Research

Find out more about Hyperlane, an innovative protocol dedicated to advancing blockchain interoperability.

Hyperlane is an open interoperability framework that facilitates communication between different blockchains.

In this Hyperlane presentation, we explore its evolution, innovations in interoperability, and ongoing role as a top cross-chain communication solution in the crypto industry. If you're curious about Imperator's crucial role in Hyperlane, learn more about its role as a key Hyperlane relayer.

What is Hyperlane

Hyperlane is an open interoperability framework that facilitates communication between different blockchains. It allows any developer to deploy Hyperlane on their chain to be able to send arbitrary data between blockchains. This cross chain data contains functions to move tokens, execute function calls, and facilitate cross chain applications.

For instance, Solana, Ethereum, and Cosmos each use distinct technologies, which naturally limits direct communication between them.

Hyperlane conducted a $18.5M Seed Round in September 2022 with participation from Figment, CoinFund, Kraken Ventures, Galaxy Digital, Circle, and Variant, among others.

Hyperlane Technical Analysis

To understand exactly why Hyperlane has emerged as one of the top interoperability protocols across the broader crypto ecosystem, one must understand the various technical features of Hyperlane that distinctly separate it from its closest competitors.

Some of the key technical features of Hyperlane are:

Hyperlane Mailbox Smart Contract

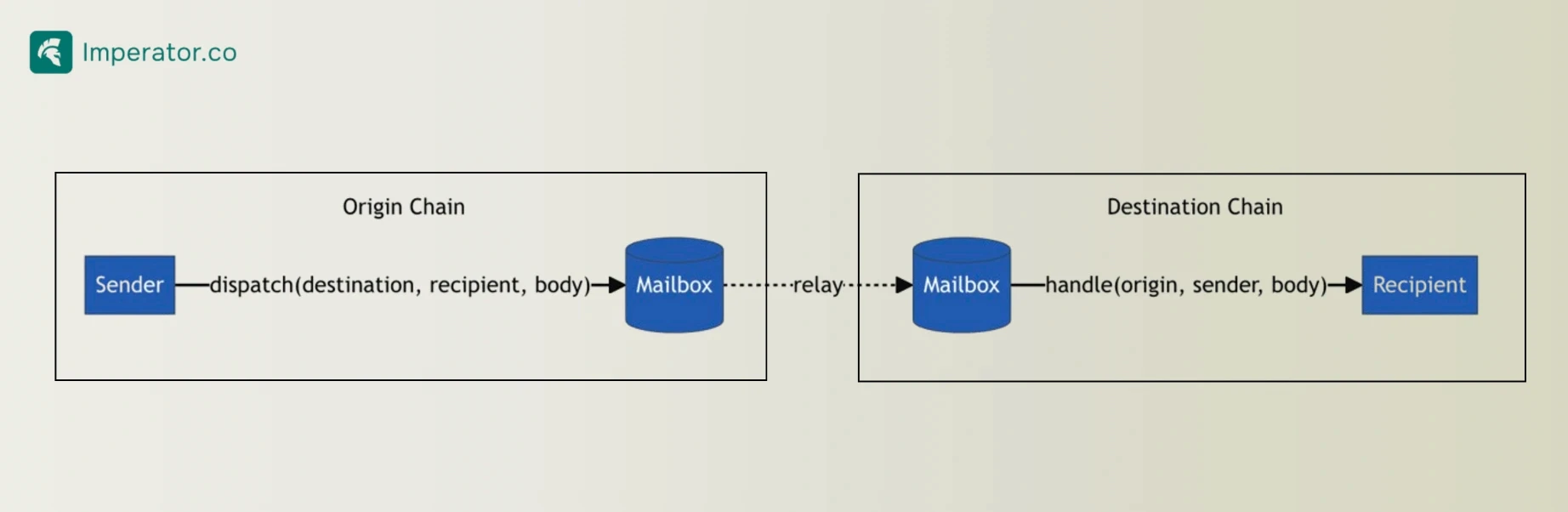

Hyperlane’s generalized message passing (GMP) interface is implemented on-chain as a smart contract called the Mailbox.

The Mailbox is essentially an on-chain application programming interface (API) that allows the Hyperlane protocol to send and receive cross chain messages.

It facilitates the cross chain messages by encoding and decoding message headers, ensuring global message uniqueness across different blockchains, and protects the protocol against replay attacks.

Message Headers: All messages traveling via Hyperlane have a header that contains six unique fields that contain crucial information about the message:

Version: The version of the Mailbox contract that is being used

Nonce: A monotonically increasing integer that is a unique identifier for each message sent from a given Mailbox

Origin: The domain of the originating blockchain

Sender: The address of the sender on the originating blockchain

Destination: The domain of the destination blockchain

Recipient: The address of the recipient on the destination blockchain

Global Uniqueness: Each message has a globally unique messageID along with a nonce that enables the network to establish and verify message uniqueness across the entire Hyperlane network. This is crucial to ensure that all messages are accounted for and are not duplicated in case of fraud.

Replay Attack Protection: Every time a message is successfully sent and executed across a blockchain, the Mailbox maps the delivered messageID value of that message. This extensive mapping of the history of transactions is kept in order to protect the protocol against replay attacks, making sure that the protocol rejects any messages that are received with a messageID that has previously been delivered.

Hyperlane’s Mailbox smart contract is a crucial piece of infrastructure that contributes to the overall success of Hyperlane not only because of its simplicity for use but also for its hardened technical security features.

The Mailbox is a very flexible piece of infrastructure that is easy to deploy and integrate with new blockchains, allowing developers to deploy the Mailbox contract to whichever chain they would like.

The Mailbox also establishes a standardized way to facilitate cross chain messages via Hyperlane while being meticulous in its security, both necessities when operating an interoperability protocol.

