Tutorial

Unlock the full potential of your staked tokens with our guide to restaking on EigenLayer. Delegate with Imperator for optimal returns and enhanced security.

Welcome to our comprehensive guide to restaking your liquid staked tokens (LST) using EigenLayer, Ethereum's first restaking protocol. In this guide, we'll walk you through the step-by-step process of restaking your LST and delegating them to a trusted operator. By leveraging EigenLayer's innovative technology, you can optimize your yield and contribute to the security of the Ethereum network.

Guide to Restaking Your Liquid Staked Tokens

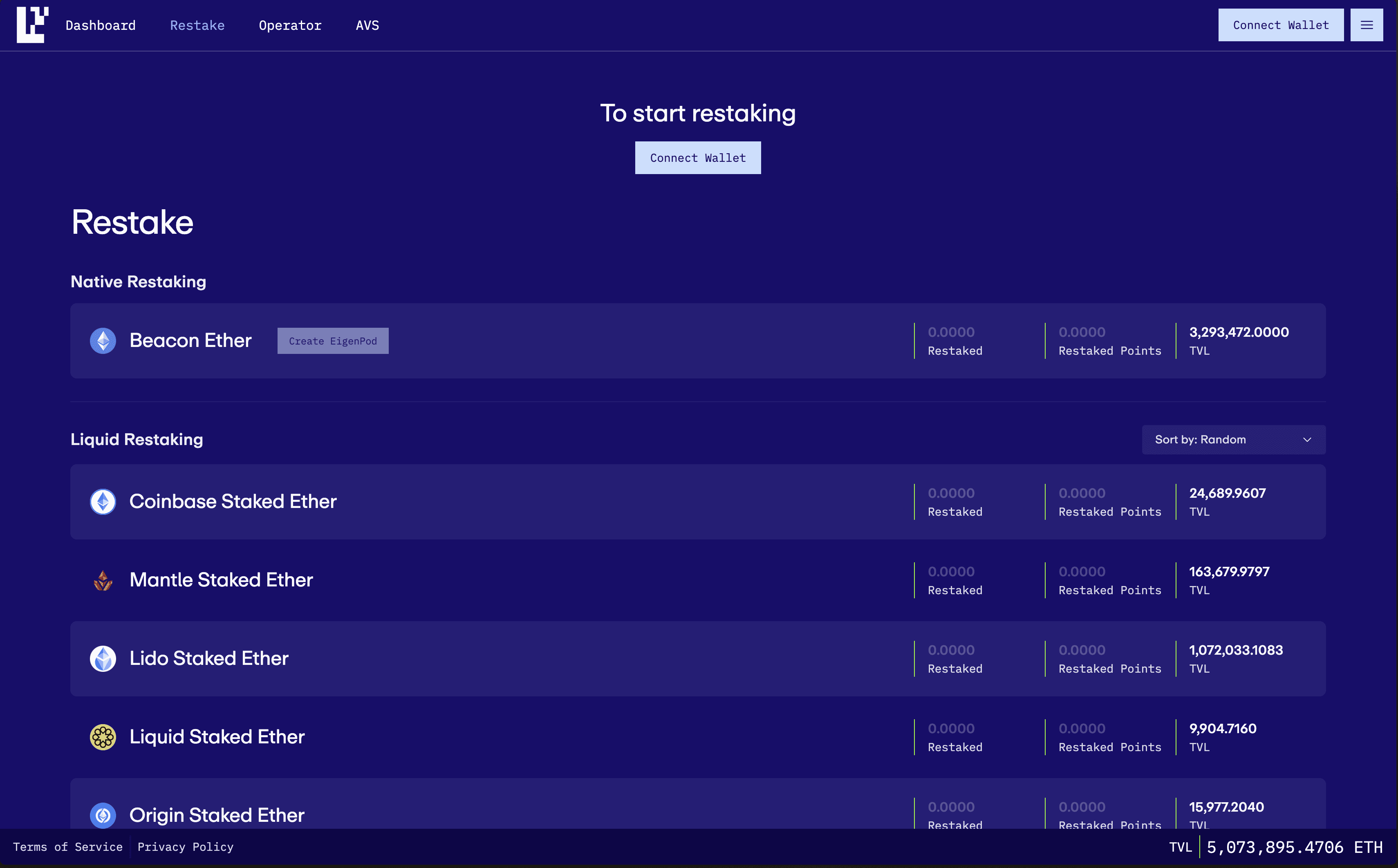

The first step in our guide to restaking is to head to the EigenLayer restaking website, and you will find a landing page such as the one in the picture below.

