Research

Delegate your DYDX with confidence, choose expert-recommended dYdX Network validators for secure and optimized staking.

The dYdX network offers a lucrative opportunity for staking, allowing users to earn rewards while contributing to network security. However, selecting the right validator is crucial for optimizing your rewards and ensuring the safety of your assets.

This guide covers the Best dYdX Validators and provides insights on how to choose the right one for your staking needs, with valuable tips to help you stake dYdx efficiently.

Best dYdX Validators to stake DYDX

Choosing the best validator can be complex, but based on performance, reliability, and community trust, here are the top 5 best dYdX validators.

1. Imperator

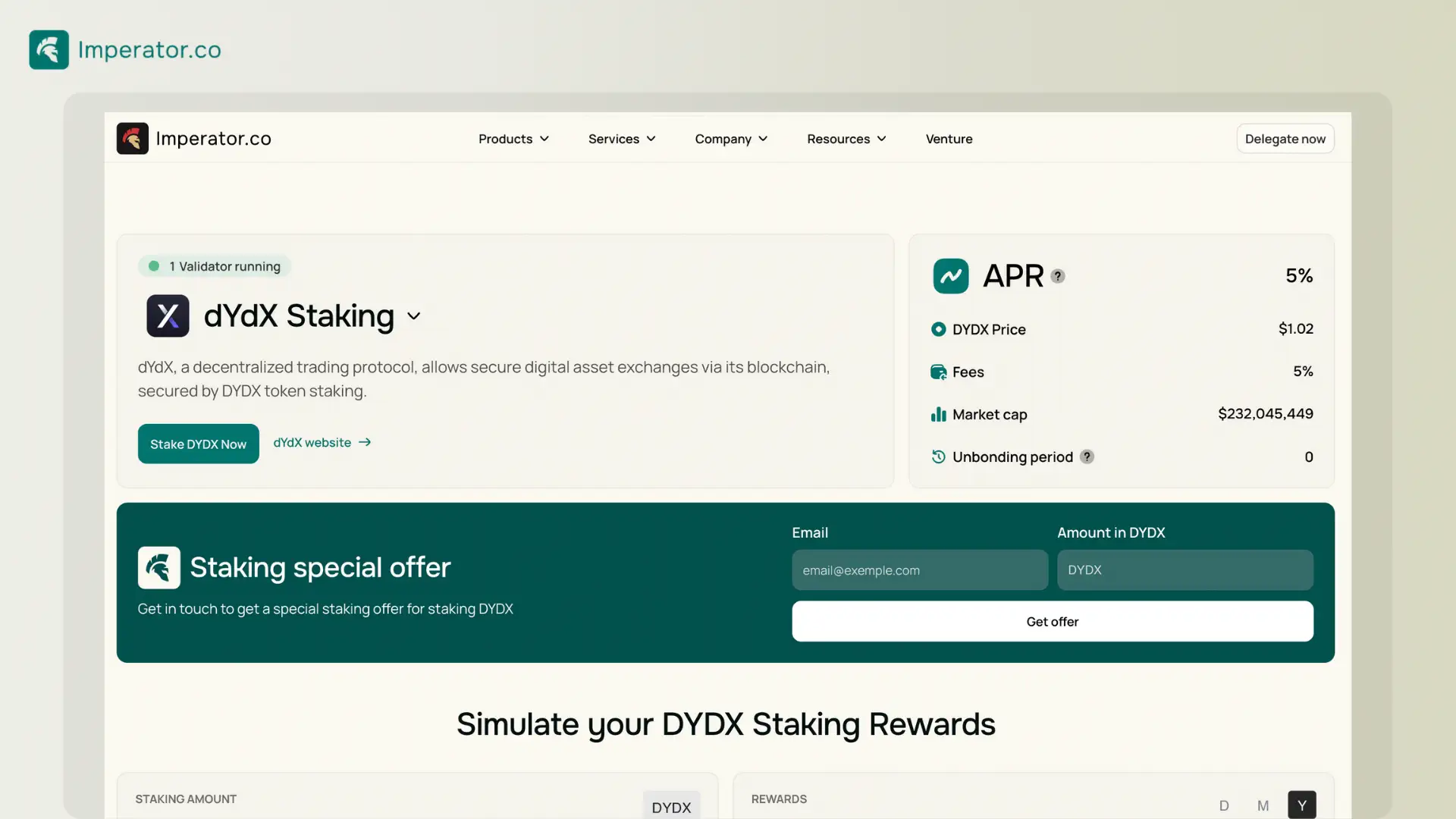

Imperator is a highly trusted validator known for its consistent performance, security, and strong community involvement. It provides top-tier infrastructure with near-perfect uptime, ensuring that delegators receive maximum rewards without interruption.