Hyperlane’s Interchain Gas Payments

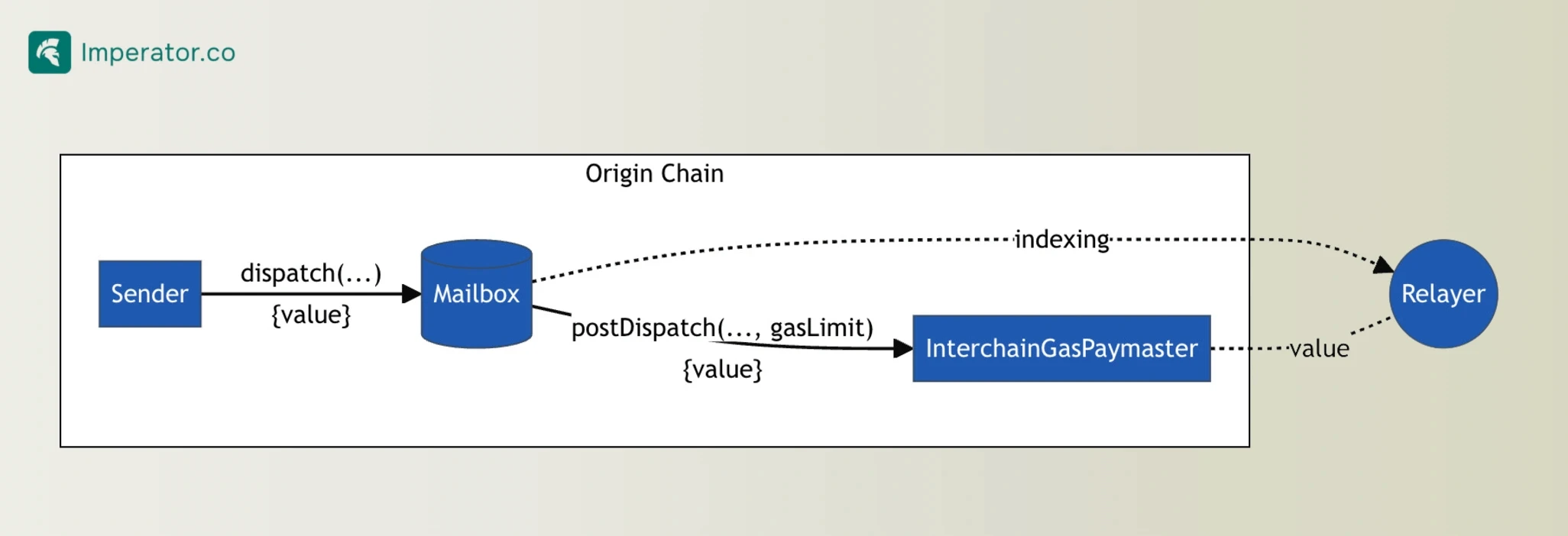

Hyperlane’s Interchain Gas Payment feature is a crucial user experience (UX) component that automates the gas payment process when executing a cross chain transaction. The Interchain Gas Payment feature contains two primary components:

Interchain Gas Paymaster Smart Contract: The interchain gas paymaster smart contract is deployed on the origin chain and manages payments for relaying messages to destination chains. It sits between the Mailbox smart contract and the Relayer, receiving messages from the Mailbox, calculating the required gas payment in order to execute the transaction, and then sends the transaction on to the Relayer to be executed. The Relayer watches for dispatched messages from the Interchain Gas Paymaster contract and will submit transactions on behalf of the message sender if they have received sufficient gas payment on the origin chain.

Gas Oracle Smart Contract: Gas Oracles are responsible for tracking remote token gas prices and exchange rates, allowing for accurate fee calculations when payment is asked for on the origin chain. This is done via an on chain smart contract that contains the exchange rates for gas tokens between the origin and destination chains.

The benefit derived from the Interchain Gas Payments feature for the user is that it automatically calculates and includes the required gas fee on the origin chain before the transaction is submitted.

As a result, the user has the required gas price presented up front and must only pay the calculated gas price in the origin chain’s native gas token.

The relayer is then able to use this gas fee to cover gas costs when delivering the message on the destination chain, no longer requiring users to maintain gas tokens on the destination chain to pay to receive the funds. This allows Hyperlane users to not need to hold tokens on multiple chains when bridging.

Additionally, the Interchain Gas Payment feature has a refund mechanism that will refund any excess amount paid for the gas fee but is not used. This feature ensures that a fair price is provided to users at all times.

Warp Token Standard

The Warp Token Standard is an interchain token standard developed and established by Hyperlane to enable asset issuers to scale token distribution alongside Hyperlane’s permissionless expansion.

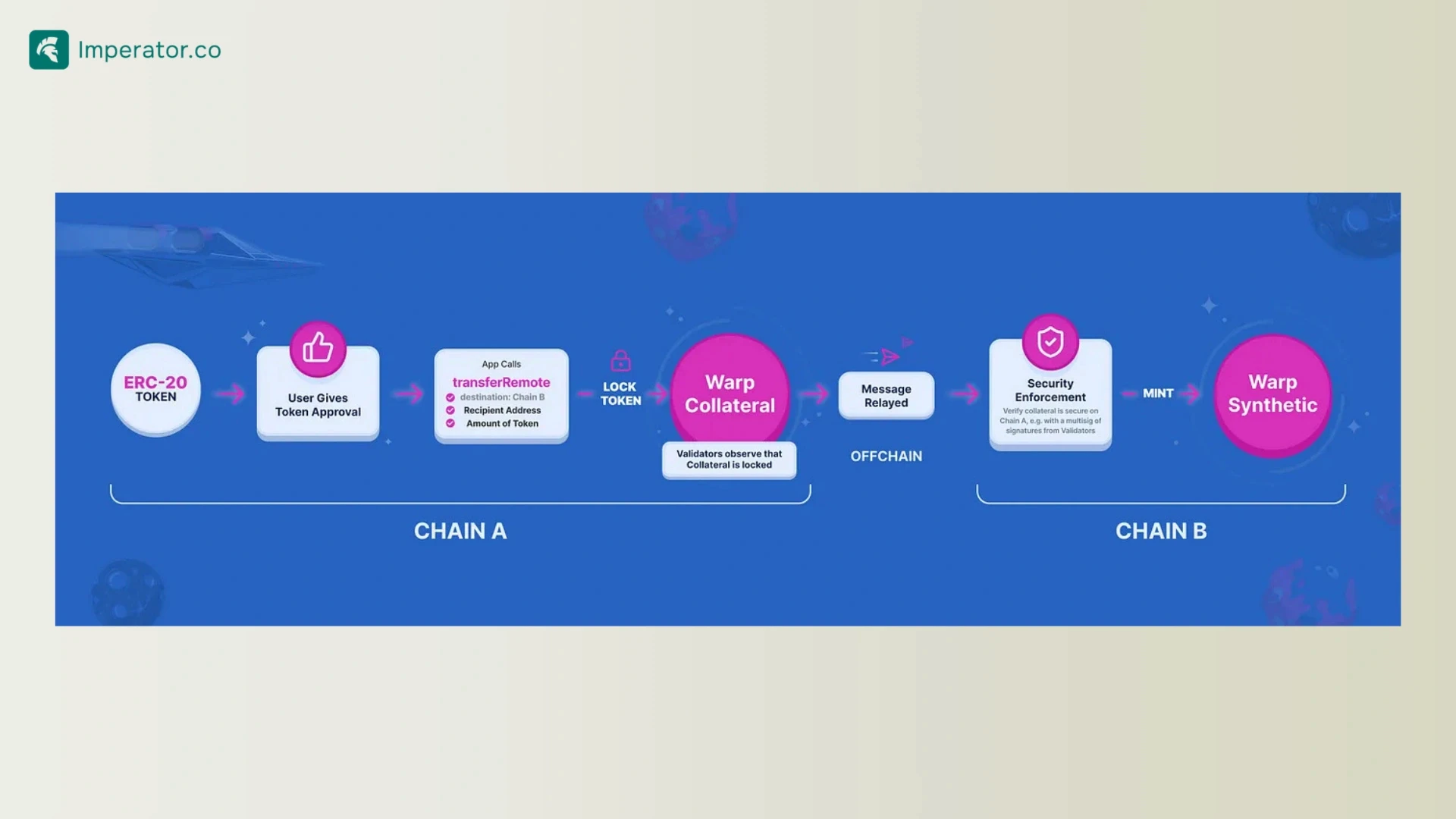

A Warp Token is created via the lock and mint bridge design when an asset on the origin chain (Chain A) is locked and a new one to one equivalent token is minted on the destination chain (Chain B).

The newly minted token on the destination chain will abide by the Warp Token Standard and be able to be used as a one to one equivalent of the originally locked asset.