The first option, which allows us to create an EigenPod, will not be relevant for this guide. That is because, in order to natively restake ETH, you need to operate an Ethereum validating node, and it will not be covered in this article.

Once we connect our wallet, we need to provide one of the listed liquid staked ETH (LST) coins. Again, this is because we want to "stake" our already staked ETH, hence the term, so all the LST coins are already staked earning yield.

Step 1: Selecting Your Liquid Staked ETH

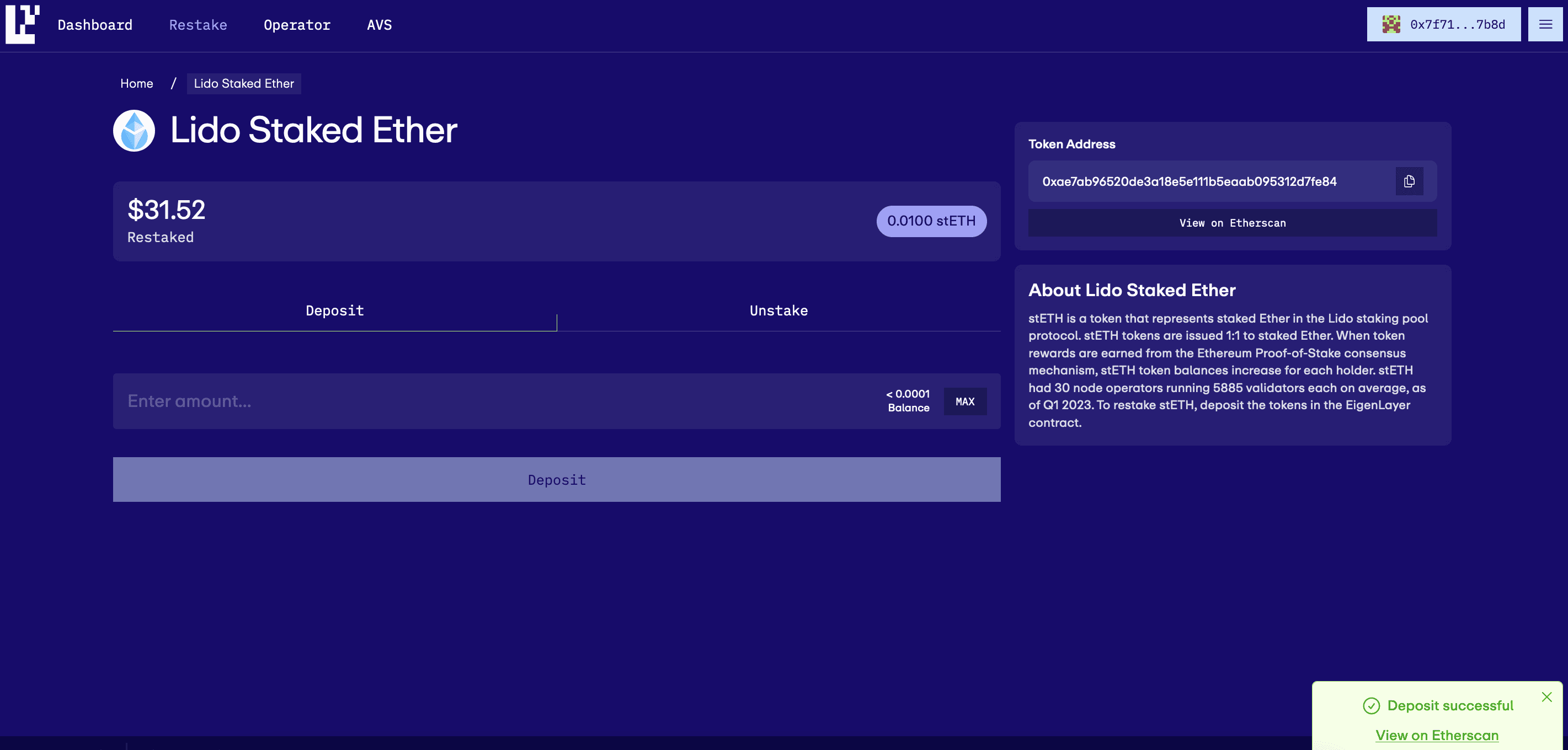

In this guide to restaking your LST, we have chosen as an example Lido's liquid staked ETH (stETH), but we can use any of the LST ETH tokens in the list provided on EigenLayer. We select stETH from the list and we connect our wallet (MetaMask, WalletConnect, or others).