Beyond reliability, Imperator stands out for its active role in governance, ensuring that network decisions benefit all participants.

This transparency and commitment to decentralization make Imperator the go-to choice for anyone looking to optimize their staking on dYdX while contributing to the network's long-term success.

For a detailed dYdX presentation, we’ve studied the project and outlined the key points.

2. Nodes.Guru

Nodes.Guru is recognized for its strong technical foundation and contribution to validator education. Its robust uptime and efficient staking services make it a popular choice for reliable staking.

3. Frens Validator

Frens offers secure staking with a community-driven approach. Known for transparency and reliability, Frens ensures excellent uptime and engagement, making it an attractive option for involved delegators.

4. Strangelove

Strangelove provides a secure and dependable staking experience with consistently high rewards. Their technical expertise ensures minimal downtime and a smooth staking process for delegators.

5. AutoStake | StakeDrops

AutoStake simplifies the staking process through automation. With additional rewards through StakeDrops, it’s a great option for users looking for a hands-off approach to staking with reliable returns.

How to choose the Best dYdX Validator

Choosing a validator requires more than just picking a well-known name. Here are the key factors to consider when selecting the best dYdX validator for your staking needs:

Performance and Uptime: Validators with high uptime (above 99%) ensure that you don’t miss out on rewards due to downtime.

Commission Rates: Each validator charges a commission on your staking rewards, so it’s important to choose one with competitive fees.

Community Reputation: Validators with strong community backing and transparent operations are generally more reliable.

Decentralization: Supporting smaller validators helps maintain a decentralized network, which in turn strengthens its security.

For a detailed dYdX presentation, we’ve studied the project and outlined the key points.

Our dYdX staking tips and best practices

To get the most out of your staking efforts on the dYdX network, here are some essential strategies.

Reinvest your DYDX rewards

Regularly redelegating your staking rewards can significantly increase your long-term earnings. By compounding your DYDX rewards, you ensure that your stake continues to grow and generates higher returns over time. This strategy allows you to maximize the potential of your assets.

Monitor validator performance

Keeping track of your validators' performance is crucial for ensuring high uptime and consistent rewards. Regularly checking their status allows you to make adjustments if a validator’s performance declines, ensuring that your staking remains optimized.

Set Alerts for dYdX validator downtime

Using monitoring tools to set alerts for potential validator downtime can help you act quickly if performance drops. This ensures you don’t miss out on rewards due to unexpected validator issues.

Top dYdX Delegators: Closing thoughts

In conclusion, choosing the best dYdX validators is essential for maximizing your staking rewards and securing your assets. Validators like Imperator offer the perfect blend of security, reliability, and community involvement, making them ideal for those serious about staking on dYdX. By staying informed and selecting trustworthy validators, you can ensure a successful staking experience and consistent returns.

FAQ

Who are the best dYdx validators ?

Discover the top dYdX validators you can rely on for staking your DYDX tokens securely and effectively.

Imperator

Figment

DokiaCapital

P2P

InfStones

How do I choose the best dYdX validator for maximizing rewards?

When selecting a dYdX validator, prioritize those with high uptime (99%+), low commission rates, and a strong reputation within the community. Look for validators with consistent performance and no history of slashing to minimize risks and maximize staking rewards.

Can I change my dYdX validator without losing rewards?

Yes, you can redelegate your tokens to a new validator without losing your accrued rewards. The redelegation process is seamless, allowing you to switch validators anytime, but keep in mind there might be a short bonding/unbonding period where rewards are paused.

How can I monitor the performance of my dYdX validator?

You can monitor your validator’s performance using tools like Mintscan or Staking Rewards. Regularly check their uptime, commission rates, and recent slashing events to ensure they’re performing well and adjust your staking strategy if necessary.

Can validator fees change after I’ve staked?

Yes, validators can adjust their commission fees over time. It’s essential to stay updated on fee changes, as they may affect your overall returns. Regularly check your validator’s fee structure to ensure it remains competitive and aligned with your staking goals.

Stake dYdX with Imperator.co!

Maximize your DYDX staking rewards : earn more, start now.

Discover all our Staking Opportunities

Acces over 50+ protocols to maximize your staking returns

Maximize your DYDX staking rewards : earn more, start now.