Warp Routes

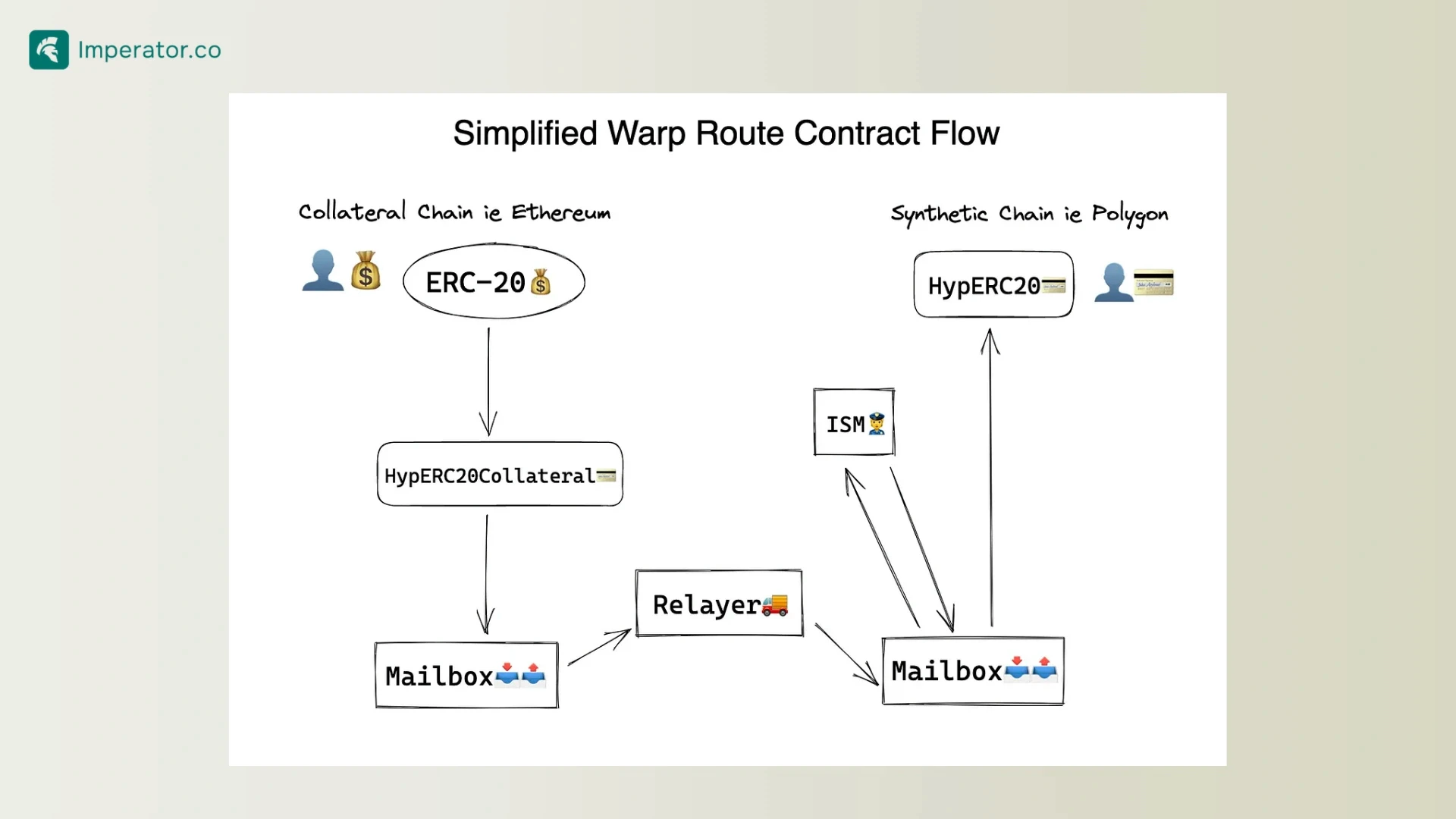

Warp Route Smart Contracts are contracts that allow any ERC20, ERC721, or native token to move between chains. They are the contracts that conduct the aforementioned lock and mint process by locking collateral tokens on the origin chain (aka the collateral chain) and then minting wrapped tokens on the destination chain (the synthetic chain).

Each Warp route refers to a route between two Warp Route contracts, the first one deployed on the origin chain and the second one deployed on the destination chain. The Warp Contracts then use the Mailbox contracts to send messages cross chain to one another while facilitating the token lock and mint process.

Hyperlane has created Warp Route contracts to primarily handle three unique types of cross chain transfers that each employ a different method of transfer:

Native Token Warp Routes: Native Token Warp Routes handle the permissionless transfer of native gas tokens like ETH on Ethereum/Arbitrum/Optimism or MNT on Mantle across different chains. Due to the transfer of native gas tokens, native token warp routes can directly transfer the tokens without needing to wrap them.

Collateral Backed ERC-20 Warp Routes: Collateral backed ERC-20 Warp Routes handle the permissionless transfer of ERC-20 tokens across different chains. It manages the cross chain transfer by wrapping and locking the original ERC-20 tokens in the Hyperlane HypERC20Collateral.sol contract as collateral before releasing a one to one equivalent Warp token on the destination chain.

Synthetic Asset ERC-20 Warp Routes: Synthetic ERC-20 tokens refer to newly deployed ERC-20 tokens that are minted on new chains. This warp route handles token transfers by locking and then creating new tokens on the destination chain that represent the token from the origin chain with support for custom attributes (name, symbol, decimals). In this, it maintains the total supply across all chains. When tokens are transferred back to the original chain, this Warp Route burns the tokens on the chain that was bridged to and unlocks the originally collateralized token on the original chain.

