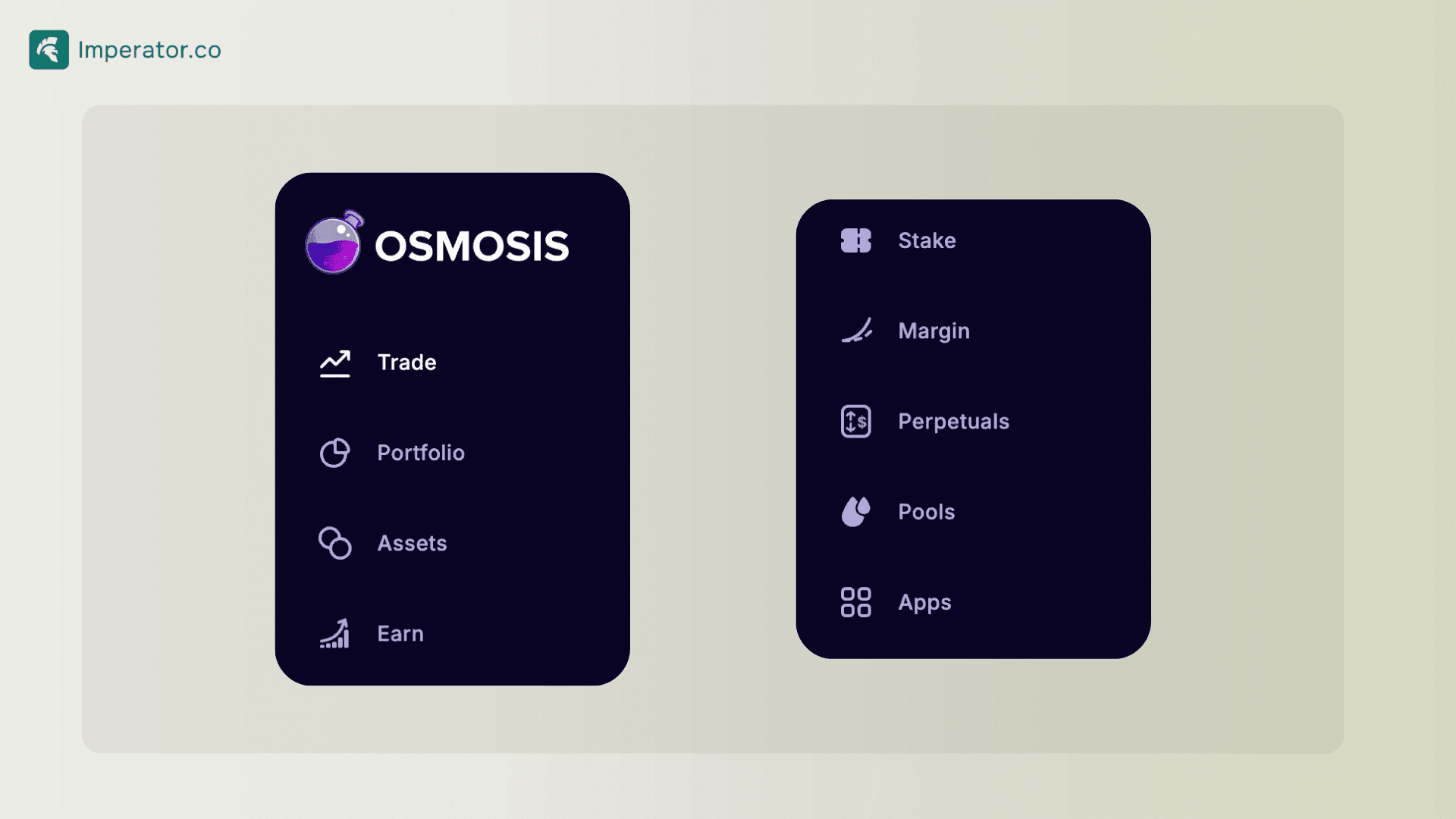

Aside from the native DEX, Osmosis hosts a ballooning ecosystem of DeFi protocols and third-party integrations.

This aspect of the platform provides a range of products and services that include perpetual derivatives markets and managed yield vaults, among other such services.

How Does Osmosis Work?

In a nutshell, Osmosis is a DEX protocol for the wider Cosmos ecosystem. It leverages the interchain capabilities of Cosmos L1, especially the IBC, to enable composability and communication among the various tokens and blockchains in the Cosmos ecosystem.

The DEX facilitates trades between any two of the 100 or so distinct blockchains within this diverse and expansive ecosystem.

The Osmosis ecosystem relies on the Cosmos-SDK Tendermint blockchain and PoS consensus mechanism to settle transactions and deliver on its mandate. It also leverages a peer-to-peer trading model and smart contracts to increase liquidity and determine the prices of digital assets.

As a DEX, the ecosystem facilitates crypto trade through AMM algorithms on liquidity pools. Osmosis network allows users to deposit pairs of tokens and add to the platform’s liquidity pools. In return, they receive LP tokens commensurate with the value of their contributions to the pool.

