Research

Explore how Mitosis revolutionizes DeFi with Ecosystem-Owned Liquidity, simplifying cross-chain liquidity for sustainable growth.

Mitosis is a Layer 1 blockchain transforming DeFi with its Ecosystem Owned Liquidity (EOL) model, which enhances liquidity management across blockchains.

In this article, we'll delve into how Mitosis simplifies liquidity, fosters sustainable growth, and makes DeFi participation more efficient and rewarding.

What is Mitosis ?

Mitosis is an innovative Layer 1 blockchain that introduces Ecosystem Owned Liquidity (EOL), a novel liquidity model tailored for modular blockchains and decentralized applications (dApps).

The platform aims to help these modular blockchains and dApps attract more Total Value Locked (TVL) by leveraging community-owned liquidity instead of relying on short-term, opportunistic capital.

Mitosis is still under development, with its vaults operational, while the public testnet for the L1 is yet to be launched. The platform has successfully raised $7 million in funding and has seen impressive growth, accumulating over $80 million in TVL within just three months.

The Mitosis team has established strategic partnerships with prominent dApps such as Ether.fi , Symbiotic, and Hyperlane.

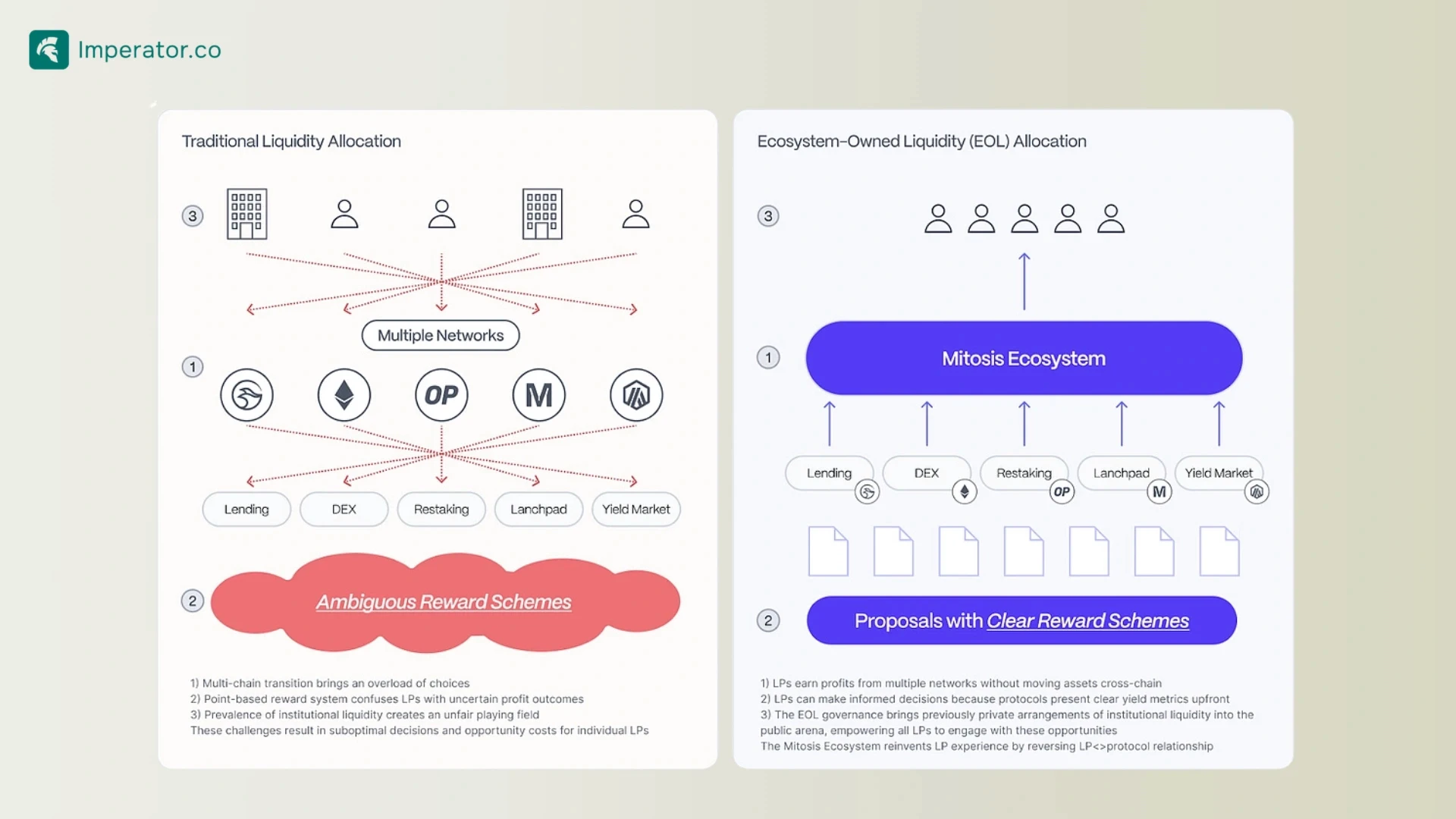

EOL is also in development, with several promising benefits for DeFi users. Notably, EOL aims to simplify the decision-making process for retail liquidity providers, who often face choice overload when deciding where to allocate their liquidity.

How Mitosis operates with Ecosystem-Owned Liquidity (EOL)