Yield Routes

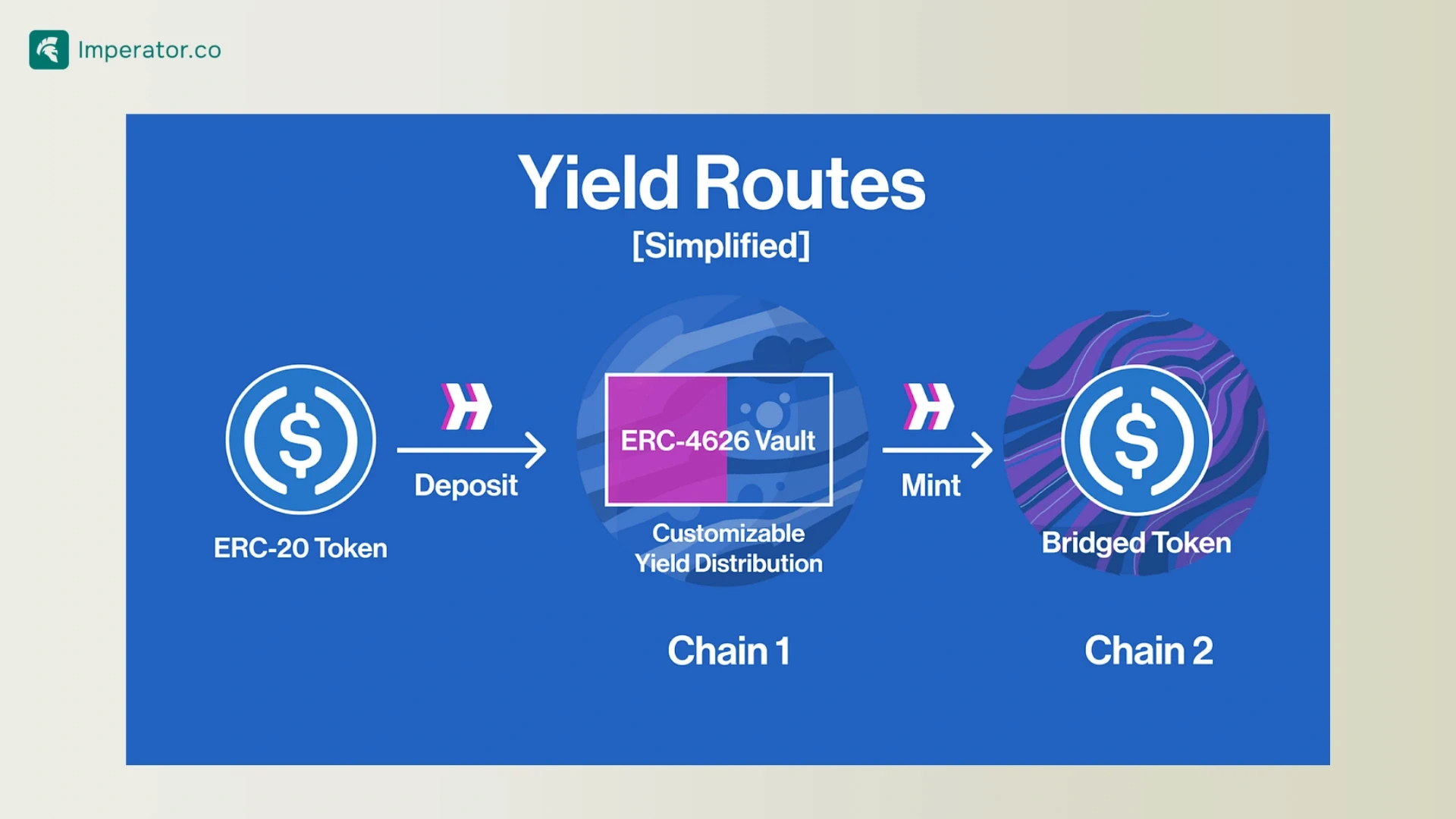

Yield Routes is a relatively new Hyperlane feature that was announced on March 21, 2024, that is aiming to bring the first “permissionless yield generating bridges”. Yield Routes are a simple variation of Warp Routes that introduce ERC-4626 vaults to its bridging mechanism.

By introducing ERC-4626 vaults to the bridging process, it allows those who are moving assets cross chain to generate yield on their idle collateralized assets.

Yield Routes work by taking the collateralized asset on the origin chain and using it to earn yield rather than having it sit idle in a locked contract. For example, if a user bridges USDC from Ethereum to Arbitrum, Hyperlane would typically collateralize and lock up the USDC on Ethereum to while minting wrapped USDC on Arbitrum for the user to be able to use. In this typical bridging process, the USDC would remain locked on Ethereum sitting idle until the user bridges the USDC back to Ethereum to unlock it. Yield Routes revolutionize this approach by implementing ERC-4626 vaults.

Hyperlane’s Yield Routes create ERC-4626 vaults in the bridging process that now allow users to collateralize their assets into yield generating vaults so while their USDC is locked up on Ethereum, it is earning additional yield. For example, a vault could be set up to supply the collateralized USDC on Ethereum to Aave or MakerDAO to generate yield.

Once the user bridges funds back to Ethereum and retrieves their original collateral, they will also be able to withdraw additional funds generated via the ERC-4626 vault and whichever strategy was employed to generate the yield.

Interchain Security Modules (ISMs)

Interchain Security Modules are crucial to the overall architecture of Hyperlane as they are the smart contracts responsible for verifying if the cross chain messages being delivered to the destination chain were actually originally sent on the origin chain.

They are incredibly important as they guard the cross chain security of the protocol, watching for any illegitimate messages being sent across the protocol.

Interchain Security Modules act as “security legos” that were designed to be modular and thus, able to be mixed, matched, and customizable to create custom security models attuned to each individual scenario. This allows some developers to implement a stricter protocol while allowing other developers to implement something less stringent with potentially less need for upkeep and monitoring.

Although each ISM can be individually customized, Hyperlane and the Hyperlane community has already created several pre-configured ISMs that developers can easily deploy including:

Multi-Sig ISM: The multi-sig ISM verifies that a specific ratio (m of n) of validators have attested to the validity of a particular interchain message before approving it.

Routing ISM: The routing ISM delegates message verification to a different ISM to allow developers to change security models based on message content or application context. An example of this is using the routing ISM to switch security models depending on the origin chain of the message.

Aggregation ISM: The aggregation ISM is used to combine the security of multiple ISMs in order to approve a message. For example, it may employ multiple ISMs and then require that m of n ISMs have verified a cross chain message before approval.

Optimistic ISM: The optimistic ISM uses the optimistic verification security model to approve cross chain messages by relying on a fraud window after message verification, during which m of n watchers configured on the optimistic ISM have an opportunity to flag messages as fraudulent, preventing them from being delivered to their recipient.

Wormhole ISM: The wormhole ISM uses the security model used by Wormhole’s cross chain communication protocol, requiring that 13 of 19 Wormhole guardians attest to the validity of a Hyperlane message.

Polygon PoS ISM: The Polygon PoS ISM is used along with the Polygon PoS hook to leverage the security of the Polygon state sync mechanism for messages passed between Ethereum and Polygon PoS chain.

Arbitrum L2 to L1 ISM: The Arbitrum L2 to L2 ISM is used along with the Arbitrum L2 to L1 hook to leverage the security of the Arbitrum rollup for messages passed from the Arbitrum L2 to Ethereum.

An example of how the Hyperlane ISMs can be used as various components to a larger security model is if an application developer wants to add additional layers of security, they could deploy an Aggregation ISM that requires verification by both a Multi-sig ISM configured with validators from the Hyperlane community, and a Wormhole ISM that verifies that a quorum of the Wormhole validator set verified the message.

This security model incorporates both the Multi-sig ISM and Wormhole ISM by using the Aggregation ISM in order to validate cross chain messages, essentially doubling the number of verification checkpoints each message has to pass through before finalization.

