Research

Sommelier's deep dive: Assessing performance, yield strategies, portfolio management, and sustainability for users, delegators, validators, and ecosystem.

Sommelier is a not so new project, with many things cooking now and ready to be served. Let’s take a good look at how pieces are starting to stick together.

1. Introduction

The aim of this report is to show a deep dive of Sommelier performance, display its current growth and potential, both for users, delegators and validators, and how it accrues value for all of them in an organic way.

The best way I’ve found to describe what Sommelier does in the simplest way for users who already have basic understanding of Blockchains is as follows. It’s a smart contract platform which optimizes platforms (currently) on Ethereum, using both off-chain calculations for portfolio optimization (via ML algorithms and trading expertise) and the Cosmos SDK so that a set of validators manages the security of those smart contracts instead of a multisig. The use cases of those portfolio optimizations go from stablecoin yield optimization, to exposure of different assets, and potentially even more use cases as the platform matures.

As one can already see, there’s a high complexity and different set of users who can benefit here. From users gaining exposures to the different strategies, strategy providers by applying a management fee, to stakers and validators by earning yield and fees.

Although the tokenomics and fees percentage might change, the scope of this report is to look at overall numbers and performance, in order to better determine the potential for the space.

2. Cellars and strategies

First and foremost, a Cellar is a concept used a lot in Sommelier jargon and it’s used for referencing a smart contract representing an on-chain investment strategy, that can take in arbitrary inputs / commands from off-chain. There are currently two types of cellars/strategies live: yield strategies and automated portfolio management.

Yield strategies, as expected, generate yield through active management leveraging lending and borrowing platforms on Ethereum using stablecoins. There are currently two yield strategies, real yield USD and aave2.

Automated portfolio management allow users to gain exposure to different assets with less risk. For instance, if you want to gain exposure to ETH with less risk, you can join one of those strategies and if ETH rallies, it’s supposed to increase with less value, but if it crashes the strategy will go towards stablecoins and it will drop less in value.

3. Yield strategies

There are currently two possible yield strategies available at Sommelier: Real Yield USD and Aave stablecoin strategy. Those are the ones which have attracted more liquidity so far, although we’ll look at stats and performance in the following section.

As defined in Sommelier app, Real Yield USD leverages lending platforms like Aave and Compound, and decentralized exchanges like Uniswap, so it focuses on these three protocols and simultaneously allocates capital to Aave and Compound lending pools and Uniswap V3 LP pools in order to maximize yield.

On the other hand, the Aave stablecoin strategy aims to select the optimal stablecoin lending position available to lend across Aave markets on a continuous basis. The goal is to outperform a static strategy of lending any single stablecoin. Returns are amplified for Sommelier users as they will not suffer opportunity costs from passively sitting in less profitable lending positions at any given moment.