Step 2: Entering the Desired Amount

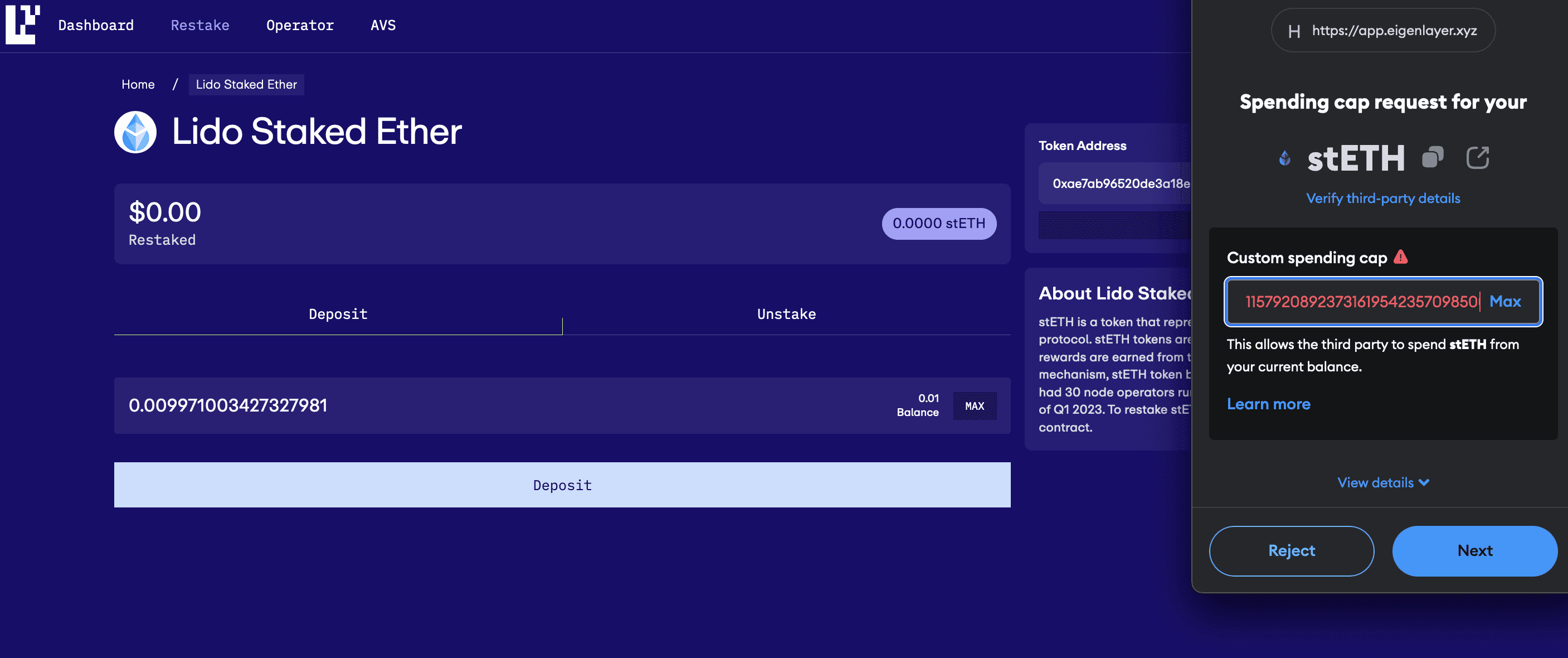

Once our wallet is connected, we type the amount we want to restake in the amount box.

Step 3: Confirming the Deposit

Finally, now we can click deposit, and a transaction will pop up on MetaMask or the selected wallet. Once approved, your LST will be restaked.