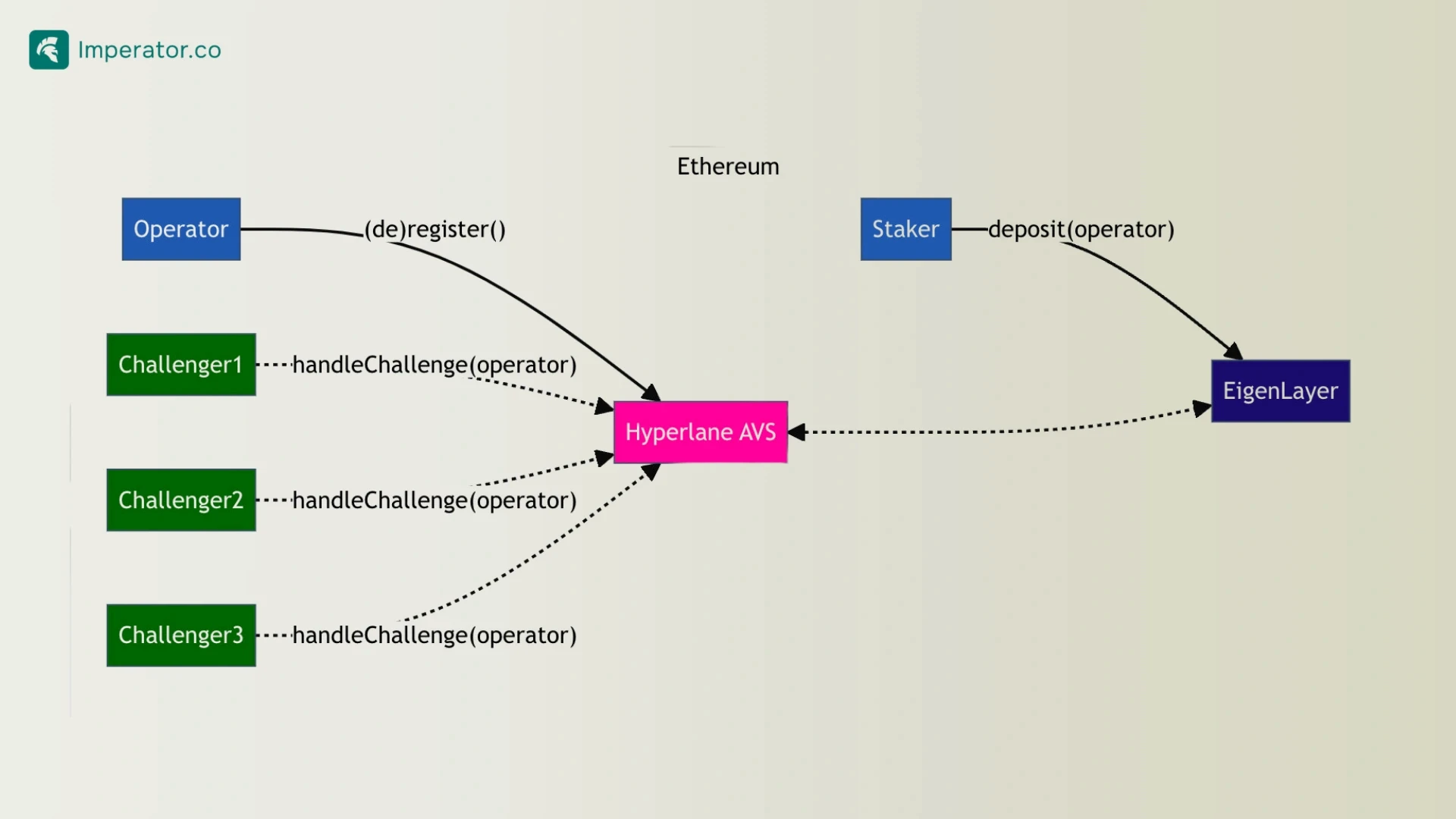

Hyperlane Actively Validated Service (AVS)

Prior to the implementation of the Hyperlane AVS, Hyperlane employed a Proof of Authority (PoA) model for security in which a trusted group of validators are chosen to maintain security.

However, if any validator signs erroneously or with malicious intent, there are no repercussions, as these validators have no economic stake. This is the gap that the AVS module is designed to address, introducing a level of economic security to Hyperlane’s security model.

The AVS module uniquely enables economic security within the Hyperlane protocol with minimum cost to bootstrap a new validator network for each chain it supports.

This is achieved by leveraging the shared pool of stake that can secure outbound messages from and between rollups. The main stakeholders in this process are:

Operators: EigenLayer Operators are entities who can be either individuals or organizations that enable ETH stakers to delegate their staked assets, whether in the form of native ETH or LSTs. In the case of Hyperlane, operators who opt into the Hyperlane AVS service can begin validating outbound messages from the chain(s) specified.

Stakers: EigenLayer Stakers are those who delegate their stake (ETH, LSTs, etc) to the network operators to secure the network via their staked assets.

Applications: Applications refer to entities looking to leverage Hyperlane as an interoperability protocol and build on top of Hyperlane infrastructure because they are seeking to economically secure all of their messages across chains.

Separated Agent Infrastructure

The Hyperlane protocol decouples the transport layer from the security layer of cross chain message passing in order to increase the efficiency, flexibility, security, and scalability of the entire protocol.

It does so by relying on off chain agents (relayers and validators) that observe on chain activity and carry out either the transport or security aspects of the protocol.

These agents are implemented in Rust and are distributed as Docker images and binaries.

Relayers: Relayers run the transport layer of the Hyperlane protocol by actually delivering the messages from origin to destination chains. During this process, relayers will aggregate any ISM specific security metadata that may be required to prove the security of the message such as Validator signatures for the Multisig ISM, merkle proofs, or zero knowledge proofs. After receiving approval from any associated ISMs in the Warp Route, the Relayer will execute the transportation of messages and even manage the price of gas fees for message delivery, which are calculated beforehand and paid by the message sender on the origin chain. Imperator is a relayer for the Hyperlane protocol, facilitating actual cross chain messages transferred via Hyperlane.

Validators: Validators contribute to the Hyperlane security protocol as they run as part of the Multi-Sig ISM or the Economic Security Module (staking and slashing mechanisms that can be added to ISMs). Validators are responsible for attesting to messages by signing a merkle root (also referred to as a public checkpoint) when new dispatches happen in the Outbox contract of the Mailbox. Signatures must then be made available for anyone (typically the Relayer) to fetch and submit alongside the message to the destination chain.

EVM and Non EVM Implementation Capability

Hyperlane continues to propagate itself as a broad encompassing bridging protocol that allows users to reach every corner of the crypto industry. Although most of Hyperlane’s Warp Routes are connected between EVM based chains, Hyperlane continues to expand itself past the EVM based world into other ecosystems. This includes Hyperlane’s implementation for the Solana Virtual Machine (SVM), CosmWasm (Cosmos), Starkware (Cairo), Movement (Move), and Sway (Fuel) ecosystems. Hyperlane’s rapid technology stack expansion has resulted in Hyperlane supporting 138 individual testnet and mainnet blockchains and specifically 70+ mainnet chains, with no plans on stopping.

Hyperlane has even built on its interoperability compatibility within the EVM based ecosystem with the proposed launch of Superlane. Superlane is an interoperability layer launched by Velodrome Finance and Hyperlane to reunite the fragmented liquidity and users within the Optimism Superchain OP Stack.

Superlane will allow each layer-2 blockchain built within the OP stack to share bridging standards, governance protocols, protocol upgrades, protocol standards, users, and liquidity. The goal is to create a smooth, singular experience for users that continues to preserve the sovereignty of the individual rollups.

This Superlane upgrade is planned to arrive in November 2024 with initial plans of bringing Velodrome’s functions and tokens across all OP Stack rollups.