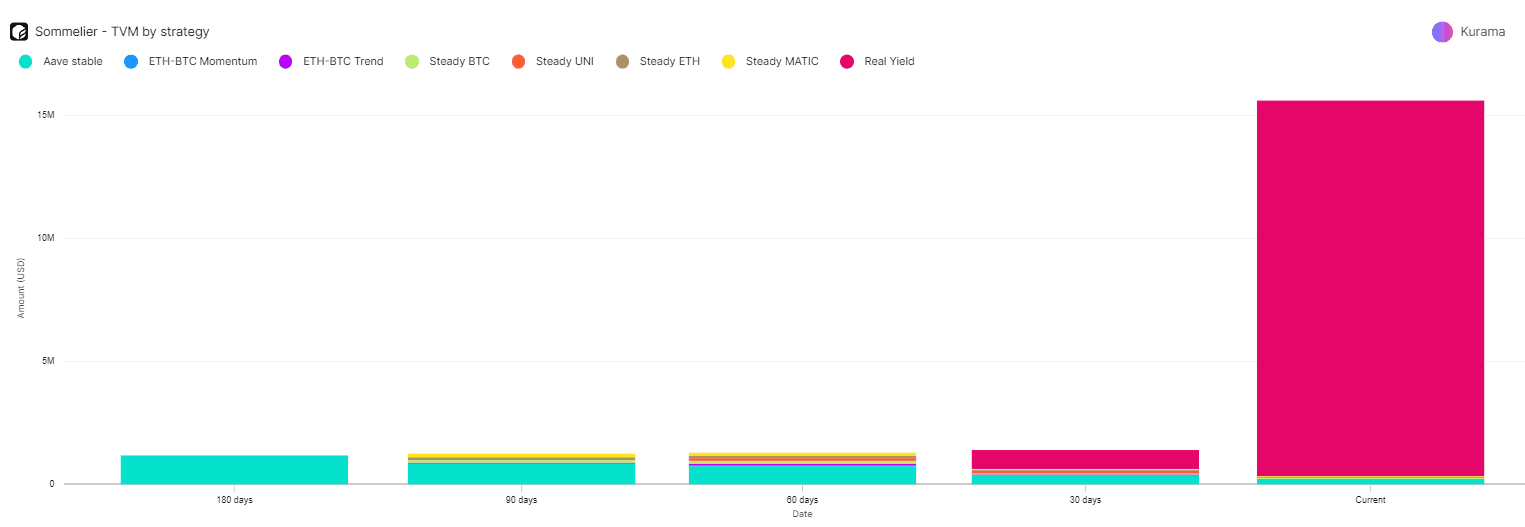

If we look at numbers, it’s clear that the new Real Yield USD strategy has outperformed the rest of strategies in terms of total value locked, jumping from 1M USD a month ago, to more than 14M USD currently.

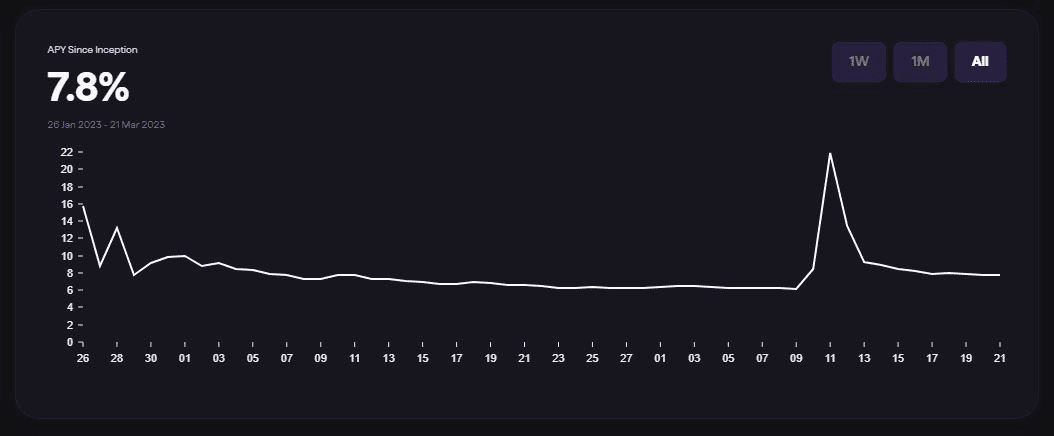

The yield return so far has also maintained around 7% return on stablecoins, which is higher than any other protocol can offer through real yield.