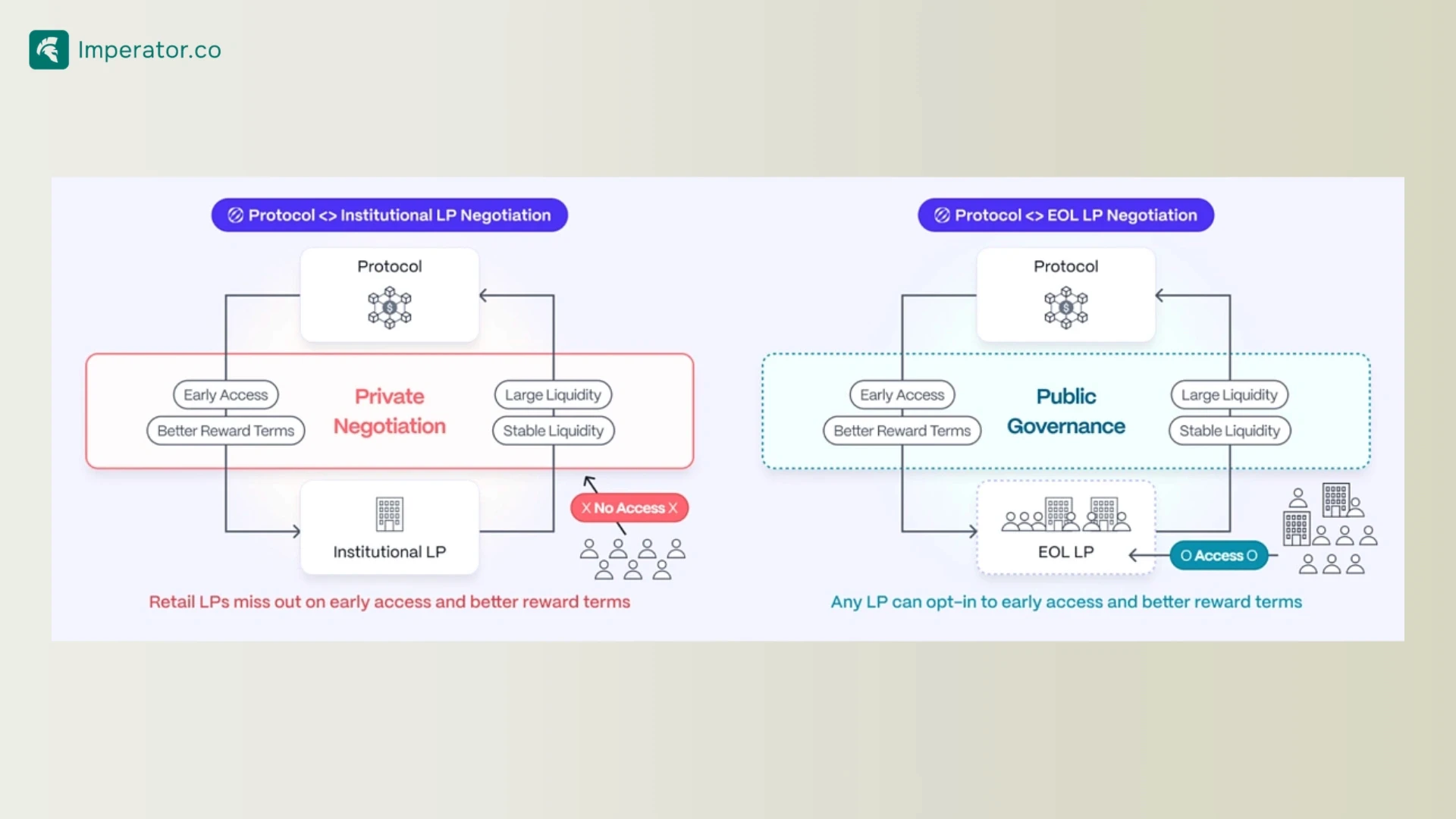

EOL is the cornerstone of Mitosis, representing a collective pooling of liquidity from individual providers under a Decentralized Autonomous Organization (DAO) governance model.

This setup enables retail liquidity providers to offer liquidity at an institutional level, similar to large financial institutions, within the decentralized finance (DeFi) space.

By aggregating liquidity, EOL enhances the bargaining power of individual contributors, allowing them to leverage the benefits of economies of scale inherent in larger liquidity pools.

The allocation and terms of liquidity provision are determined through public governance votes and forum discussions, ensuring transparency and community involvement.