Hyperlane Protocol Data

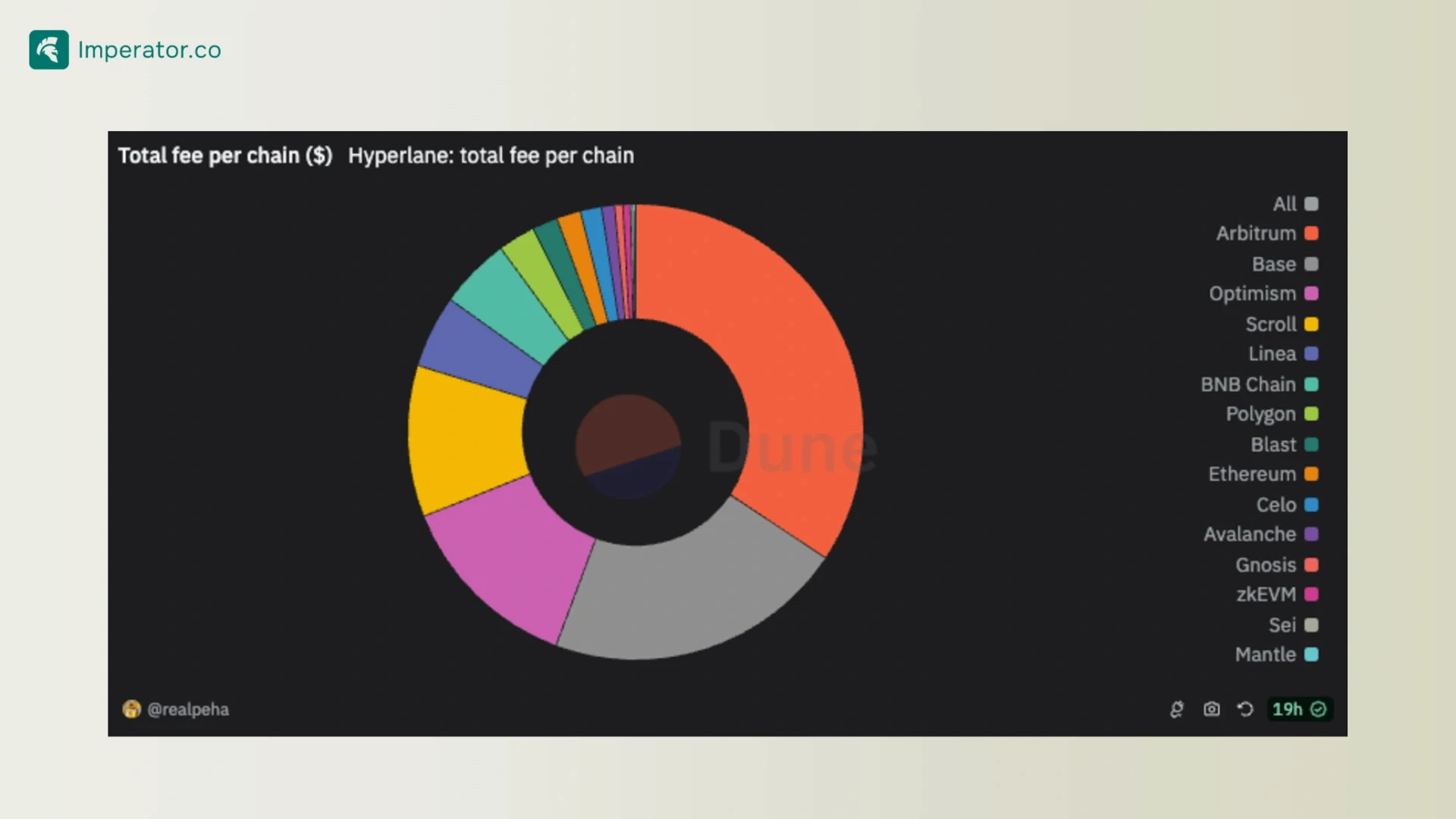

As of writing, Hyperlane has hosted over $3B in total value transferred over its protocol.

By taking a deeper look into some of the most prominent and popular Warp Routes that exist in Hyperlane via Dune, Hyperlane has hosted 607,934 users and sent a total of 5,216,248 messages across 43 different blockchains.

As a result of the messages sent, Hyperlane has collected a total of $2,863,338 in fees, primarily sourced from Arbitrum, Base, and Optimism.

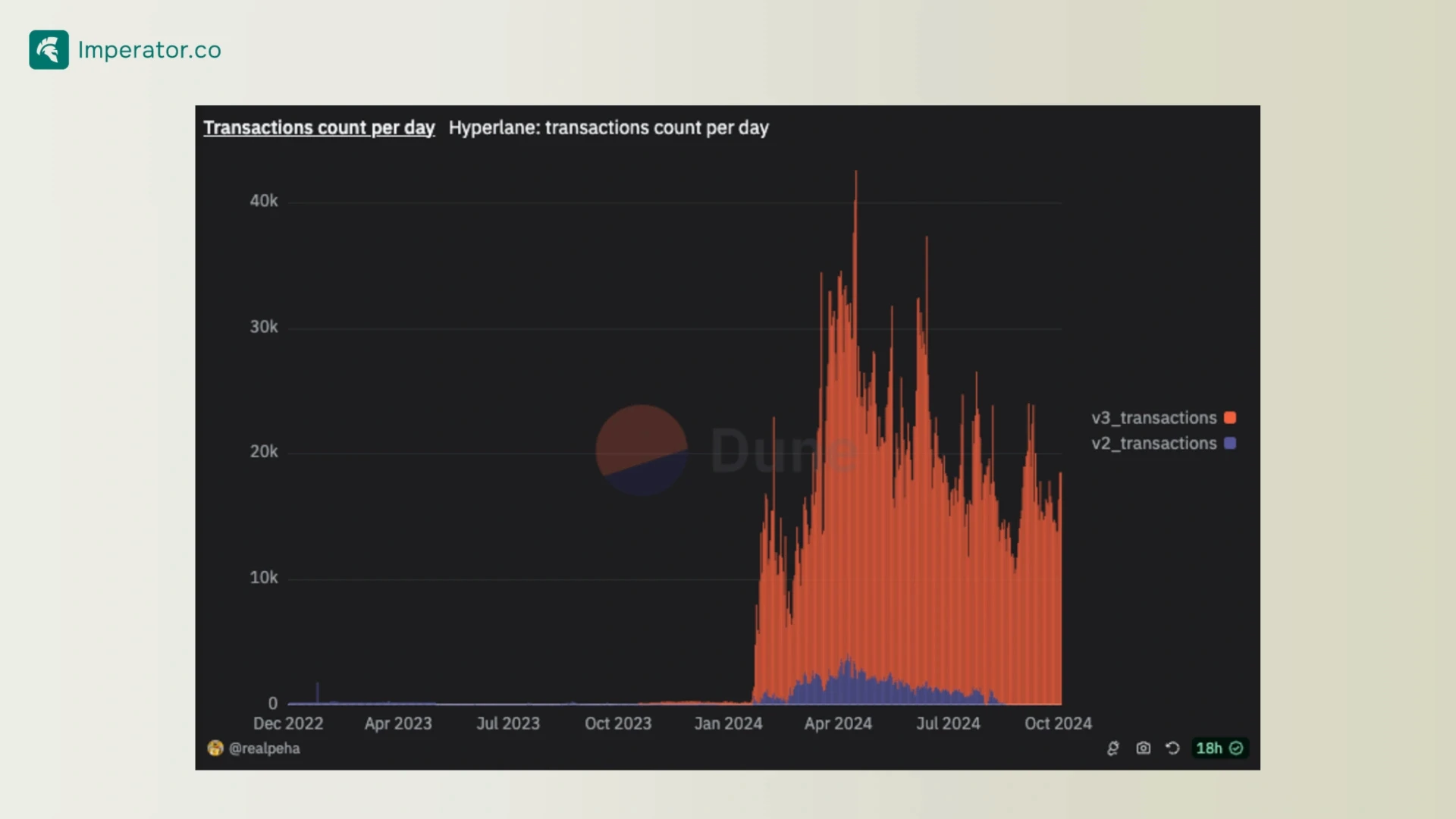

The number of transactions per day since the inception of Hyperlane is as follows:

By taking a closer look at Hyperlane’s Warp Routes between Ethereum, Avalanche, Polygon, BSC, Base, Arbitrum, Optimism, Gnosis, Celo, Scroll, Polygon zkEVM, Linea, and Blast via Dune, Hyperlane has hosted 2,256,421 total transactions transferred a total of $2,117,891,383 in value. A deeper analysis shows around seven thousand unique addresses sending Hyperlane messages and approximately 175 unique contracts sending Hyperlane messages.