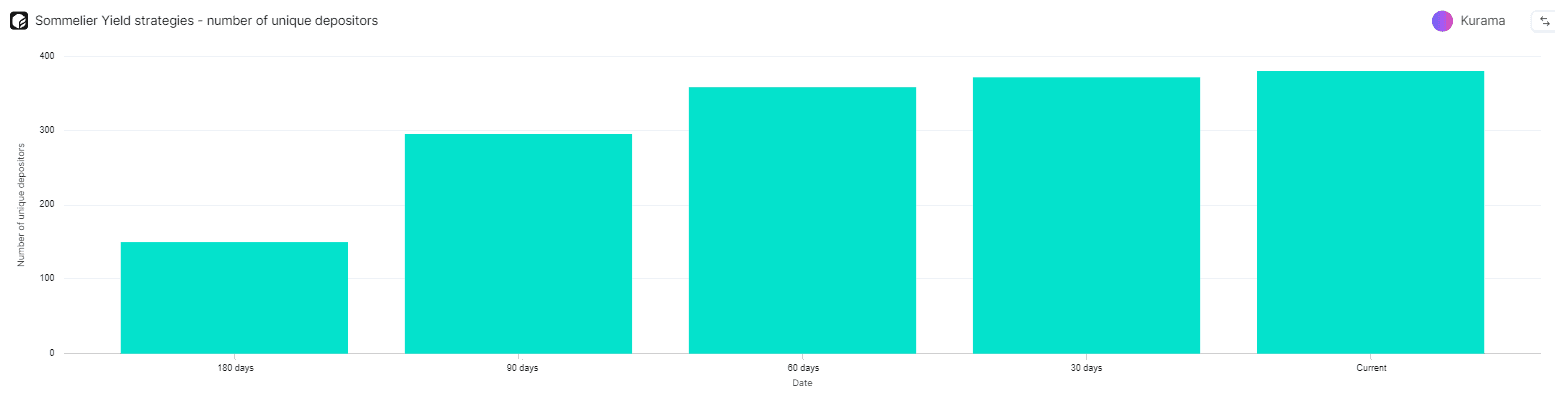

However, in terms of unique depositors, it’s worth noting that although the number of unique depositors in Sommelier yield strategies has increased, the number of unique depositors during the last 30 days at the time of this report has not increased as much as the amount deposited, meaning that users with a high amount are also leveraging the Real Yield strategy.

4. Automated portfolio management

The two first automated portfolio strategies which launched were ETH-BTC Trend and ETH-BTC Momentum, and are the ones which had more traction at their launch.

ETH-BTC Trend

The Cellar aims to outperform simply holding BTC and ETH, while also giving investors lower volatility and risk than holding BTC or ETH individually or an equally weighted portfolio of BTC and ETH.

The strategy is long only but cuts risk exposure when the price trends are negative. The Cellar is expected to outperform at times when price increases are moderate, while outperforming significantly and reducing risks in a bear market. The strategy is likely to underperform in sideways markets or when prices are rising extremely quickly.

The Cellar is expected to capture the majority of any positive price trends, but it will always enter the market only after the trend has started to be positive. The strategy will limit losses if price movements are negative with the expectation of improving the risk-reward ratio. The benefits of the strategy are expected to emerge within a 3-6 month holding period in case of diverse market conditions and are very likely to emerge for holding periods over 1 year.

ETH-BTC Momentum

The momentum Cellar strategy aims to outperform and have lower volatility and risk than holding BTC or ETH individually or in an equally weighted portfolio of BTC and ETH.

The strategy is long only, but it reduces risk exposure if price momentum is negative. The cellar is expected to outperform at times when prices are rising moderately or one of the portfolio assets is appreciating faster than the other. The strategy is likely to underperform when there are extreme price appreciations but is expected to capture the majority of any positive price movements. The strategy is expected to outperform in a bear market since it can cut risk exposure, but it is exposed to negative price movements because it is long only and always holds at least a small proportion of risky assets. The benefits of the strategy should emerge within 3-6 month holding period in case of diverse market conditions and are highly likely to emerge for holding periods over 1 year.

350,000,000 clients stake with Imperator.co

350,000,000 clients stake with Imperator.co

Start staking with Imperator and maximize your rewards.