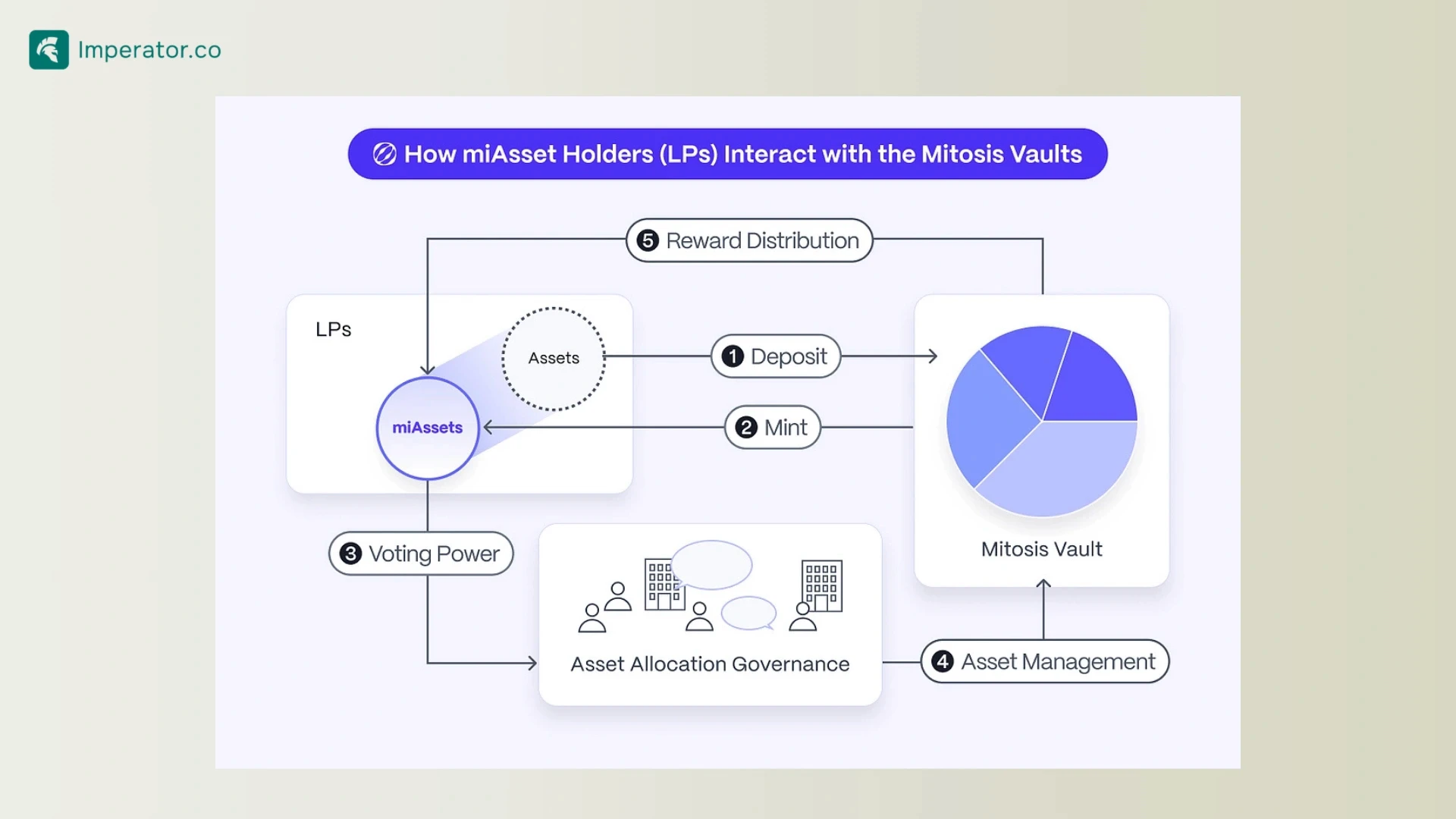

Ecosystem Owned Liquidity Pools (EOL LP) are accessed through Mitosis vaults. To use a Mitosis vault, a user deposits assets like weETH into the corresponding Mitosis vault and receives miweETH in return.

miweETH represents the user's share of the pooled liquidity and grants them voting rights, enabling them to participate in the decision-making process for managing the vault's liquidity.

For a protocol to become an approved Mitosis vault, it must first be discussed on the forum and then undergo an initiation vote. Once approved, the vault is officially listed and integrated into the Mitosis platform.

Earnings from EOL are accumulated in Mitosis Vaults, and rewards are distributed to all liquidity providers (LPs), regardless of the network they used for deposits. This approach ensures that all LPs benefit from cross-chain yield opportunities.

Core Elements of Mitosis

Liquidity Vaults

Liquidity vaults are at the core of Mitosis's modular approach. These vaults help pool liquidity across different chains, ensuring that liquidity is available wherever it is needed.

By doing so, Mitosis optimizes the capital efficiency of the ecosystem, providing better returns for liquidity providers and more consistent liquidity for users of DeFi protocols.

miAssets

miAssets are yield-generating tokens that represent a user's share of the ecosystem-owned liquidity. When users deposit assets into Mitosis vaults, they receive miAssets in return.

These tokens not only signify the user's ownership stake but also generate returns by utilizing multiple strategies, such as staking, lending, and participating in liquidity pools.