Osmosis AMM leverages IBC to connect with other Tendermint blockchains, allowing the ecosystem to dip into a larger pool of assets with expansive liquidity.

The LPs on Osmosis are self-governing, functioning as Decentralized Autonomous Organizations (DAOs). As such, liquidity providers determine pool parameters based on market realities.

This flexible degree of customization fosters robust fee structures that consider market volatility and the rarity of token pairs, among other factors.

What Makes the Osmosis Network Useful?

Blockchain technology addresses a myriad of transparency issues plaguing many industries. In DeFi, assets and liquidity are siloed, shrouded in mystery, and hard to analyze because of the complications associated with many real-time data streams.

Osmosis is:

Facilitating Interoperability — The early days of blockchain were characterized by networks that wanted to compete with one another, each seeking to offer features that outperformed the last. This approach created platforms that exhibit specialization by default, fragmenting use cases, resources, and assets. Osmosis creates an environment that eliminates industry segmentation, fosters cross-chain transactions, and allows interchain native dApps to thrive.

Eliminating Liquidity Crunches — Lack of interoperability sequesters assets into isolated siloes because networks cannot communicate to share data and value. Osmosis lets users fetch liquidity from the Cosmos ecosystem and popular networks such as Ethereum, facilitating a cross-chain DeFi environment.

The OSMO Token

What is the OSMO Token?

OSMO is the native token of the Osmosis network. It gives holders the right to vote on the network’s future by proposing, vetting, and passing network upgrades.

OSMO governance participants select pools eligible for liquidity rewards, allowing stakeholders to create the most sustainable incentivization strategy for the protocol.

OSMO is used to pay transaction fees, reward validators using the proceeds from taker fees, and allow holders to participate in Superfluid Staking. Superfluid Staking refers to the process where tokens provided by validators to secure the network also serve as assets in Osmosis liquidity pools.