Performance and users

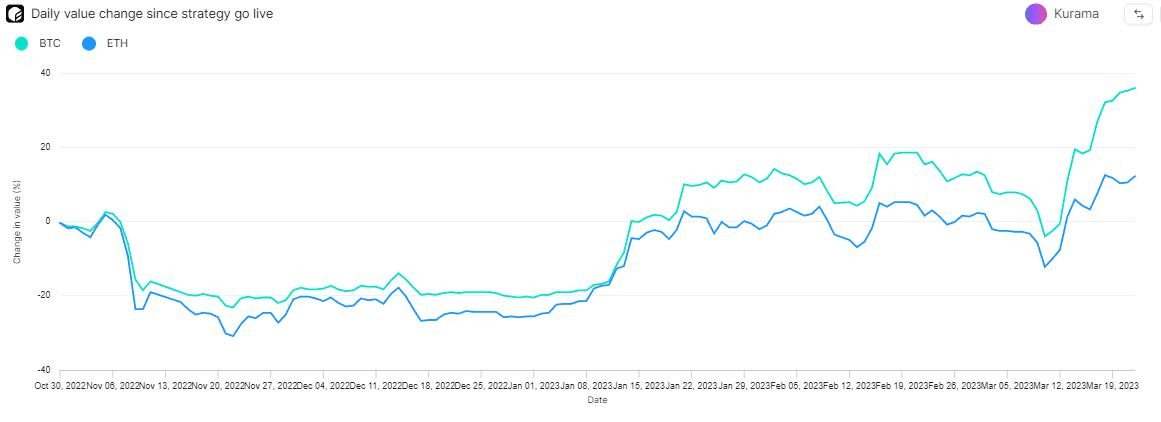

Now that we’ve already analyzed the theory of the two main automated portfolio management strategies, we can dig into how they’ve behaved so far. The first figure below shows precisely the price action of both strategies since inception.

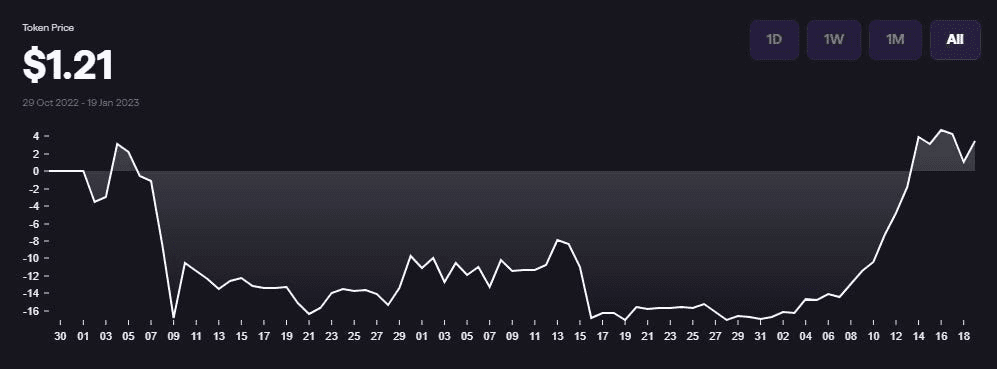

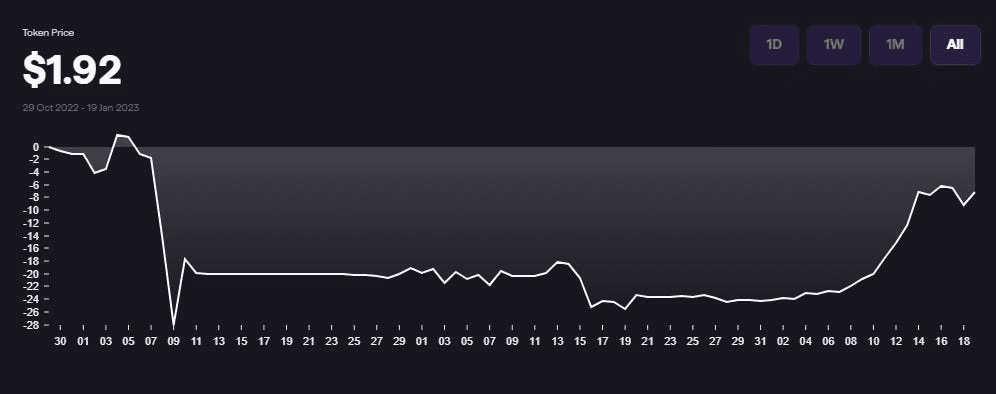

The trend strategy has outperformed currently the momentum one, when comparing both of them in terms of ROI since they went live, with a net increase of 21% for the trend strategy (started at 1 USD) and a negative -2.53% for the momentum one (it started at around 2 USD).

On the other hand, we if we look at ETH and BTC price separately and their value increase in percentage, we get the values displayed below, where ETH price has surged a 12% in price and BTC a total of 36%, thus having an average return of around 24%, pretty close to the trend strategy.