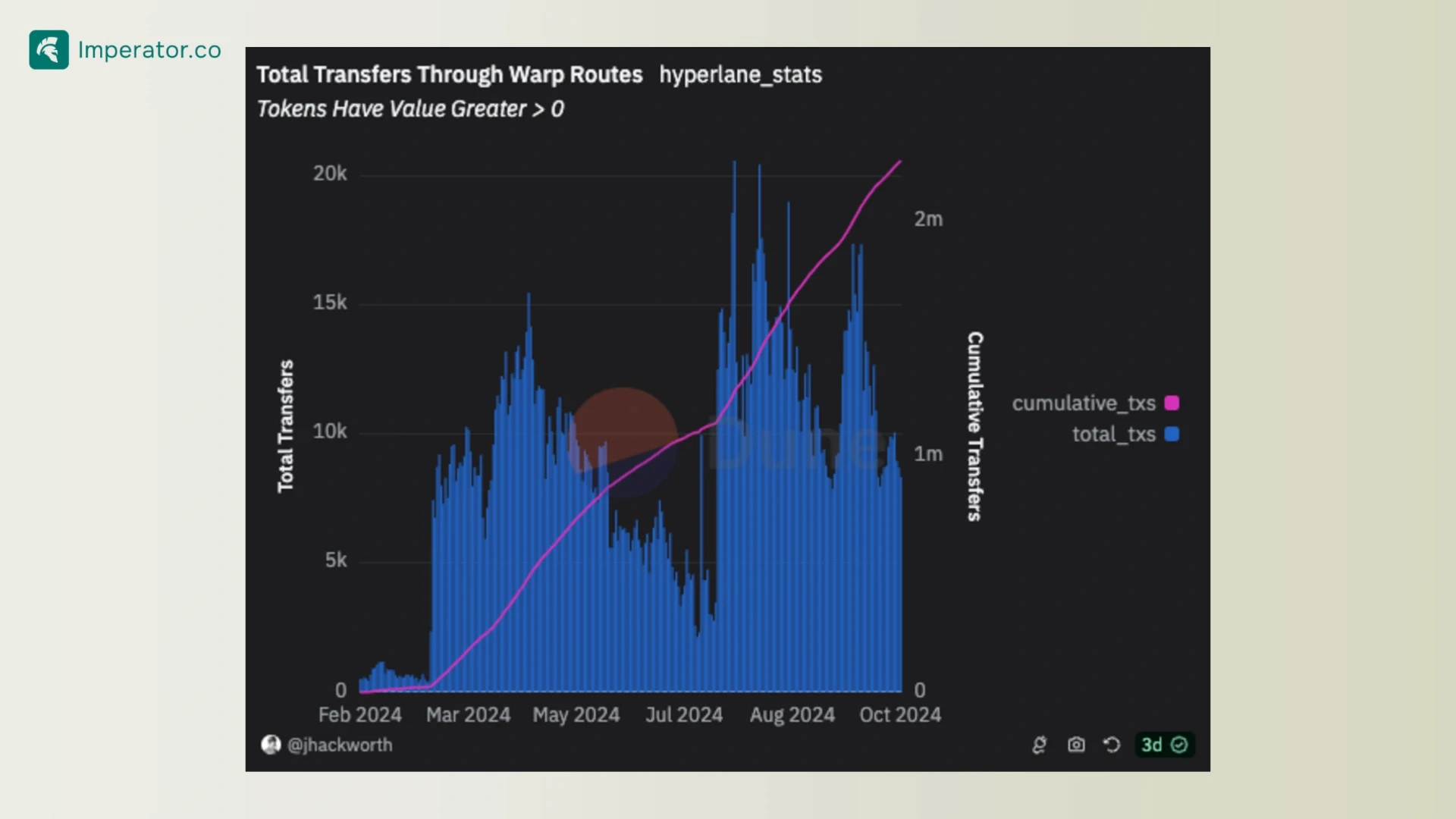

The total number of transfers through the aforementioned blockchains and Warp Routes are as follows:

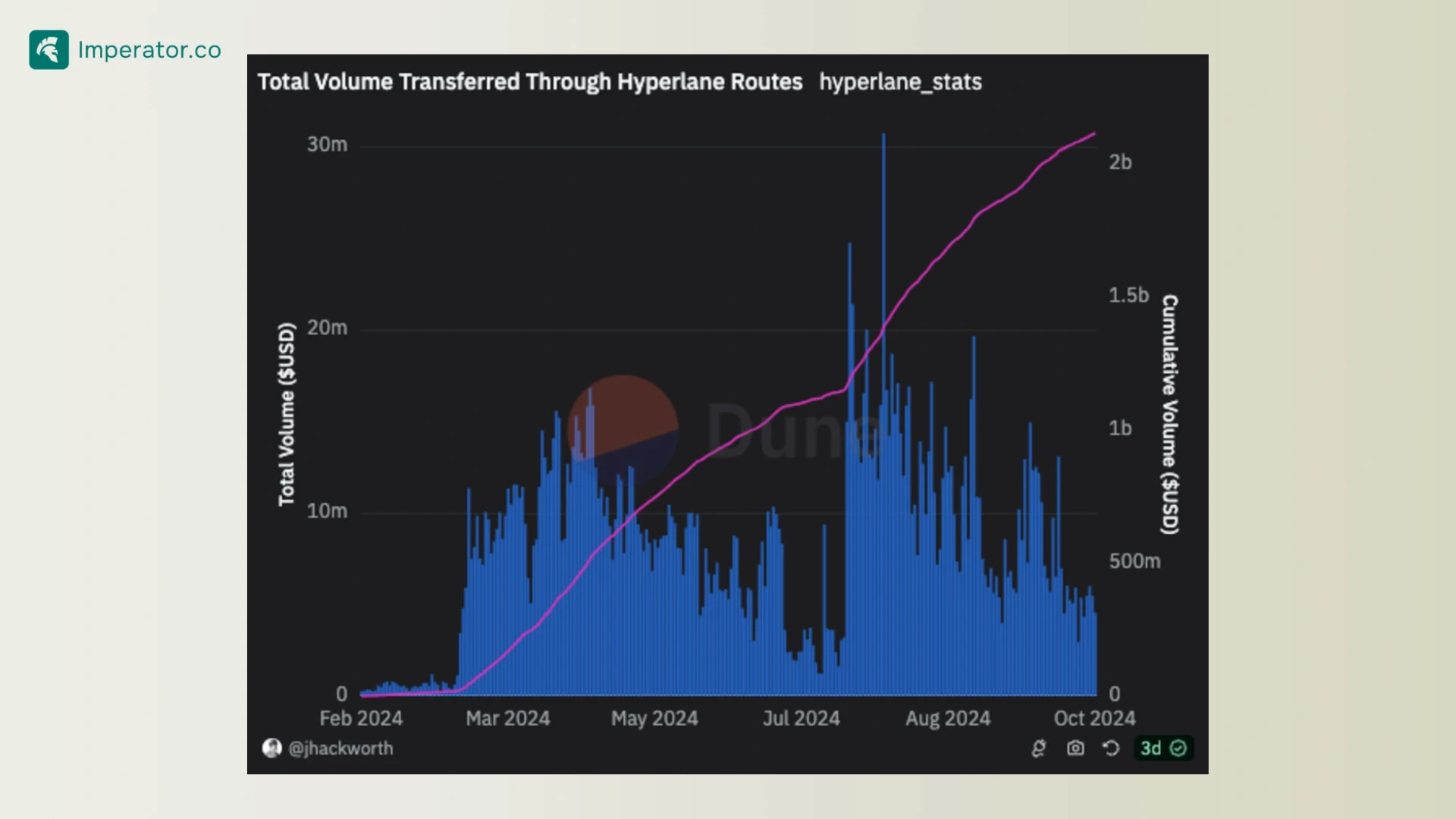

The total amount transferred through the aforementioned blockchains and Warp Routes are as follows:

Competitive Technical Analysis

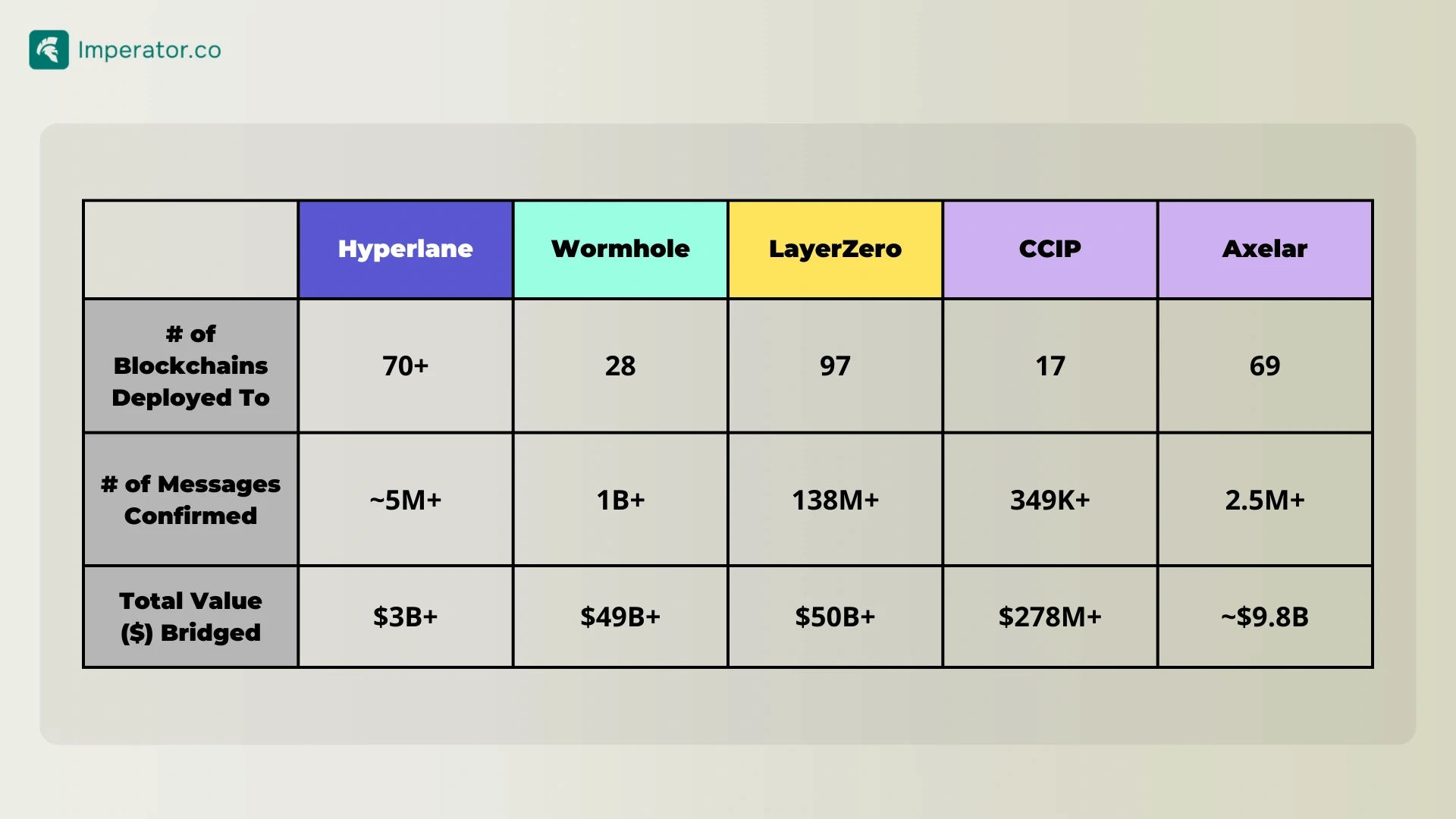

As a cross chain interoperability protocol, Hyperlane has a plethora of large competitors competing for the same cross chain token volume. This includes major protocols like Wormhole, LayerZero and Stargate, Axelar, and Chainlink’s Cross Chain Interoperability Protocol (CCIP).

Hyperlane Tokenomics

Although there is no live Hyperlane token at the time of writing this article, Hyperlane did announce the launch of the Hyperlane Foundation, the Hyperlane Alliance, and its subsequent HYPE token on August 8, 2024.

Although the announcement did not include specific details about the HYPE token regarding the token genesis event (TGE), token utility, or tokenomics structure, it did emphasize the desire for Hyperlane to expand as a protocol through community collaboration with the ultimate goal of eventually becoming the first truly developer owned network.

By launching the HYPE token to its community members, Hyperlane is aiming to accomplish the goal of community collaboration and ownership since the token is specifically designed to establish an alliance between motivated users of the Hyperlane network and build a foundation for a developer owned network, one where those who make it useful become owners.

Hyperlane’s Future

Although Hyperlane continues to face stiff competition as an interoperability protocol, it continues to hold the advantage as a smaller and more agile protocol that is continuing to innovate with a better and more sensical product.

Hyperlane lags behind its larger competitors in statistics like total number of messages confirmed and total value bridged compared to its competitors but it continues to expand its reach due to its state as a permissionless protocol.

The number of blockchains that Hyperlane is actively deployed on rivals or beats out its fiercest competitors, most likely due to its unique bridging architecture.

The ability for developers to create custom security mechanisms via Hyperlane’s customizable ISMs, run a relayer without needing permission, or to simply deploy a lane on any necessary blockchain, continues to be an attractive feature that allows Hyperlane to reach blockchains and protocols that others continue to lag on.

Hyperlanes permissionless and modular architecture is one of the easiest to deploy while also being one of the most functional with regards to customization for different scenarios. With the continued development of new features like Yield Routes and Superlane, Hyperlane is well positioned to continue gaining market share and further prove itself as a significant player in the interoperability vertical.

FAQs about Hyperlane

What is Hyperlane?

Hyperlane is an innovative interoperability platform designed to facilitate secure and transparent communication between different blockchains. It acts as a universal translator, enabling various blockchain systems to understand each other and exchange information seamlessly.

How does Hyperlane enable communication between blockchains?

Hyperlane utilizes special smart contracts called "mailboxes" that serve as on-chain messaging interfaces. These mailboxes allow for the sending and receiving of interchain messages, effectively bridging the communication gap between diverse blockchain networks.

What is the significance of interoperability in the blockchain ecosystem?

Interoperability is crucial as it allows different blockchains, each with its own technologies and programming languages, to interact and exchange information. This capability enhances the overall functionality and user experience within the blockchain ecosystem.

How does Hyperlane's modular security approach benefit developers?

Hyperlane's modular security approach provides developers with the flexibility to choose security models that best fit their applications. This customization optimizes the reliability and efficiency of interchain operations, catering to specific security requirements.

On which blockchains is Hyperlane currently integrated?

Hyperlane is integrated with over 50 blockchains, including major networks like Solana, Ethereum, Optimism, Cosmos, and Arbitrum. This extensive integration showcases its versatility and wide-reaching applicability.

Who are the notable investors supporting Hyperlane?

Hyperlane has secured $18.5 million in funding from prominent investors such as Circle, Kraken Ventures, and Figment Capital, reflecting significant confidence in its potential to transform blockchain interoperability.

Is there a native token for Hyperlane?

While specific details about Hyperlane's native token have not been announced, there are numerous rumors about a potential Hyperlane airdrop for early protocol users, indicating plans for a future cryptocurrency.

Who is developing Hyperlane?

Hyperlane is developed by Abacus Works, a team dedicated to creating blockchain interoperability solutions. The project is entirely open-source, with development primarily led by key contributors from Abacus Works.

350,000,000 clients stake with Imperator.co

350,000,000 clients stake with Imperator.co

Start staking with Imperator and maximize your rewards.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

$350,000,000 assets under managment

$350,000,000 assets under managment

Join investors who trust Imperator to maximize their returns. Take the first step today.