How to Delegate to Imperator

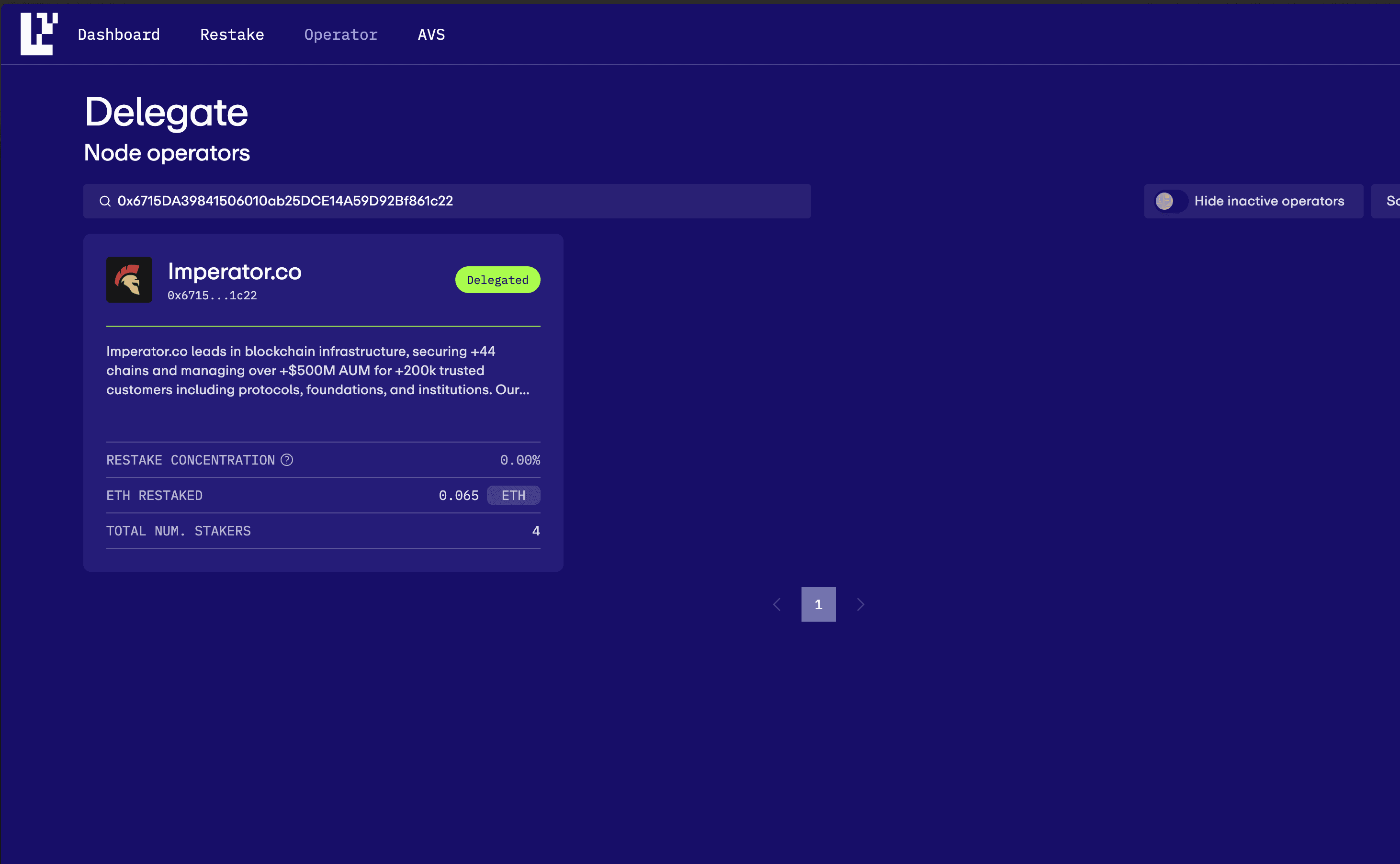

The next part of our guide to restaking involves delegating your restaked tokens to a trusted operator. This step is crucial as different operators will support different AVSs, and the risks described later in this article will vary from operator to operator. We can find the link on the EigenLayer’s Operators tab.

In this section, we'll be presented with a searcher for Operators available to delegate, as shown in the picture below. Again, there are two more steps here for us to follow.