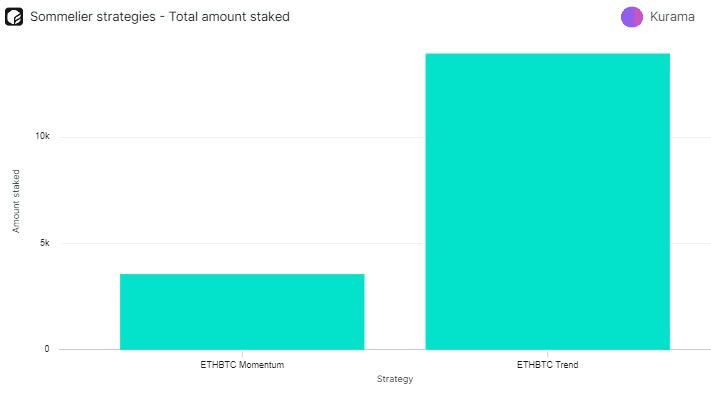

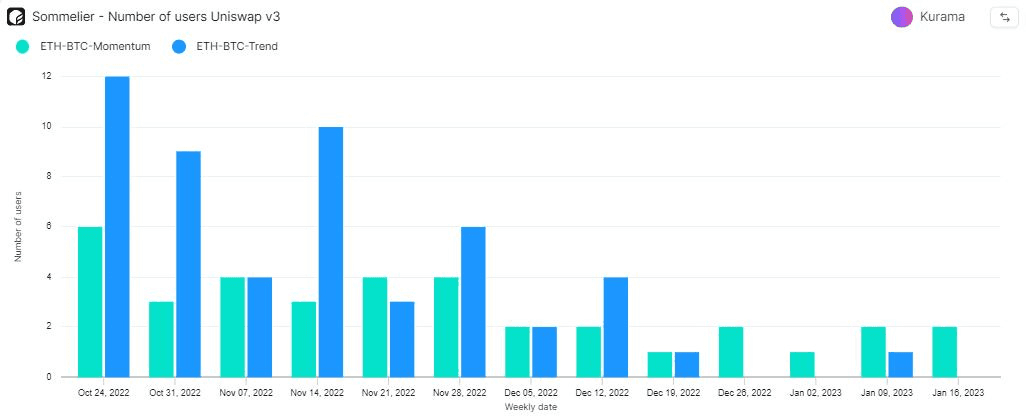

Finally, we can look at both the total amount currently staked for both strategy tokens, as well as the number of weekly unique users swapping in the Uniswap v3 pools for both strategies.

There are currently around 14k trend tokens, and 3.5k momentum tokens, and the number of users swapping through the Uniswap v3 pools has been declining over time.

There are more strategies (steady ETH, steady BTC, steady MATIC and steady UNI), but I’ve decided for the scope of this report to stick with the main ones.

5. Conclusions on fees and long term security

Right now each strategy has its own fee schedule and split with the protocol. Real Yield USD is basically all of the protocol TVL and the protocol is earning 0.1% annually on the funds in that strategy. That 0.1% is split with the validators, stakers and protocol treasury.

Once new and successful strategies go live, this fees will be redefined for each one of them so it’s all currently an assumption waiting for the protocol to mature. As explained very well by jack (@OriginalJakeW) in this substack article:

[Those fees] will be auctioned off to swap for SOMM coins which will then be given back to stakers as rewards for securing the network. The beauty of the system is the auction will act as price support when the protocol is accruing enough fees. You can see how valuable this can be to the protocol and how it starts to turn into a flywheel. The more success the protocol has, the more fees generated, the more value swapped through auction, the more rewards to stakers, the more number go up.

The most important point to keep an eye on is how long will it take for the protocol to be sustainable for validators to keep validating, but it is clear that the protocol is committed to achieving use cases and results through a long term vision, rather than diluting the token for short term gains.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

$350,000,000 assets under managment

$350,000,000 assets under managment

Join investors who trust Imperator to maximize their returns. Take the first step today.