OSMO Tokenomics

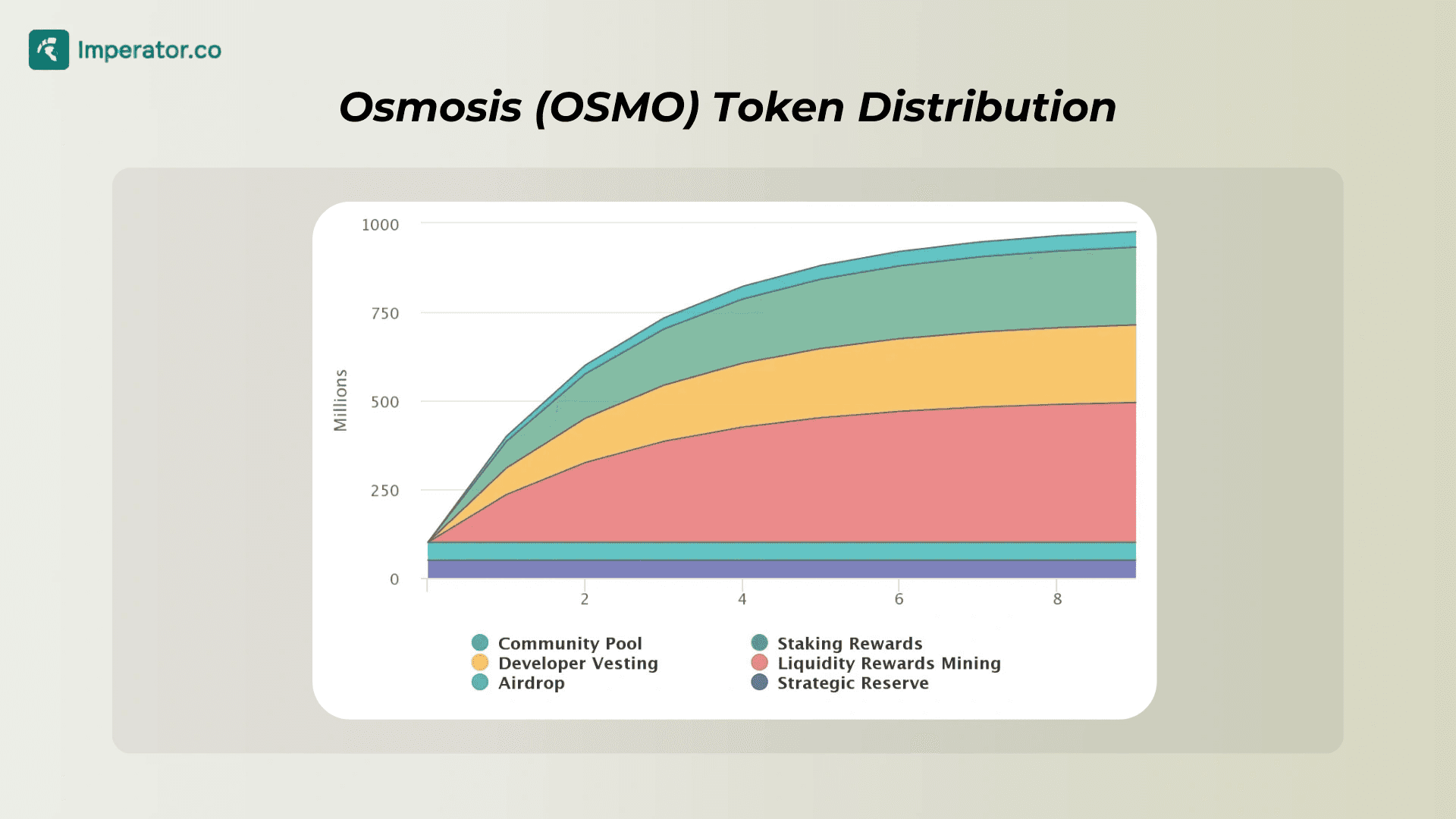

OSMO tokens are capped at 1 billion, 100 million of which were released with the genesis block. These tokens went to the strategic reserve and airdrop campaigns at a ratio of 1:1.

The tokens, which follow a thirdening schedule, are released at the end of each daily epoch. The thirdening schedule implies that their issuance reduces in number thrice a year.

The network released 300 million tokens in its first year, 200 million in its second year, and 133 million in the subsequent year.

How to Get Started With Osmosis and OSMO Token

Follow these steps to get started on Osmosis:

1. Create a Keplr Wallet

To use the Osmosis network, you need to install and create a wallet on Keplr. Keplr is a browser extension wallet that lets users store, manage, stake, earn, and send and receive digital assets.

It is important when starting with and holding OSMO because it facilitates the movement of assets over the IBC protocol. Other recommended wallets are Ledger and Trust.

2. Deposit Assets

Deposit ATOM (an IBC asset) into the wallet you have created. Alternatively, connect the wallet to the Osmosis network and deposit the assets.

3. Swap Assets for OSMO Tokens

With the assets in your wallet, proceed to the “Trade” tab and swap the assets for OSMO tokens. You can also buy the tokens from centralized exchanges such as Kraken and Coinbase.

4. Staking OSMO tokens

Token holders who stake OSMO earn rewards for securing the Osmosis network. Staking facilitates validation and makes the network stable. By the way, Imperator also offers this OSMO staking service.

For those interested, we’ve written an article on the best Osmosis validators.

Who Created Osmosis?

Osmosis Labs, founded in early 2021 by Josh Lee, Sunny Aggarwal, and Dev Ojha, aimed to build a customizable DEX inspired by Balancer and Uniswap. Sunny envisioned liquidity pools functioning as DAOs, with governance tools to optimize fees and curve parameters, fostering competition among pools for user value.

Sunny, a UC Berkeley CS graduate, contributed to Tendermint and the Cosmos SDK. Josh, an Anderson University graduate, co-founded Keplr, a wallet enabling IBC-based token transactions.

Osmosis Labs raised $21M, led by Paradigm, with support from Robot Ventures, Electric Capital, Figment, and others.

What is Osmosis: Closing Thoughts

Osmosis is a revolutionary DEX that seeks to smooth interchain transactions. It connects the Tendermint blockchains to facilitate the transfer of data and value.

The network has assembled tools that redefine the DeFi space by improving interoperability and deepening liquidity, tackling two of the biggest challenges of global DeFi. Importantly, its Superfluid Staking feature allows users to enhance their earnings from their crypto holdings.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

FAQs about Osmosis Blockchain

What is Osmosis (OSMO)?

Osmosis is an application-specific blockchain (appchain) built to support the functions of a native DEX. It is an appchain with a native automated market maker (AMM) protocol and a DEX and serves as the DeFi hub for the Cosmos ecosystem.

What are the key value propositions of the Osmosis Network?

Osmosis allows users to experience true cross-chain DeFi. Its liquidity pools are customizable, structured to deepen liquidity and make DeFi easy, practical, and beneficial for all stakeholders.

Why is the Osmosis network important?

Osmosis improves interoperability, fosters cross-chain transactions, and provides an environment where interchain native dApps can thrive. Besides, it deepens liquidity by dismantling barriers restricting communication among blockchains.

What is the OSMO token, and why is it useful to holders?

OSMO is the native token of the Osmosis network, which is used for governance, securing the blockchain through staking, participating in Superfluid Staking, and providing assets to the network’s LPs.

How can users get started on Osmosis and the OSMO token?

To use Osmosis and the OSMO token, users must create a compatible wallet. After setting up a wallet, they must fund it with ATOM, connect it to Osmosis, and swap the assets for OSMO. Alternatively, they can buy OSMO from centralized exchanges and transfer it to their Keplr wallet.

Who created the Osmosis blockchain?

Osmosis was created by Osmosis Labs, founded by Josh Lee, Sunny Aggarwal, and Dev Ojha in early 2021. The trio is part of the core development team of the Cosmos Hub, Cosmos SDK, and IBC.

Maximize your OSMO staking rewards : earn more, start now.