Step 4: Searching for Imperator

Once our wallet is connected, we look for Imperator in the search bar, either typing Imperator.co or our operator address. Make sure it matches: 0x6715da39841506010ab25dce14a59d92bf861c22.

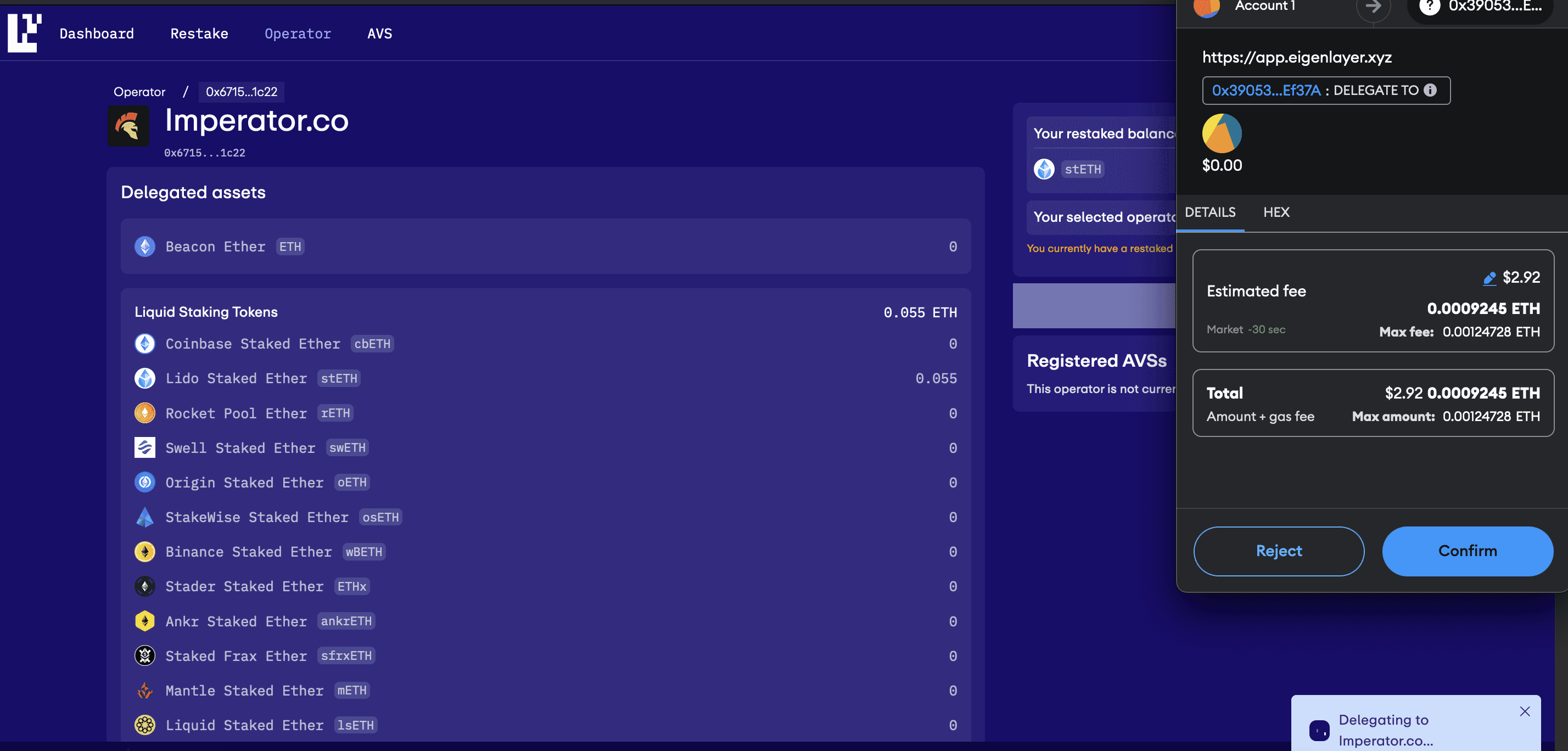

Step 5: Confirming the Delegation

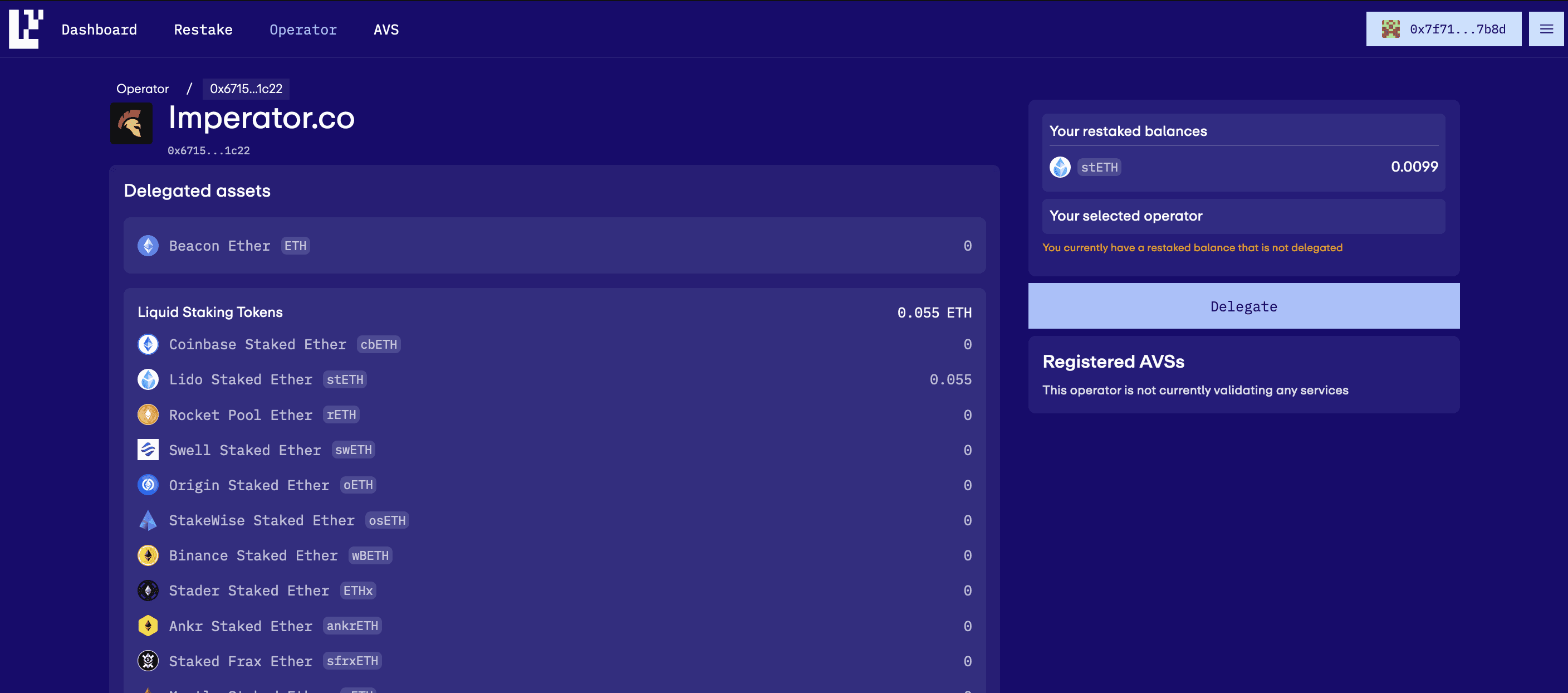

Finally, after making sure we're on the right operator, we select it and enter the last part. You'll be able to see the stats of the operator, and your available restaked balance will appear.

Click deposit, and a transaction will pop up on MetaMask or the selected wallet. Once approved, your LST will be restaked through Imperator and you're good to go!

Understanding Restaking

Restaking involves leveraging your existing staked assets to earn additional rewards through EigenLayer's secure protocol. By restaking your LST, you contribute to the security and decentralization of the Ethereum network while earning passive income. It involves utilizing ETH staked for new AVSs with updated slashing conditions on the capital. AVSs can leverage Ethereum restakers to 'lease' security. This approach enhances capital efficiency for ETH restakers while providing potentially more robust security for AVSs, decoupling them from the volatility of their native token's price.