miAssets provide enhanced flexibility, allowing users to move their assets across various chains without exiting the Mitosis ecosystem, thereby maximizing yield opportunities and minimizing friction.

How to get involved with Mitosis

Providing Liquidity

Getting involved with Mitosis is straightforward. To provide liquidity, users can deposit their assets into Mitosis vaults through the protocol's platform.

This provides participants with the opportunity to earn returns on their deposits, while also contributing to the overall liquidity of the ecosystem.

Liquidity providers also benefit from the incentives offered by Mitosis, making it a compelling option for yield-seekers.

Participating in the Mitosis ecosystem

Users can interact with the Mitosis ecosystem in various ways beyond providing liquidity. By holding and using miAssets, users can benefit from the rewards that Mitosis offers, including yield generation and participation in governance opportunities.

Mitosis aims to create an inclusive ecosystem where every participant has a stake in its success.

What is Mitosis: Closing thoughts

Mitosis is redefining the way liquidity is managed and provided in the DeFi space. By offering a modular and cross-chain liquidity protocol, it addresses the inefficiencies and complexities that have historically plagued liquidity provisioning.

As Mitosis continues to grow and develop, it holds the potential to have a lasting impact on the blockchain landscape, making DeFi more accessible and efficient for everyone involved.

Stake Mitosis with Imperator.co!

Maximize your MITO staking rewards : earn more, start now.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

Maximize your MITO staking rewards : earn more, start now.