How Restaking Works with EigenLayer

EigenLayer offers a platform for decentralized projects to leverage the security provided by Ethereum stakers. By restaking their LST, stakers can support multiple projects simultaneously. EigenLayer's model ensures that AVSs can rent security without needing to establish their own validation network, making it easier for new projects to launch and grow securely.

Leverage Staked ETH: ETH stakers can use their staked assets to provide security for AVSs on EigenLayer.

Renting Security: AVSs rent security from restakers, allowing them to focus on development without building a new validator network.

Decentralization: This approach supports decentralization by distributing security responsibilities across multiple stakers and AVSs.

350,000,000 clients stake with Imperator.co

350,000,000 clients stake with Imperator.co

Start staking with Imperator and maximize your rewards.

Benefits of Restaking

Restaking offers several key benefits for both stakers and the Ethereum network:

Increased Rewards: Restakers can earn additional rewards on top of their existing staking returns.

Enhanced Security: By restaking, you contribute to the security and stability of the Ethereum network.

Flexibility: Restaking allows for the use of various liquid staking tokens, providing flexibility in how you manage your assets.

Passive Income: Earn consistent income with minimal effort through EigenLayer restaking.

Restaking your LST is not just about earning more rewards; it's about contributing to the broader Ethereum ecosystem and supporting the security of various decentralized projects.

Challenges and Risks in Restaking

Restaking presents a good opportunity for maximizing returns, but comes with inherent risks that demand careful consideration. Restakers must acknowledge the additional slashing conditions imposed by AVSs, which could lead to asset losses if not monitored. Moreover, the potential for operator collusion poses a significant threat, where a subset of operators may conspire to exploit vulnerabilities and steal funds. EigenLayer proposes strategies to mitigate collusion risk, such as restricting profit potential for corrupt AVSs and actively increasing the cost of corruption, underscoring the importance of robust security measures.

Understanding Slashing Conditions

Slashing is a penalty mechanism designed to enforce security by punishing malicious or negligent behavior. When restaking, it's important to understand the slashing conditions that may apply to your assets. These conditions vary depending on the AVS you choose to support and the overall security protocols in place.

Mitigating Collusion Risks

Collusion among operators is a significant risk in any decentralized system. EigenLayer mitigates this risk by implementing measures such as limiting the profit potential for corrupt operators and increasing the cost of collusion. By understanding these measures, restakers can make informed decisions and choose operators that align with their risk tolerance.

Technical Risks

Technical risks are inherent in any blockchain protocol. Continuous auditing, monitoring, and bug bounties are crucial to ensure the integrity of the EigenLayer protocol. Staying informed about potential vulnerabilities and updates can help restakers navigate these risks effectively.

Best Practices for Restakers

Diversify Your Restaking: Spread your restaked assets across multiple AVSs to minimize risk.

Stay Informed: Keep up to date with the latest developments in EigenLayer and the AVS ecosystem.

Regular Monitoring: Regularly check the performance of your restaked assets and the operators you delegate to.

By remaining vigilant and informed, restakers can leverage the benefits of EigenLayer's restaking protocol while managing the associated risks.

Why Choose Imperator for EigenLayer’s Restaking

Choosing the right operator is crucial for successful restaking. Here’s why Imperator stands out:

Higher Returns: Boost classic staking rewards with EigenLayer restaking through Imperator.

Passive Income: Earn consistent income with minimal effort through EigenLayer restaking.

Enhanced Security: Contribute to the security of Ethereum’s network and EigenLayer’s AVS through strategic restaking contributions.

Trusted Experience: Renowned for robust expertise in PoS networks, Imperator offers a proven platform for secure and effective restaking operations.

Easy Accessibility: Access EigenLayer restaking easily with Imperator, no technical skills needed.

Institutional Trust: Trusted by over 200,000 customers, including protocols and foundations, Imperator is a preferred choice for major blockchain stakeholders.

Conclusion

Restaking with EigenLayer offers a powerful way to maximize returns on your liquid staked tokens while contributing to the security and decentralization of the Ethereum network. By following this guide to restaking EigenLayer, you can navigate the restaking process, delegate to reliable operators, and understand the risks involved. Stay informed, choose wisely, and leverage the potential of EigenLayer to enhance your staking strategy.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

$350,000,000 assets under managment

$350,000,000 assets under managment

Join investors who trust Imperator to maximize their returns. Take the first step today.